In August of last year, an analyst who said that crypto investors will suffer for a while longer said that Bitcoin could pull back again in June. Senior analysts like Willy Woo and Altcoin Sherpa have similar views for Bitcoin. Bitcoin (BTC) price and detailed market data from hereyou can see.

Hit Bitcoin analyst Smart Contracter sets these bottoms for June

Smart Contracter correctly predicted that Bitcoin would peak at $63,000 earlier. cryptocoin.com In this article, we have included the analyst’s other accurate predictions. In its current analysis, Contracter has identified a scenario that is a continuation of the chart it shared in August, which many investors believe will cause the market to crumble.

If the rest of Smartcontracter’s technical analysis comes true, BTC is currently on its way to hurting the bulls, retreating to the $18,000 region by early June.

this is probably what #btc max pain feels like, 12 months of sideways with a sprinkle of capitulation in the middle pic.twitter.com/CoBpvyUVyA

— Bluntz (@SmartContracter) August 29, 2022

At this point, the analyst believes that Bitcoin will reverse once again, trapping the bears and leading to a long-term rally. Similarly, a popular technical analyst nicknamed Altcoin Sherpa says that Bitcoin’s altcoin market, which he expects to drop, could also lead to destruction.

“If Bitcoin falls into this range, altcoins could lose 50% of value”

Smart Contracter expects Bitcoin to test $18,000 by June, while Altcoin Sherpa predicts that the correction will depend on critical support. Current analysts said that altcoins could collapse by up to 50% if Bitcoin drops to the $23,000 region:

If the current $23,000 support is broken and this could send altcoins 30-50% down from their current levels. Bitcoin could see a drop to $21,000 later.

Could see a flush down to the 21ks if this current 23k low breaks and that'll send alts down 30-50% from current levels IMO. Happy to buy some of the strong ones at that time and rebalance my active trading positions. Going to cut some of them in the following days.

— Altcoin Sherpa (@AltcoinSherpa) February 23, 2023

Sherpa previously said that Bitcoin could see a correction of around 15%. The analyst states that Bitcoin has historically (2019) experienced rallies and dips of around 15% to 20%.

Friendly reminder that $BTC can still dip 15% or something in these types of uptrends and still be 'fine'. I don't even think it's over if we get to the 21ks.

Alts, on the other hand, would get rekt.

#Bitcoin #BTC https://t.co/6l9cbsCQRh

— Altcoin Sherpa (@AltcoinSherpa) February 22, 2023

Sherpa now predicts that in a scenario where Bitcoin drops to $21,000, it will run back into the $30,000 range.

I still personally believe we will go to $30,000 in the medium term.

So when people start screaming ITS OVER if it goes to 21k ….maybe they're right. Or maybe it's just consolidating before another run up. I still believe we go to 30k eventually in the mid term personally.

— Altcoin Sherpa (@AltcoinSherpa) February 17, 2023

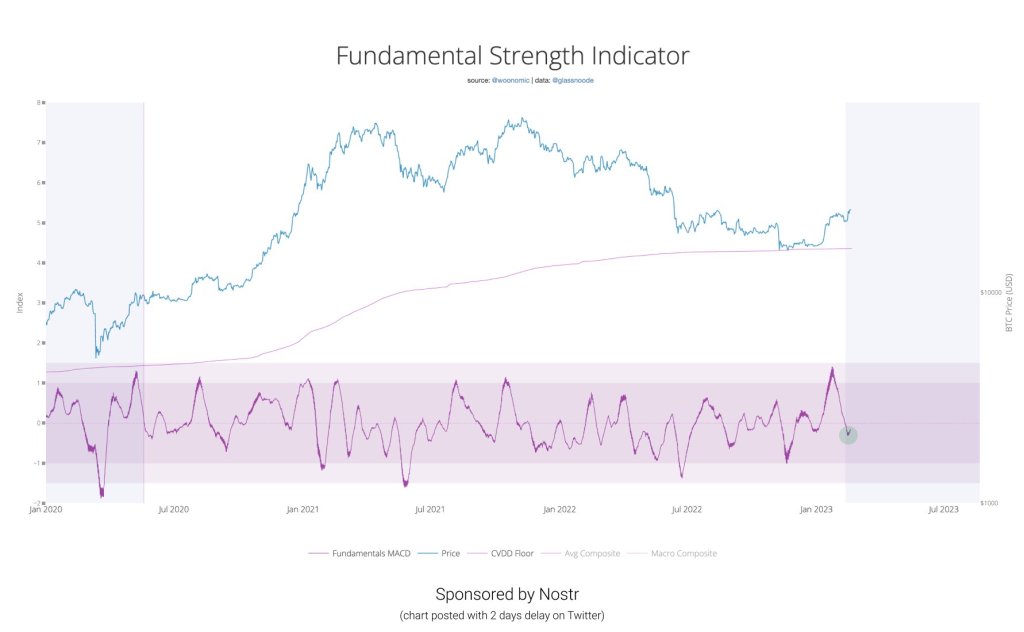

Willy Woo says it could be bearish in the short term as BTC indicators signal bullish

