Over the past 24 hours, the BTC and altcoin market has witnessed an unprecedented wave of liquidations as over $250 million in altcoin bets evaporated, driven by the turbulent performance of Big Time’s BIGTIME and Ordi Protocol’s ORDI tokens. Here are the details…

Unprecedented liquidation for two altcoins

Over the past day, Bitcoin’s price has slowed to around $41,000. This development caused a decline in other altcoin projects. However, according to the data, two altcoins in particular were critically injured by this development. Because Big Time (TIME) and Ordi (ORDI) investors faced liquidation of $ 250 million in 24 hours. This staggering figure does not include liquidations from Bitcoin (BTC) and Ethereum (ETH) futures trading, which recorded a separate cumulative loss of $85 million.

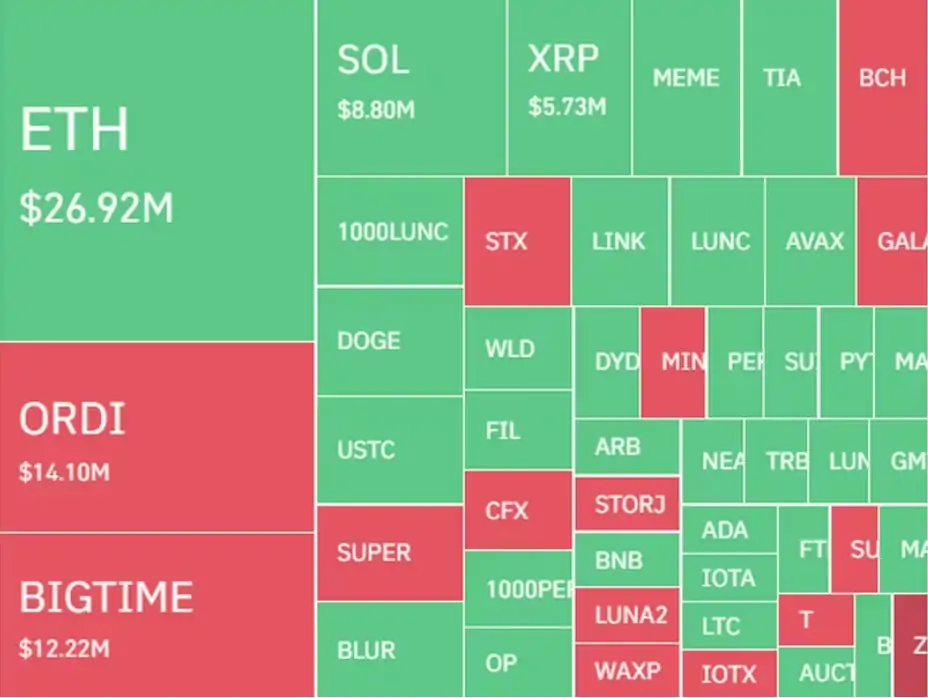

Liquidation, which means the forced closing of leveraged positions due to insufficient margin, attracted attention. This occurred as a result of traders struggling with the sudden and intense volatility of these altcoins. The liquidation of $15 million from ORDI bets and $12 million from BIGTIME, covering both long and short positions, underlined the wild price swings these tokens have experienced over the past day, affecting traders on both sides of the market.

BTC-linked ORDI takes a bigger hit

Demand for Bitcoin-linked tokens in particular has fueled the excitement surrounding ORDI, which is tightly integrated into the Bitcoin ecosystem. As we reported as Kriptokoin.com, it increased by a staggering 580% last month. Simultaneously, the narrative surrounding crypto gaming platforms continued to benefit BIGTIME holders, witnessing a notable gain of 400% since the beginning of November.

However, not all tokens emerged unscathed from this liquidation spree. Celestia’s TIA and Memeland’s MEME both launched last month. But these coins also saw traders lose around $10 million. Meanwhile, bets on tokens associated with Terra’s once “collapsed” ecosystem also fell apart, with LUNC, USTC and LUNA investors collectively losing $11 million. According to data, these tokens had increased by up to 70% on Monday due to various catalysts.

What is the significance of purges?

The importance of such large liquidations extends beyond immediate losses for traders. In the volatile world of cryptocurrencies, large liquidations often mark a local top or bottom of a steep price movement. Thus, it offers savvy investors the opportunity to position themselves strategically in response to market dynamics.