Terra (LUNA-UST) ecosystem collapse resulted in billions liquidations in 5 altcoin projects. In this article, let’s look at the extent of the damage, including Avalanche (AVAX), Solana (SOL), and Ethereum.

LUNA-UST collapse wiped billions in a week

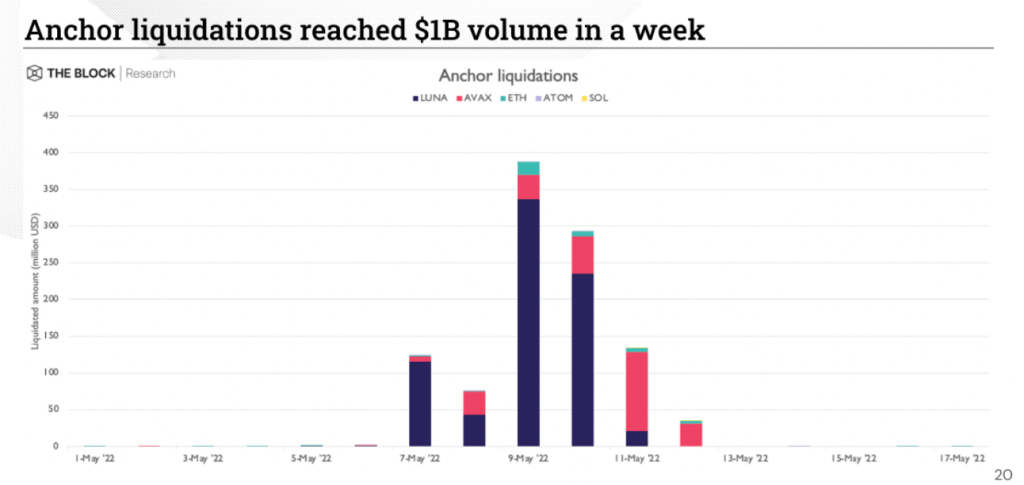

The $1,048 billion crypto collateral deposited by borrowers in Anchor was fully liquidated on the platform between May 7 and May 12. Luna (LUNA) accounts for more than $750 million, equivalent to approximately 75% of Anchor’s liquidation. Meanwhile, Avalanche (AVAX) is in second place with $261 million, with the rest evenly split between Ethereum (ETH), Solana (SOL), and Cosmos (ATOM).

Also, the meltdown in Anchor played a key role in driving the TVL value of the entire Terra ecosystem down from its March peak of $26 billion (2nd in the market). played a role. Anchor has also been split more than 12 times from $13 billion to $101 million. Specifically, the last time such a major liquidation happened was a year ago.

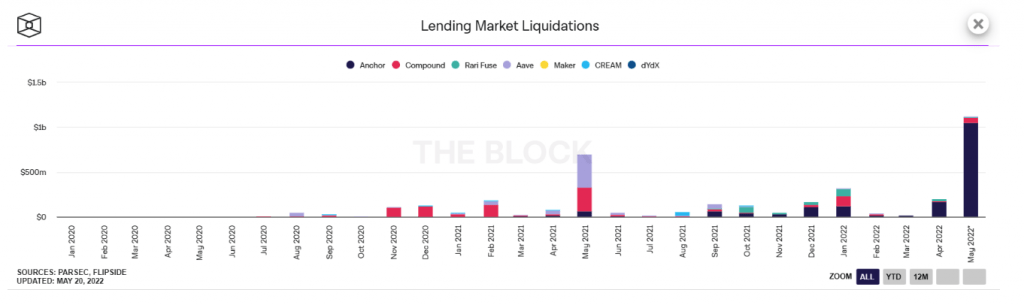

On the other hand, as we reported on Kriptokoin.com , on May 21, Compound and Aave to liquidate a total of $633 million during a general market crash triggered by China’s cryptocurrency mining ban. had to.

What exactly are the liquidations due to?

The chart below shows the largest liquidations of loan protocols in crypto history.

To understand the cause of the destruction, we need to understand a few points about the Anchor’s mechanism of action.

- Anchor is a lending platform in the Terra ecosystem.

- Users can borrow from Anchor by collateral in many other tokens such as LUNA, ETH, AVAX, SOL and ATOM. They also borrow from Anchor at 10% interest and can borrow up to 60% of the value of the collateral they deposit on the platform.

- Anchor holds these credits as UST.

- At the time of the crash, users rushed to send UST to Anchor, forcing the amount of UST ($14 billion) invested in the project to exceed the loan amount of only 3 billion UST.

- However, the market was bleeding as Bitcoin dropped to $34,000 on May 8.

- As a result, other altcoin projects have been affected as the crypto market continues to decline on a broad scale.