Rich Rosenblum, who says he also has positions on Collapsed Terra (LUNA), runs a crypto market maker that moves billions of dollars every day. He shares an altcoin project that isn’t ‘very sexy’ but is battling a bearish wave, and a little-known Blockchain to watch as it anticipates a surge in demand for new networks.

Is the LUNA crash a ‘Lehman thing’?

With a $33 billion market capitalization, the Terra (LUNA) ecosystem began to collapse on May 7 as the algorithmic stablecoin UST lost its dollar peg, market participants speculating that it was crypto’s bottom line as a number of major players were caught in the crash. He questioned whether it would be a ‘Lehman moment’.

Market maker, GSR was founded in 2013 and processes over $4 billion in crypto transactions every day. Commenting on the LUNA event, GSR co-founder and president Richard Rosenblum thinks the contagion effects have been limited so far

“The LUNA crash doesn’t seem to have had much of an impact in space.”

As the UST began to collapse, Arca doubled its positions and Galaxy Digital, whose CEO and founder Michael Novogratz got a tattoo referencing Terra (LUNA) from Terra’s collapse. A number of funds were affected. Even GSR had positions on Terra (LUNA), but Rosenblum says they weren’t ‘big’.

Rich Rosenblum, “We are very active in DeFi and we think part of it is our duty as market maker. “We want to provide liquidity on both centralized and decentralized exchanges, and we see it as part of our core knowledge base.” Rosenblum explains that even for players with larger positions with billions to lose, this is minimal relative to the broader portfolio.

Rich Rosenblum, “Even if the investment community suffers and is in highly concentrated positions, I think these are groups that have money to lose and have been very successful over the last few years. . And there doesn’t seem to be much of an impact in space,” he comments.

An example of more robust business models: MakerDAO (MKR)

Rosenblum says many investors and market makers are flocking to decentralized protocols. He hopes this will take a more thoughtful approach, looking at whether it’s a solid business plan. The decentralized finance (DeFi) ecosystem is already starting to see a significant slowdown in activity.

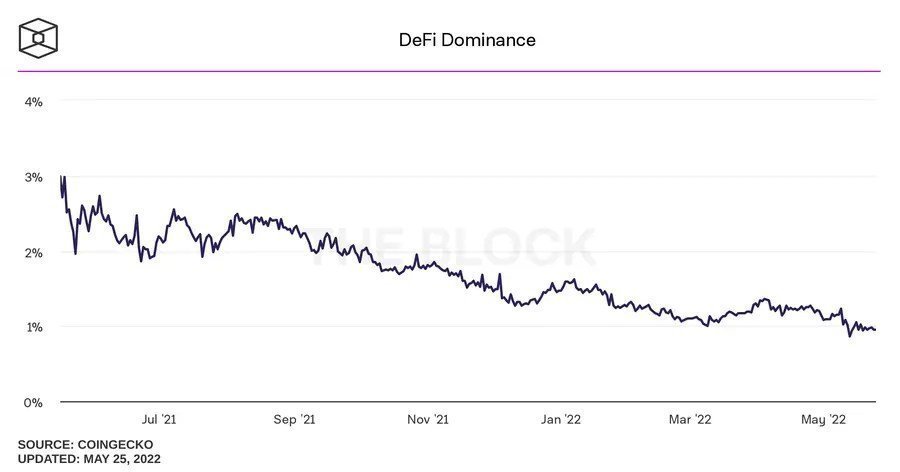

Chart looking at DeFi dominance from The Block Research

Chart looking at DeFi dominance from The Block Research Rosenblum says, “I think it’s less about the LUNA, it’s just the first time private and public markets have been beaten in several years,” says Rosenblum. An example of this move towards more robust business models is the activity surrounding MakerDAO amid the current bear market. Recently, DefiLlama’s total locked value jumped to the top of the leaderboard.

, describing the response to the project when it launched the algorithmic stablecoin DAI, “MakerDAO wasn’t always a very sexy project in 2018,” says Rosenblum. MakerDAO is a decentralized lending platform that allows individuals to lend and borrow cryptocurrencies. The ecosystem uses DAI, an overcollateralized stablecoin, to set lending rates. Rosenblum comments:

The concept of having an algorithmic borrowing and lending tool was new at the time, but they haven’t really done that much since then. And I think it’s stood the test of time, because its products, let’s say, are pretty basic to Terra’s grandiose plans, but I think it still does what it does and it works.

Rosenblum highlights that the Maker token (MKR) is one of the few cryptos that has traded upwards over the past week.

MAKER token trading activity chart for one month period on FTX

MAKER token trading activity chart for one month period on FTX Project that stands out as one of the new contenders: Aptos (APTOS)

Rosenblum said, “There was a time when this kind of investment was very difficult. Because both stocks and bonds fall in parallel with each other. “At a time like this, it is difficult to expect crypto to disperse as it is such a new asset class,” he says.

Seeing a surprise bull market in crypto this year, Rosenblum is hoping that some really new ideas will need to enter the market for a resurgence of interest like the DeFi summer. As we have covered in Cryptokoin.com news, one of the anticipated catalysts for the market this year is Proof of Stake (PoS), alongside the airdrops of the leading altcoin Ethereum, which are highly anticipated for layer-2 Ethereum scaling solutions. ) ‘merge’ with the consensus model.

Michael Safai, co-founder of crypto support store Dexterity Capital, expects developers and investors to return to the security of legacy protection blockchains like Ethereum and Bitcoin in light of Terra’s boom. Rosenblum disagrees and instead believes that ‘it will whet the market’s appetite for new tiers’, commenting that there is now a very clear path to not only compete with Ethereum, but also to provide value in the space.

Rosenblum highlights Aptos (APTOS) as one of the new contenders sitting by billions of valuations and still pre-mainnet. Also, Rosenblum thinks there is room for a few more blockchains to be successful this year.