According to Chris Watling, Chief Market Strategist at Longview Economics, record purchases by central banks helped support the gold price. But a new case is emerging as to why investors should go long gold.

3-factor macro-driven gold model

cryptocoin.com As you follow, experts say that central bank purchases are supportive of gold. “As we noted in our recent analysis of central bank/official gold purchases, there is no clear correlation between the level/growth of purchases and the direction of the gold price,” says Chris Watling in Longview Economics’ latest Commodity Fundamentals Report. Based on this, Watling makes the following assessment:

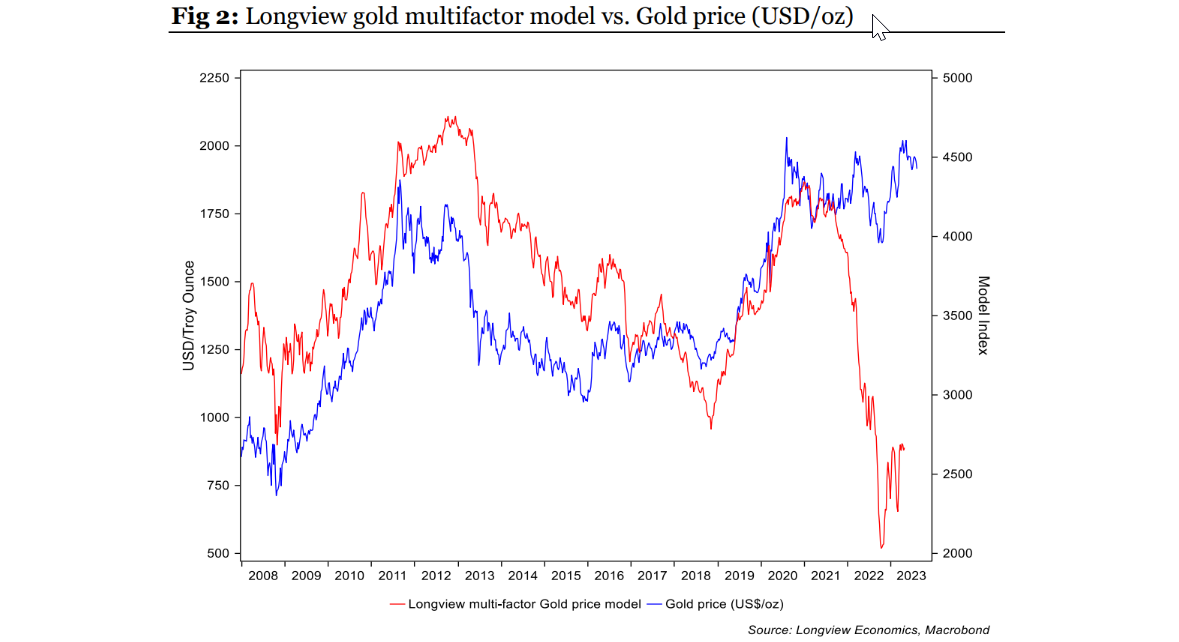

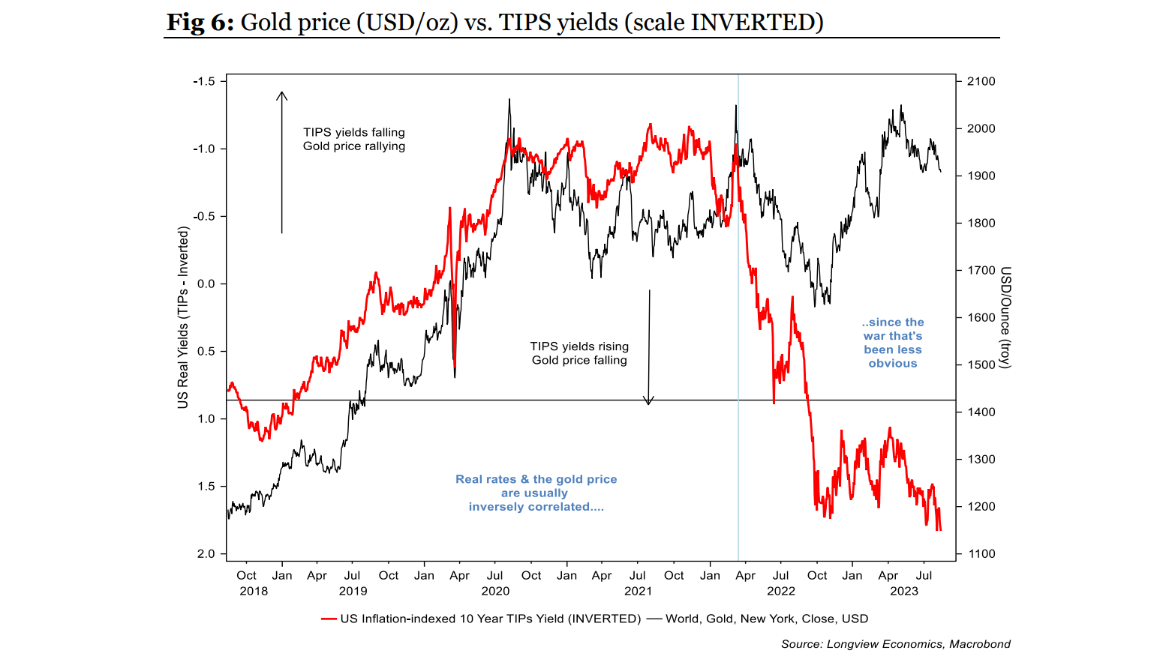

Indeed, apart from the 18 months since the war, gold price has been highly correlated with our 3-factor macro-driven gold model, which focuses on TIPS, interest rate expectations and the performance of the US dollar.

