Ethereum (ETH) spent February in a narrow price range and was forced to gain acceleration of the rise. However, the market collapse triggered by Donald Trump’s trade policies led ETH to a very monthly bottom level. Now investors are wondering if the price of ETH in March will fall further or if there is a chance to recover.

Ethereum: Supply is increasing, sales pressure is getting stronger

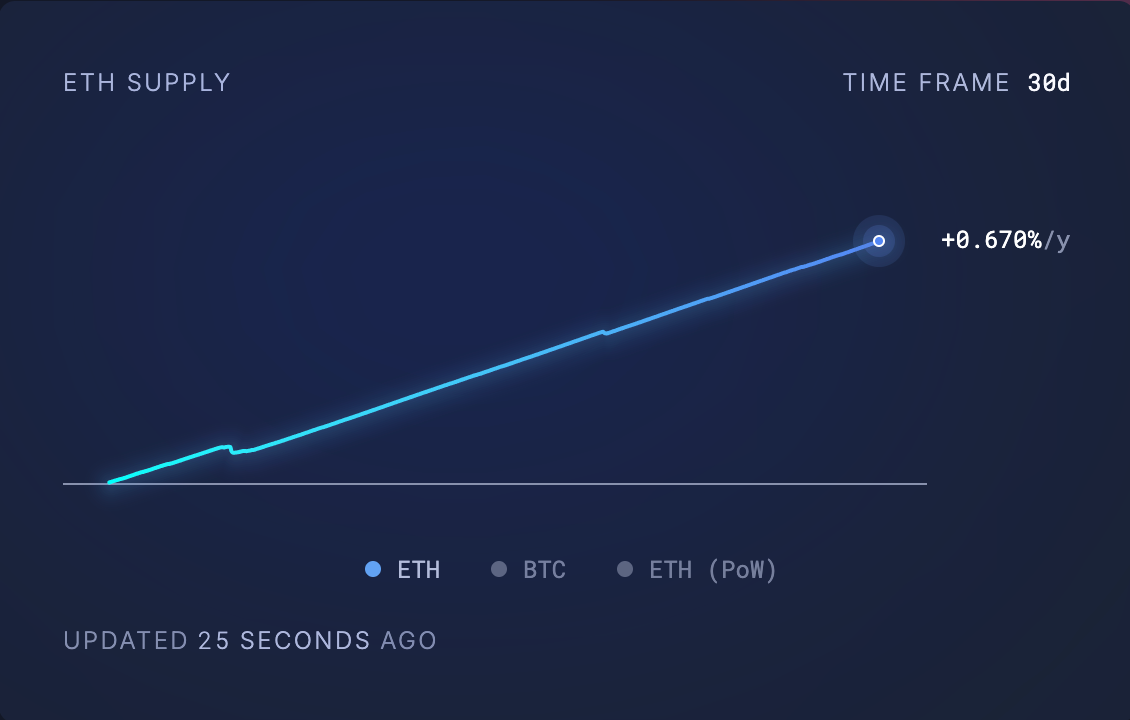

The continuous increase in ETH’s circulating supply is concern for March. 66,350 ETH has been released in the last 30 days. The value of this amount at current prices exceeds $ 138 million.

More ETH circulation may increase sales pressure. If the demand cannot reach this increase, downward pressure may occur on the price. Since there is no strong buyer interest at the moment, ETH is expected to perform weak performance in March.

The amount of ETH in the stock exchanges increases, is it a sales signal?

The eclipse rate of ETH’s stock market wallets began to rise again. The stock market balance, which fell to 17.27 million ETH levels on February 21st, has now reached 17.67 million. There was an increase of 2 %in the last seven days.

The increasing amount of ETH in the stock market wallets shows that investors are preparing to sell. If this trend persists, the sales wave may deepen. If more investors tend to sell ETHs in their hands, the pressure on the price may take during March.

Could there be an opportunity to buy for ETH?

Some analysts think that current price levels offer opportunities for long -term investors. Centimental Analyst Brian Quinlivan said that ETH performed weakly in 2023 and 2024 compared to other large subcoins and that it could create a great recovery. Currently, both short -term and long -term investors are in a loss. This may indicate that the gathering of a large price is approaching.

March 2025 will be decisive for Ethereum! Will the sales pressure continue, or will the expected rise opportunity arise? The fact that large investors start to make purchases may determine the direction of the price. If ETH can maintain critical support levels, the possibility of a strong recovery in March may be on the table. However, if the sales wave persists, it seems inevitable that Ethereum will test new bottom levels.