Aiming to facilitate cryptocurrency trading stablecoin‘s in recent years depegand collapseleft its mark on the sector with its scenarios.

satoshi Nakamoto The crypto revolution started by Bitcoin gained global popularity, led by Bitcoin. Cryptocurrencies have continued to evolve and be adopted over the years. Years ago, to be able to buy any cryptocurrency bitcoinor Ethereumparity was used. A Coinsomeone who wants to get A/BTC He was trading on par. In the next period, stablecoins emerged with the aim of integrating fiat coins into cryptocurrencies more easily. However, this innovation brought with it many problems.

The Beginning of Stablecoins and the Advancement of Stablecoins

stablecoin products gained popularity by integrating the traditional financial system with the crypto ecosystem. The first stablecoins produced in this medium, BitUSDand NuBitsit happened.

BitUSD, 2014in the year USA It emerged as a decentralized cryptocurrency indexed to the dollar. Popular crypto project behind this first stablecoin BitSharestook place. BitUSDguarantee, BitSharessupported by its assets.

Another stablecoin to come out NuBitsdecentralized, which aims to rival the traditional financial system. Nu networkCreated by NuBitsalso tried to provide collateral with asset reserves.

Over the years stablecoin Various improvements and updates have been made on . The first products of the field NuBitsand BitUSDAlthough it was supported by all kinds of secure methods, up to bank assets, it could not show continuity.

Investors in the early stage of stablecoins as adoption is low BTCand ETHcontinued to buy cryptocurrencies with its parities. stablecoinPopularization phase of ‘s, Tether ( USDT) and USD Coin ( USDC)thanks to it.

As the interest in cryptocurrencies increased, there was a noticeable increase in the amount of fiat money entering the industry. The crypto industry has begun an influx of dollars. In this case, for investors to trade crypto more easily stablecoin’ ers came to the fore. Leadership seat, the most actively used stablecoin USDTtook.

Stablecoin Crash and Stablecoins Collapsing

The fact that the money circulating in the crypto money market has increased by ten times is among the transaction parities. stablecoin It made them stand out. Many investors fastand less costlybecause it is stablecoinHe traded through .

Influenced by the crypto bull market stablecoin Demand on ‘s has reached the ceiling point. This situation, USDTand USDCaccording to market value top 10inserted into the cryptocurrency.

However, behind this demand, stablecoin The collateral and support status of the . In the crypto bull market, most investors stablecoin He didn’t care about the working logic of the ‘s. In fact, many investors did not even consider what would happen in the crypto industry if any stablecoin product crashed.

Fiatpegged to currencies stablecoin‘s, 1 dollar used various methods to stay at the stable exchange rate. The traditional and most preferred method has been to collateralize with crypto assets in order to maintain decentralization. Many stablecoinpreferred to be collateralized with its own decentralized assets.

A few crypto projects have also established their own ecosystem, stablecoinmade them the heart of this ecosystem. terra, waves, NEAR, Kavaused this method frequently. terra‘s system, lunawith the coin’s own assets TOP was to support stablecoin. The two cryptocurrencies acted in tandem.

However stablecoin‘s long-term unplanned and pessimistic market conditions brought many collapses.

1- TerraUSD (UST)

terra tried to do innovative work to develop and expand its ecosystem. The project team acted widely to stand out as a payment method and investment tool. algorithmicas a stablecoin TOPbecame the backbone of the ecosystem. TOP , has a different structure than other stablecoins. Behind the popular stablecoin terracryptocurrency of the ecosystem lunatook place.

lunathe assets in TOPpresented as a guarantee. lunathe rise in TOPwill support and TOPmoney entering, luna would raise the price. What started out as a great idea turned into a huge disaster. Because the bear market and hacking attacks were enough to bring down the entire ecosystem.

2021of the year Mayby the month of TOPThe worst-case scenario broke out. TOP, Mayas depeg at the beginning $0.96 decreased to around. Many crypto investors and analysts thought it was a minor shake-up. By crypto market TOP, again for 1 dollarIt would be fixed soon.

However, 12 Mayon TOP suffered a major collapse. The source of the collapse is due to its algorithmic structure. luna It was moving in parallel with it. Most used cryptocurrency lunaof 99 percentdepreciation, TOP He also pulled it to the bottom. It terraThe crisis caused the crypto money market to enter a bear trend that will not improve.

occurred at that time terra crisis took a big place on the agenda as the crypto collapse. Current assets in the cryptocurrency industry 35 percent‘i evaporated after this collapse.

USATreasury Minister Janet Yellen, at his meeting TerraUSDof ( TOP) collapse revealed “risks to financial stability” and that the audit should be planned.

TOP, now stablecoinceased to be and continues to exist like a normal cryptocurrency.