The situation is forming for the continuation of the gold rally

Watling says the key question is why this relationship has ‘deteriorated over the past year and a half’. In this context, the strategist comments:

Some argue that this reflects significant purchases by central banks. Others argue that it is the TIPS yield itself that has been distorted (not the price of gold) by the massive sale of USTs by the Chinese, perhaps to slow the weakness of the RMB […] Either way, the situation is forming for gold to continue its rally.

Yellow metal is once again a tempting ‘long’ offer!

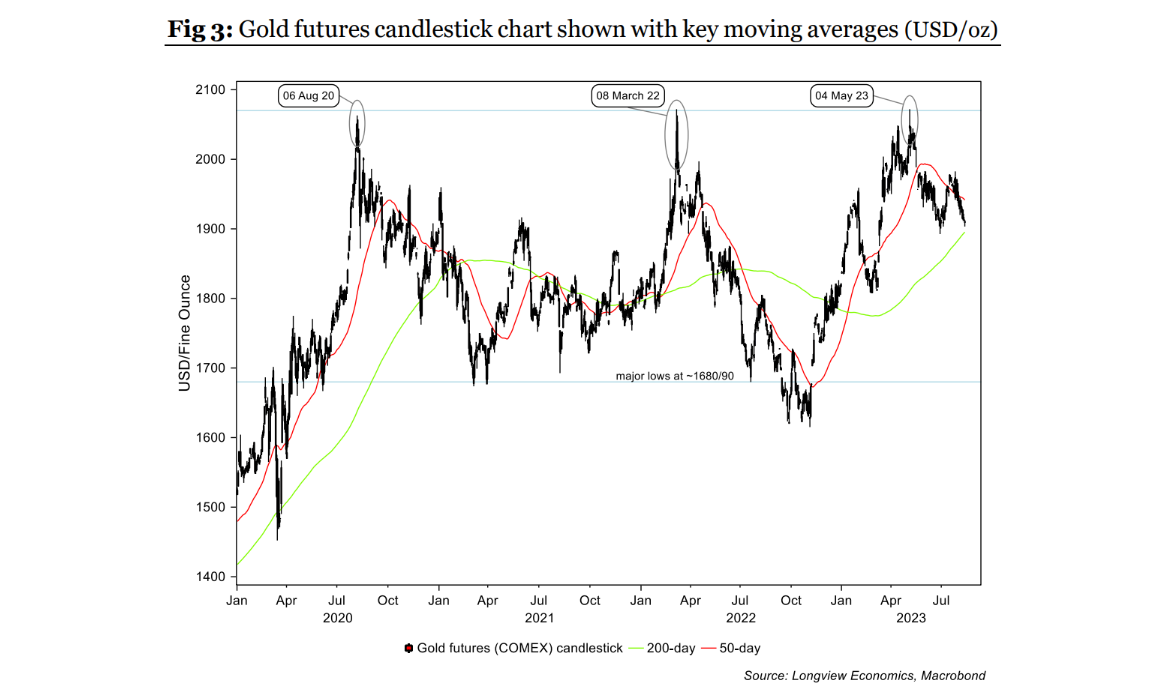

Watling first points out that gold is once again oversold. It also says that it has bounced back around the 200-day moving average support level at $1,895. In this regard, Watling underlines the following:

