In February, Litecoin reversed the stagnation in the crypto money market with an impressive 51 %impressive rise. LTC, which was traded for $ 135 on Friday, has left behind the performance of large crypto assets such as Bitcoin, Ethereum, Solana and Dogecoin. In the same period, the XRP increased only 6 %.

One of the biggest factors behind this ascension was that Litecoin has passed an important stage in the process of receiving the approval of the Spot Stock Exchange Investment Fund (ETF).

One of the most powerful candidates for Litecoin ETF approval

The US Securities and the Stock Exchange Commission (SEC) currently have many crypto ETF applications. However, market analysts think that Litecoin ETF is the highest probability of approval.

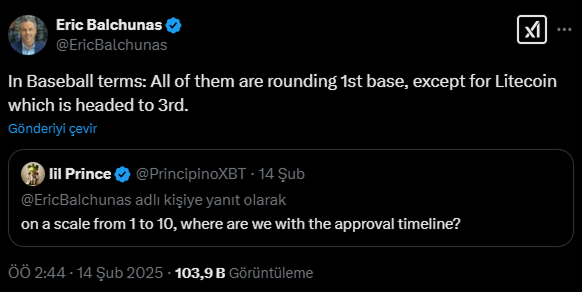

Bloomberg Intelligence Analyst Eric Balchunas explained this with the terms baseball and said:

The other subcoins are still in the first stage, Litecoin is moving to the third stage.

Balchunas and his colleague James Seyffart consider the probability of Litecoin ETF as 90 %. The crypto estimate platform Polymarket, on the other hand, shows the probability of Litecoin ETF at 85 %this year. This rate was 87 %last week.

Does SEC’s attitude towards Altcoin ETFs change?

In the last two weeks, the SEC has announced that many subcoin ETF applications have officially evaluated. Previously, some applications had to withdraw immediately, but the latest developments may have shown that the SEC was looking at such ETFs more hot.

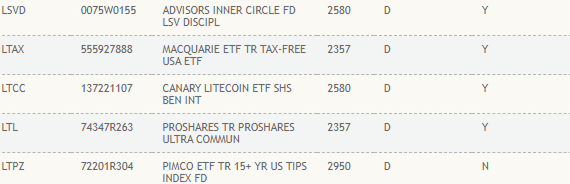

On Thursday, Canary Capital’s Spot Litecoin ETF application was listed on the website of Depository Trust and Clearing Corporation (DTCC), an important tool in the US financial market.

According to Bloomberg analyst Balchunas, being listed in the DTCC shows that although there is no definite sign for SEC approval, it is preparing for exporters for the approval process. The DTCC is known as an important center that exchanges the securities of approximately $ 10 trillion per day.

Previously, Bitcoin and Ethereum ETFs were also included in the list of DTCC just before the SEC approval.

Litecoin is advantageous in terms of legal arrangements

Experts say that the possibility of Litecoin’s acceptance as an commodity offers a great advantage for the SEC approval. The US Commodity Futures Commission (CFTC) officially included Litecoin in the commodity class as part of an investigation into the Kraken stock exchange last year.

According to Balchunas, Litecoin’s technical similarities with Bitcoin also give advantage in the regulatory process. Because SEC had previously classified Bitcoin as an commodity. While the developments in the Litecoin ETF process are closely monitored, this rise is a matter of curiosity.

Kriptokoin.comAs we have transferred, XRP COIN completes the final stages in the US to receive ETF approval.