2- Neutrino USD (USDN)

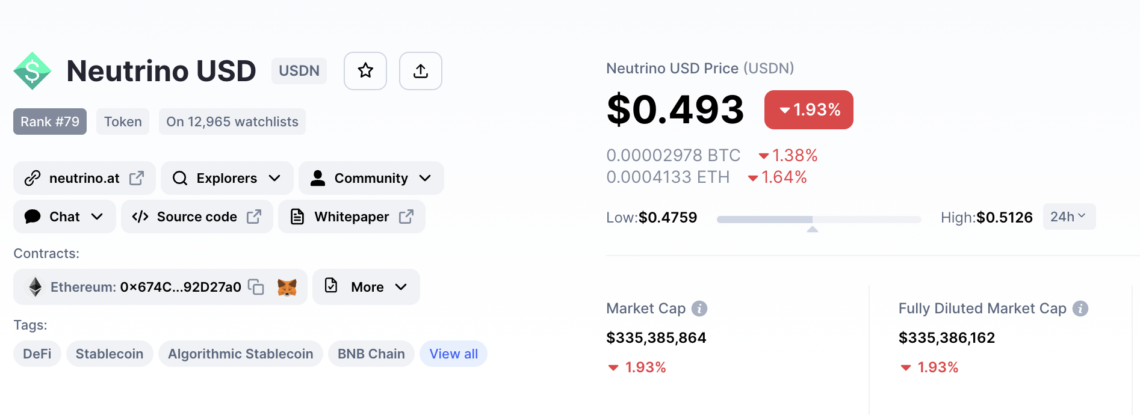

Decentralized cryptocurrency project wavespegged to the US dollar as an ecosystem product Neutrino USDtook out the . USDN, just like terrastarted to serve in an algorithmic structure as in the case of USDNguarantee waves tried to be provided with their assets. When viewed, USDNwith TOPoperation appeared to be exactly the same.

However TOPThe unsafe atmosphere brought about by the events experienced on the TOPlike USDNHe also shot . USDN became a depeg after many investors fled. On the other hand, with the impact of the crypto bear market, wavesThere was also a decrease in price. wavesfall of, USDNcaused the price to drop.

A stablecoinserving as USDN, as available 0.5 dollars moves level. daily volume 600 dollarsnot exceeding stablecoin , may become history. Investors prefer to stay away from this project for now, as it is not reliable.

stablecoinin the reserves of its service, waves ecosystem products. In a possible collapse scenario, all wavesecosystem may be affected.

3- NEAR Stablecoin (USN)

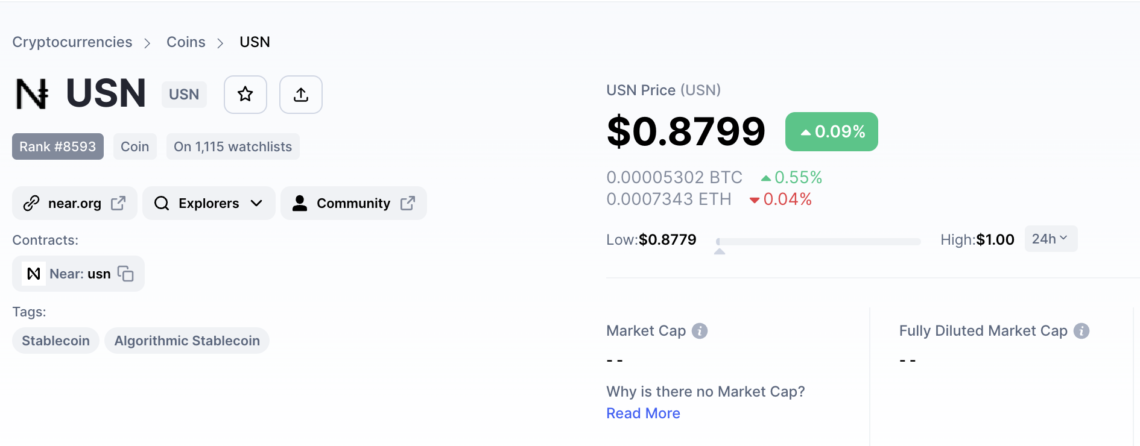

Decentralized smart contracts platform NEAR, released a stablecoin to improve its ecosystem and have a strong network structure.

USN took the UST potential and FRAX reliability as its launch purpose. USN, which emerged to develop and improve the NEAR ecosystem, was seen as a new method to increase liquidity.

The USN took UST as an example with its algorithmic structure. While this might seem intriguing at first, the crash of UST changed everything. Stablecoin is fully secured by NEAR ecosystem assets. In the project, which is intended to be fixed to the dollar, strong studies were planned with staking and liquidity ratios.

However, the great collapse experienced on the UST side turned the arrows of fear and distrust towards the USN. Although USN showed a solid image, it could not escape the fud current.

Popular cryptocurrency NEAR‘s stablecoin USN, depegaspect $0.88 down to the level. It stablecoin, is not listed by any major central exchange.

