Liquid staking, which allows users to stake cryptocurrencies while retaining a tradeable variant of the locked coins, will soon become accessible to investors wary of Ethereum’s high transaction costs.

On Monday, Ethereum-based liquid staking giant Lido Finance announced plans to offer staked ether (stETH) – a derivative representing an equivalent amount of ether (ETH) deposited into the protocol – on layer 2 solutions, which process transactions relatively faster and at cheaper costs than the Ethereum mainnet.

“For Ethereum stakers, this means staking with lower fees and access to a new suite of DeFi applications to amplify yields,” Lido said in an explainer blog published Monday. Lido’s stETH is heavily integrated into decentralized finance. Ethereum’s high transaction costs have kept retail investors from accessing decentralized finance (DeFi), therefore, the launch of liquid staking solutions on the relatively cheaper layer 2s could boost mainstream adoption of DeFi.

Layer 2 protocols run a separate blockchain on top of the mainnet, providing a secondary framework where transactions can take place. Once the transactions are processed, the data is sent back to layer 1 where it is stored in the blockchain ledger. That way layer 2s help alleviate network congestion on the mainnet.

Polygon, Optimism, Arbitrum, and Loopring are some of the well-known Ethereum layer 2 solutions, facilitating higher transaction throughput (expressed as a number of transactions per second) at lower prices to broaden participation, all the while retaining the security of the layer 1.

While Lido did not announce a timeline for its layer 2 expansion, it did express commitment to offering liquid derivatives of staked tokens on various layer 2s with “demonstrated network activity,” starting with Arbitrum and Optimism.

Lido said it has already integrated with Ethereum smart wallet Argent to make wstETH, the wrapped version of the staked ether token, available on Ethereum-focused scaling solution zkSync. Earlier this year, Aztec protocol unveiled its layer 2 solution on zkSync.

At press time, Lido controlled 90% of the $6.9 billion ether liquid staking market, according to Dune Analytics.

Lido users can stake their ether in return for stETH, which can be used in decentralized lending and borrowing protocols to generate an additional yield. Lido users can also avoid the burden of owning a minimum of 32 ETH to participate in staking – a process of holding coins in a cryptocurrency wallet to support the network’s operations in return for newly minted coins. Lido users can redeem stETH for ETH only after the completion of Ethereum’s transition from the proof-of-work to the proof-of-stake consensus mechanism.

Lido is confident that a large portion of economic activity will migrate to layer 2 networks in the future. The company plans to support wstETH bridging and staking in the early days of L2 expansion, eventually allowing “staking of ETH held by users on L2 networks directly from that L2 without the need to bridge their assets back to Ethereum Mainnet.”

stETH is supposed to trade close to the spot price of ether. However, the staked derivative slipped to a discount of 0.93 to ETH following the collapse of Terra’s algorithmic stablecoin UST in May.

The situation has improved somewhat, with the Ethereum developers recently announcing Sept. 19 as the tentative timeline for the long-awaited transition to a proof-of-stake mechanism. The stETH discount to ether has narrowed to 0.98 since the announcement on Thursday. While ether has rallied by more than 30%, Lido’s governance token LDO has surged by 58%, according to data provided by CoinDesk.