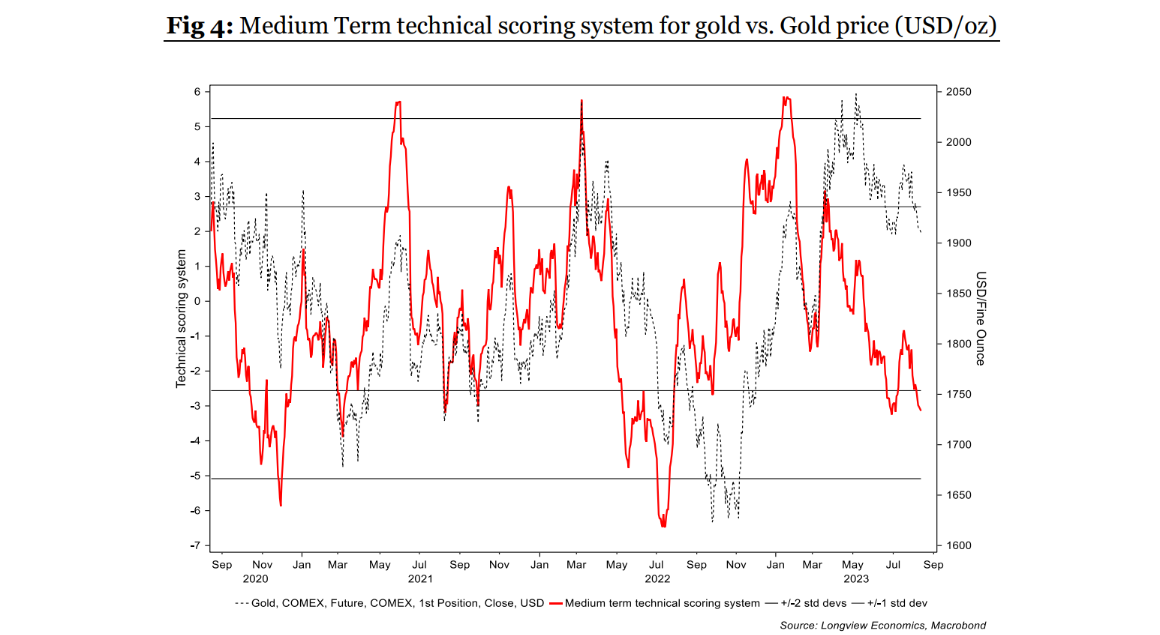

Given that it is currently oversold (see the medium-term technical market timing model – figure 4 below) and our expectations of the change in interest rate expectations and TIPS yields […] gold is once again an attractive ‘long’ offer.

These are the first to direct the gold

From a fundamentals perspective, Watling says the gold price continues to be driven primarily by interest rate expectations, real TIPS yields and the dollar. Also, “Inflation is mainly driven by monetary factors. In line with this view, we continue to expect US inflation to decline rapidly and deflation to be a possible and growing risk.” According to Watling, if the recession view is correct, US interest rate expectations should drop significantly.

A significant improvement will be enough to raise the price of gold

On the other hand, Watling points out that the dollar’s outlook is less favorable for gold. In this regard, he makes the following statement:

Still, it is worth keeping in mind that the probability of intervention in both the RMB and the YEN is increasing, and that both currencies are/are at/around previous intervention levels. In addition, if 2 of the 3 key macro factors support the gold price, this will be a significant improvement over recent months. It will probably be enough to raise the price of gold.

Startejist warns there are still risks

Watling warns that risks still remain in gold’s bullish scenario, including a “2008-style credit crunch” caused by the Fed’s dramatic tightening. But he points to the March banking crisis as proof that the central bank is ready and willing to flood the system with liquidity to prevent it. The Strategist said, “Therefore, it is a low-risk event for long gold positions. Other risks include a strengthening dollar. However, despite the strengthening of the dollar in 2001, the rise of gold is remarkable.” says.