Popular on-chain analyst Willy Woo says Bitcoin could soon get a short squeeze. According to daily analysis, the Core Strength Indicator is no longer overheating and is starting to rise (FSI tracks the strength of 17 key and technical indicators). If the price goes well above $25,000, we could enter a short squeeze.

In the case of a short squeeze, the accumulation of a large number of short investors can cause the price of the corresponding crypto to explode in an unexpected price increase. Jamming then triggers additional rallies. Based on his analysis of the timing of past cycles, Woo states that Bitcoin is likely “entering the reaccumulation phase of the cycle.” On the threat of a recession, the analyst says:

I’m not a macro expert, but macro liquidity seems to be on the rise. BTC is still tied to it. I’m currently expecting a climb and a dead cat if the recession starts. Also, consider that a divergence may occur in future cycles.

Famous crypto whale says Bitcoin could rise more than 65%

In an extremely bullish analysis, widely followed analyst and BTC whale Kaleo said that if the leading crypto breaks $25,000, it could rally. Kaleo says that Bitcoin is watching the $40,000 price level.

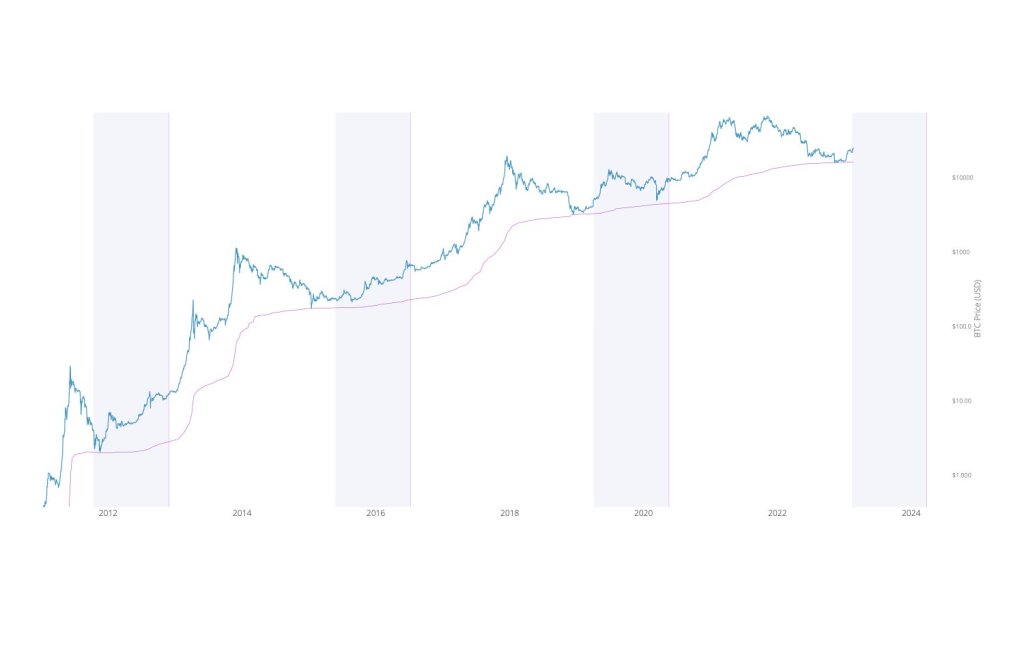

According to estimates drawn in a chart that Kaleo released earlier this week, BTC could trade between $30,000 and $40,000 between April and July of 2023. Following this rally, Bitcoin would return to mid-$20,000 towards 2024 before embarking on a bull run that would hit ATH in late 2024 or early 2025.

Here’s how Kaleo maps Bitcoin’s path forward:

The timeline will be ecstatic about the pennant exit, but more dips at the top of the range are sounding right before we see a return to $24,000 followed by foot up to $30,000.

The analyst also says that Bitcoin dominance is on an upward trajectory and will only consider altcoins when the dominance level rises above 50%:

As Bitcoin continues to strengthen, BTC Dominance is also getting stronger with it. I’m looking for more than 50% [on Bitcoin.D] returns before I take a serious look at most altcoins again.