Lido proposes selling 2% of the LDO token supply

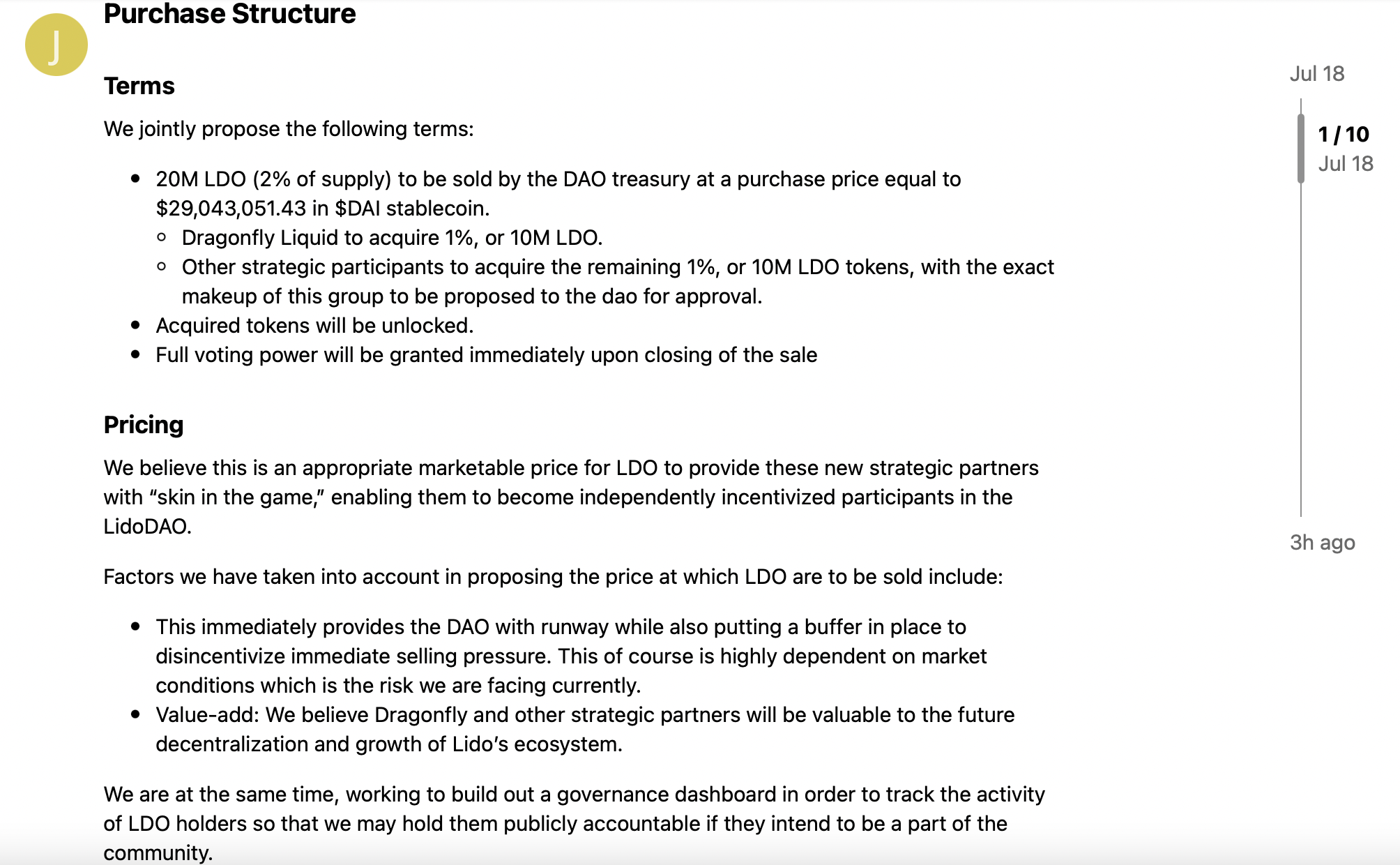

On Tuesday, Lido Finance also introduced a community proposal to liquidate 20 million of its LDO tokens, amounting to 2% of the total supply of 1 billion, in return for stablecoin DAI.

The 20 million LDO will be sold from the Lido DAO treasury, which administers stETH, at a per token price of $1.45215. The price was calculated by adding a 50% premium to the 7-day time weighted average price (TWAP).

“This proposal is looking to secure ~2 years of operating runway for Lido DAO, in stablecoins,” Lido said. “This will ensure Lido and its core contributors are able to continue the important work needed for the protocol in the long term and to flourish as an autonomous, self-governing collective.”

Details of the proposal reveal a plan to sell 10 million tokens to the crypto investment firm Dragonfly Capital, which had around $3 billion in assets under management as of April. The remaining coins will be distributed to the DAO-approved group of other strategic participants.

Lido expects Dragonfly’s participation to facilitate vertical integration of staked derivatives in the DeFi ecosystem and strengthen Lido’s grip over the liquid staking market.