Gold finds support as stocks rise and the US dollar drops below 20-year highs. According to market analyst Ross J Burland, the bulls are correcting the price of gold equating to a significant pullback. The analyst comments on upcoming key events such as the pre-Fed ECB and US PMIs next week, and looks at the technical outlook for gold.

“The price of gold finds solace in a risky environment”

Gold price in Asia is flat in a quiet session consolidating overnight volatility. However, stocks are trailing the lead on Wall Street, with the Nikkei gaining a stunning 2% in the first hour of the session. Therefore, the US dollar is in the background as the risk-taking sentiment persists.

Overall, gold is trending bullish with time frame continuation within the bullish correction of the last supply leg at $1,750, which hit $1,700 last week. Meanwhile, investors are stepping aside before important central bank meetings. Also, the pullback in the US dollar continues to support the gold price.

US stocks were solid with better-than-expected gains. This gave some relief to investors who were worried about high inflation risks. Otherwise, it was predicted that a stronger US dollar could eat into corporate profits. According to the analyst, this supports the gold price as risk weighs on the US dollar.

US dollar slides down from 20-year high

The US dollar is correcting towards a potential long-term support area. This is an area that gold investors will follow. DXY falls below 20-year highs in Asia. According to the analyst, DXY has moved around the 50% average reversal level of the last weekly bullish impulse. The analyst makes the following assessment:

From a daily perspective, the price is hovering above a bid gap that leaves 105.27 vulnerable if DXY bears continue to hit bids. Gold traders will be watching price movements closely at this point.

Meanwhile, markets will be watching central banks and key US PMI data this week and beyond. The Federal Reserve will meet next week. Before that, the European Central Bank (ECB) has a meeting on Thursday. Next will be the US July PMI Surveys on Friday.

ECB, Fed and US PMIs approaching

The analyst says the ECB and US PMI Polls have the potential to create some volatility in the gold price before the FOMC. ECB’s 25 basis point rate hike seems certain. It’s unlikely to be a surprise.

However, the meeting will coincide with the news about the Nord Stream pipe. After turning it off, the gas flow should continue. But Berlin worries that Moscow will not be able to restart gas flow as planned. In a letter dated July 14 and seen by Reuters earlier this week, Russia’s Gazprom declared force majeure to at least one major customer over gas supplies to Europe. Ross J Burland comments:

Warmed inflation risks have seen money markets scramble for a half-point gain. Uncertainty is indeed a cloud over the ECB thing. However, whether the central bank charges 25 or 50 basis points, this will be the first time in more than a decade. The outcome of the event could have a significant impact on the price of the euro, US dollar and gold.

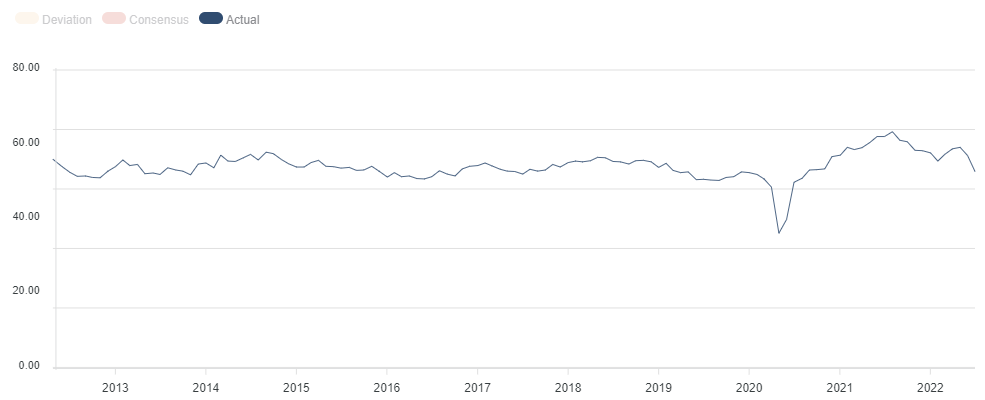

As for US PMIs, analysts at TD Securities said, “Business surveys fell markedly in June, led by broad declines in S&P Global PMIs. In particular, the manufacturing index recorded a great decline from 57.0 to 52.7 in May,” he explains. Analysts also share their predictions:

MFG is seeking relief from the pace of decline in PMI. Still, we anticipate a new decline in the latest forecast. Conversely, we expect a stable figure for the services index after recent declines.

“This situation increases the risk of short-squeeze for gold in the short term”

cryptocoin.com As you follow, the Federal Reserve is waiting around the corner for now. Against Fedspeak’s statement from key hawks, the Fed backed off by 100 basis points. TD Securities analysts assess the impact of this situation as follows:

This increases the risk of short-squeeze in the short run. However, gold prices are supported by the markets. However, this scenario would create the ideal setup for additional negativity in yellow metal.

Gold price technical analysis

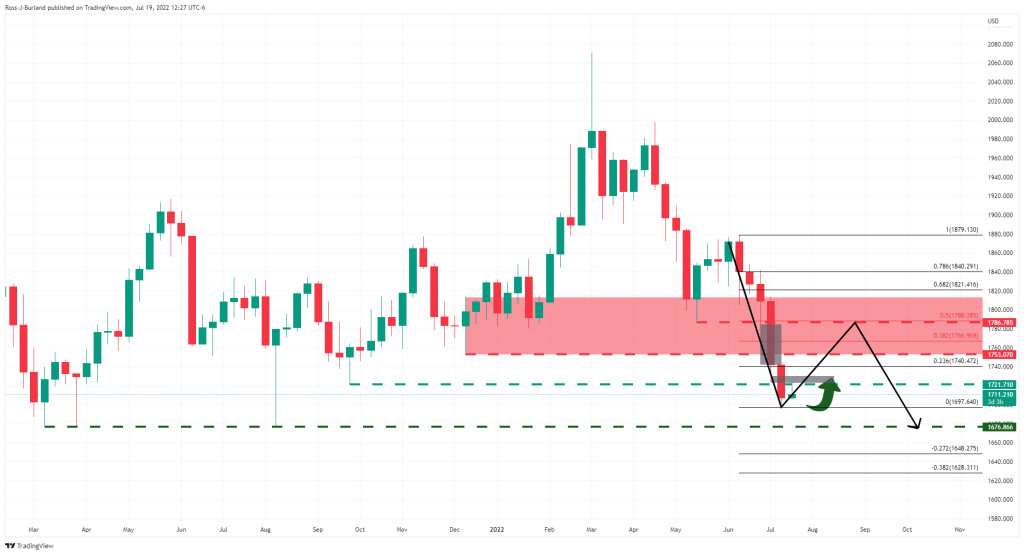

Market analyst Ross J Burland analyzes the technical outlook for gold as follows. A bullish correction continues for gold price in a weekly perspective. However, the lows of $1,676.86 are technically pushing up in the longer term as the chart below shows.

Gray areas in the chart above invalidate gold bids to test the bears’ commitments at a 50% average return. However, there are a few key pivot points on the way that could offer resistance at $1,721 and $1,753.