4- Kava Stablecoin (USDX)

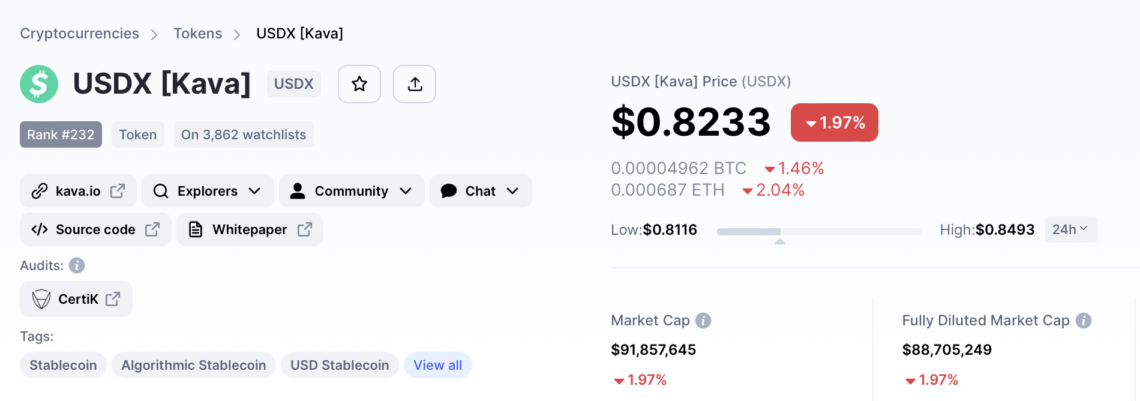

Kava, a DeFi loan platform, started its services with the aim of opening different income doors to its users and investors. Kava, users USDXIt allowed them to borrow and lend with their stablecoin and earn interest by staking the system.

Working as a decentralized bank Kava, stablecoin product USDX He put a lot of effort into it. pegged to the US dollar USDXhas not received enough attention from its users.

Rippleand maker DAO Supported by Kava, could not bring its ecosystem products to a sufficient level. Popular project that wants to increase its validators on the mainnet side, USDX wants to be supported. However, the collapse on the UST side was due to the inability of the team behind it to give enough confidence. USDXaffected the other side.

USDX, as depeg at fixed dollar rate $0.82levels dropped. stablecoin, 200It doesn’t attract much attention with a thousand-dollar daily volume. USDXIt is not listed on any stock market other than the Kava ecosystem.

5- Huobi Abandoned Stablecoin (HUSD)

Popular cryptocurrency exchange Huobi, in order to create usage area and liquidity source in the central stock market. HUSD supported it. emerging on the Ethereum network HUSD, USAcame to the fore with its price fixed to the dollar and stablecoin service.

by Stable Universal 2018revealed in the HUSD, Huobi It was listed on the market with the support of the stock market. The initial purpose of the popular stablecoin was to be a combination of four different stablecoins. PAX, TUSD, USDCand GUSDwould merge into a single stablecoin, creating a more reliable port.

However, this idea was not approved by investors. Therefore HUSD , began to exist as a stand-alone stablecoin and withdrawing from Huobi support. Investors, who did not want to be behind a centralized exchange, started to trust after this move.

However TOPthe impact of events on the HUSD It was painful for him too. Faced with the meltdown of millions of dollars of assets and loss of users HUSDbegan to struggle for survival.

Finally Huobi, HUSD He made the finishing move when he decided to delist . After all these processes HUSD, has ceased to be a stablecoin and remains depeg.

currently HUSD, $0.142 progressing levels. The once sensational stablecoin, in the last 24 hoursOnly 4 thousand dollarssaw a volume.

Stablecoin Future, Regulations and Controls

Stablecoins falling and failing negatively impact the outlook towards the entire stablecoin industry. Cryptocurrency investors and institutional companies prefer stablecoins with strong collateral and protected assets. In this context, USDT, USDCand BUSDA rivalry ensued.

However, to the crypto industry in general and stablecoin confidence in the industry has declined. took place this year FTXand terra The collapse triggered this situation. There was a need for rapid regulation and supervision, which was spoken and expected globally

Particularly on the stablecoins side, a global and legally supported regulation is expected to come. This issue is on the agenda of other countries, especially the USA. The collapse of the UST and the depegs of other stablecoins accelerated the legal processes.

The US regulator and the European regulator agree that stablecoins should be on track by 2023. Although this situation does not make people forget the events of the past, it may increase the confidence in the market.

However, investors are expected that these pessimistic clouds over the crypto money market in general will lift and the bear trend will end. The regulation of stablecoins could also be an important factor for the next bull run.

After regulations and inspections, USDT, USDCand BUSD A new medium will emerge. This place reservessolid and collateralable ensure the continuity of the products. Contrary projects will be banned and eliminated. Moreover, stablecoinThe team and assets of the project will also be shared transparently with the regulators.