The LUNA crisis continues to be talked about in the cryptocurrency market. Crypto prominent Bitcoiner Max Keizer calls LUNA the grand example of all ‘DeFi scams’, while Changpeng Zhao, the wealthy founder of crypto exchange Binance, jokingly complains that LUNA assets are evaporating.

LUNA is not representative of all crypto

According to Jake Chervinsky, prominent Bitcoin supporter Max Keizer, Bloomberg economic news anchor Joe Weisenthal’s UST/LUNA is a ‘Ponzi-like He responded to a tweet calling it ‘a terrible example of games. Keizer also accused LUNA, DeFi, Ethereum, and even Mike Novogratz of associating them with scams.

Joe Weisenthal tweeted that despite being ‘the biggest thing in crypto’ in the last few years, in reality DeFi implementations are not making an economic impact. Responded to Jake Chervinsky, head of policy at the Blockchain Association. Chervinksy had complained on Twitter that the anti-crypto media were harshly critical of LUNA, stating that basically all crypto was potentially like LUNA/UST.

Anti-crypto media is milking UST for all it's worth. I've seen a few unfair critiques this week acting like all of crypto is just one big algo stable.

Annoying, but expected. That's just how it is. What matters is that the hit pieces don't translate into policy. So far, so good.

— Jake Chervinsky (@jchervinsky) May 19, 2022

Weisenthal apparently believes that all DeFi is Ponzi schemes, He cites LUNA as ‘an especially gruesome example of a broader Ponzi-like gaming phenomenon in space’.

Max Keiser says the LUNA is the epitome of all DeFi scams

Economist and RT host of his own show on finance and Bitcoin Max Keiser tweeted that he fully agreed with Weisenthal in describing DeFi as a scam and a Ponzi scheme. As for the UST stablecoin from LUNA and Terra, Keizer described them as “the token of all DeFi.”

Even Galaxy Digital CEO Mike Novogratz, who was a fan until LUNA collapsed and even got him tattooed (a wolf howling at the moon), was harshly criticized.

Agreed.

DeFi (like ICO’s) was a scam from the start. The underlying ‘yield’ on these is based on Ponzi-nomics. LUNA/UST is emblematic of all DeFi. Shysters like @novogratz are scammers who prey on noobs. ETH is an exit scam. https://t.co/8cqcl3Ah04— Bitcoin Ambassador 🇸🇻 #Nayib2024 (@maxkeiser) May 19, 2022

Max Keizer is known as one of the Bitcoin OGs and all altcoins He criticizes the scams and calls them a scam, including the second-largest crypto Ethereum, on which the majority of DeFi applications are running.

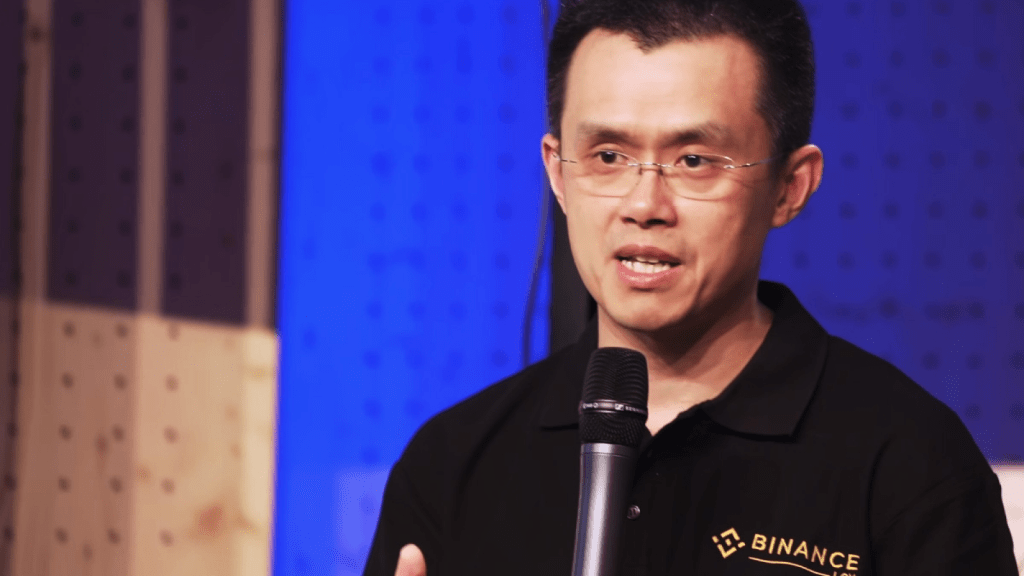

CZ discloses that LUNA tokens ‘never moved or sold’

The billionaire founder of crypto exchange Binance, after the collapse of LUNA assets, once valued at $1.6 billion, and he said he was ‘poor again’ after he was now only worth $2,200.

Kriptokoin.com In a tweet on Monday, Zhao stated that the world’s largest crypto exchange Binance holds 15 million LUNA tokens. told. He said that Binance acquired these tokens in 2018 in exchange for an investment of $3 million in the Terra network on which LUNA is based. He added that LUNA tokens were ‘never moved or sold’.

On Monday, Zhao urged the Terra team to repay their individual investors first. “To set an example in Protecting Users, Binance will drop it and ask the Terra project team to compensate individual users first, Binance last,” he tweeted.

Hashed Wallet and Delphi report loss after LUNA collapse

Delphi 13% of LUNA tokens’ assets under management at peak He says he built his reputation, while Hashed seems to have lost over $3.5 billion. This is the latest reflection from Terra’s loss of trust in the UST stablecoin.

The collapse of tokens linked to the Terra ecosystem, stablecoins TerraUSD (UST) and Terra (LUNA) has caused some major investors to make statements and detail their losses. Two other backers of Terra explained exactly how their balance sheet was affected.

Delphi Digital, a research firm and boutique investor, acknowledged in a blog post that it has always had concerns about the structure of UST and LUNA, but believed that the large assets in the Luna Foundation Guard would prevent the unthinkable.

The firm wrote that in the first quarter of 2021 it purchased a small amount of LUNA worth 0.5% of Delphi Ventures Master Fund’s net asset value (NAV) at the time. . That position has grown as LUNA’s value has grown, and the fund has increased its holdings, including a now worthless $10 million investment in LFG’s February 2022 hike. While Delphi says it hasn’t sold any LUNAs, it’s currently sitting on a “major unrealized loss.”

One of Terra’s other leading supporters is Hashed, an early-stage venture fund based in Seoul, South Korea. The company helped raise $25 million in Terra’s 2021 venture round, according to Crunchbase data. Hashed wrote about Terra in 2019: “We were immediately impressed by the complexity of their mechanical design and the speed of execution.”

“LUNA crashed last week and investors lost billions of dollars”

US Commodity Futures Trading speaking at Politico’s sustainability summit Commission (CFTC) chairman Rostin Behnam explained his views on Bitcoin and altcoins. Rostin Behnam stated that they have encountered quite a lot of fraud events in the crypto markets and made the following assessment:

Loss of tens of millions of dollars in digital assets due to phishing attacks, other fraudulent and manipulative actions, and this is becoming more common day by day. Two-thirds of cryptocurrency-related scams have occurred in the past year. TerraUSD and LUNA collapsed last week and investors lost billions of dollars.

Rostin Behnam drew attention to fraud incidents in the crypto market and stated that the CFTC will use its existing powers to the fullest to combat them. In addition, the Chairman of the CFTC invited industry representatives to work together against such fraud cases.