Litecoin continues to rise with the increase in expectations that the US Securities and Stock Exchange Commission (SEC) will approve a spot ETF this year. Increasing expectations for Litecoin ETF has a significant impact on the price.

Expectations for Litecoin ETF approval are increasing

Litecoin’s price rose to $ 136 on Sunday and approached the highest level of 2024 to $ 146. LTC, which gained 23 %in the last seven days, has managed to be among the best performance -performing crypto currencies.

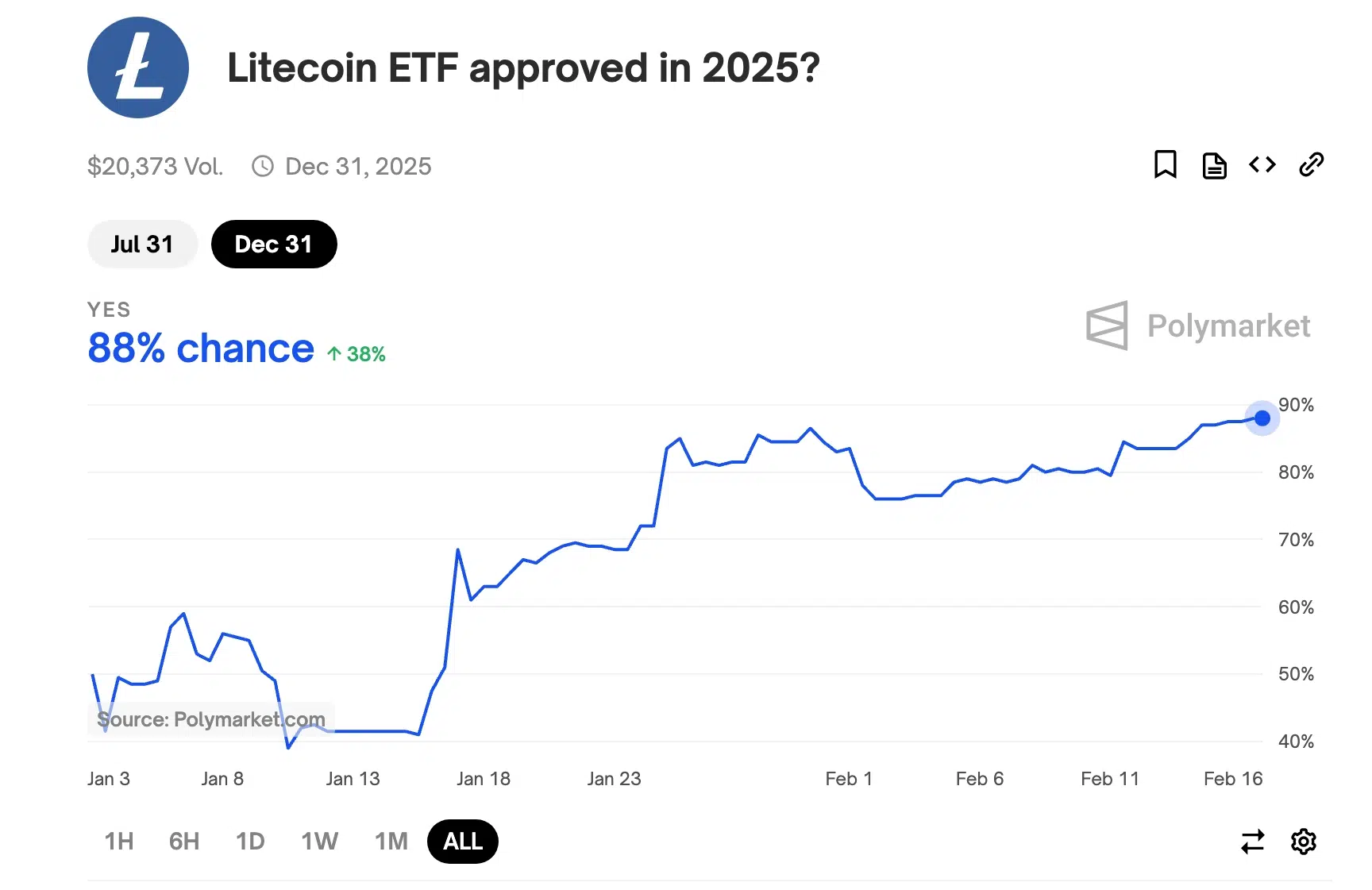

Polymarket data reveals that investors see the likelihood of approval of Litecoin ETF in 2025 as 88 %. This ratio was only 42 %at the beginning of the year. If approval is obtained, companies such as Grayscale, Canary and Coinshares can benefit from this development.

SEC’s approach

Since Litecoin is a Proof-of-Work-Work-Work-Work Crypto currency born as a hard fork separated from Bitcoin, the SEC has no strong reason for rejecting this ETF. Following the approval of Bitcoin ETFs, Litecoin is expected to follow a similar process.

In the past, SEC rejected some crypto ETF applications due to securities. However, since Litecoin has a decentralized structure like Bitcoin, it seems difficult to include this status. This stands out as one of the factors that increase the probability of approval.

Technical Analysis: Critical levels for LTC

Litecoin has been traded in a narrow price range since 2022. Finally, a significant threshold exceeded the $ 113.38 resistance. This level was the highest point of 2023 and March 2024.

Currently, LTC is trying to exceed 23.6 %Fibonacci correction level in $ 130. If the price exceeds the level of $ 146.95, the summit of December 2023 with a volume -supported rise, the upward trend can be confirmed.

The next targets for Litecoin

If Litecoin breaks this level, there is a possibility of up to 38.2 %Fibonacci correction point at $ 185. This level is located above 36 %of the current price and shows that Litecoin can maintain long -term rise trend.

However, while maintaining the uncertainty of SEC’s decision, investors need to closely follow the ETF process. The approval of Litecoin ETF may have a permanent impact on the price by increasing the interest of corporate investor.