Transaction records detected by on-chain researcher Lookonchain show that one of the well-known founders of the market is selling large quantities of Lido (LDO). The founding name is moving to this altcoin from LDO, which has seen hard sells with the latest moves from the SEC.

Lido DAO (LDO) price drops in double digits, whales start selling

According to transactions Lookonchain detected last week, it was observed that MakerDAO co-founder Rune Christensen bought MKR while exiting his LDO positions. The MakerDAO founder has sold 18.86 million LDO tokens for a total DAI price of $27 million. During the same period, it bought 15,092 MKR worth $4.44 million DAI.

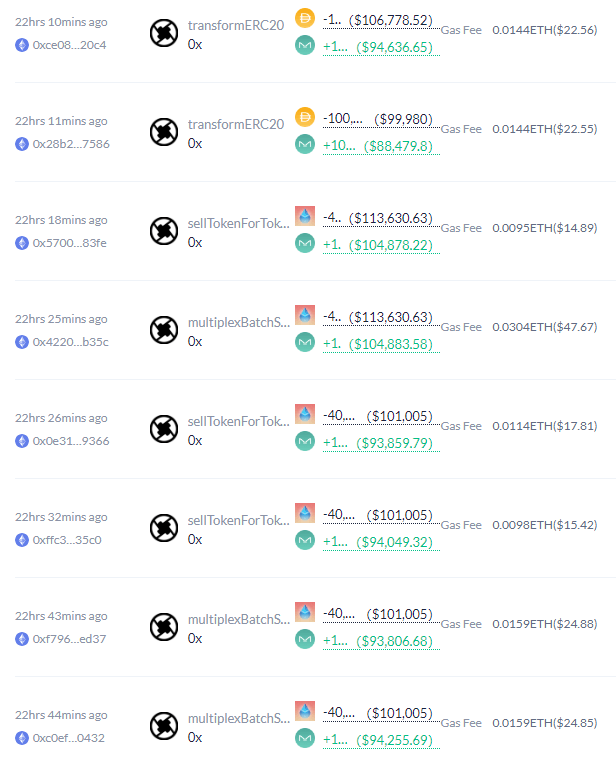

On-chain data for the last 24 hours shows that the founder has sold another 760,000 LDOs for close to $2 million. Later, he added on this fund and bought 2,788 MKR for $2.6 million. LDO sales averaged $2.6, while MKR purchases averaged $940.

In the past, there were five instances where Rune sold large quantities of LDO. The first three transactions coincided with the large-scale sale of LDO, with price drops. However, no correlation was observed as LDO prices rose despite sales the last two times. Transactions in the last 24 hours come at a time when the LDO price dropped in double digits due to regulatory concerns.

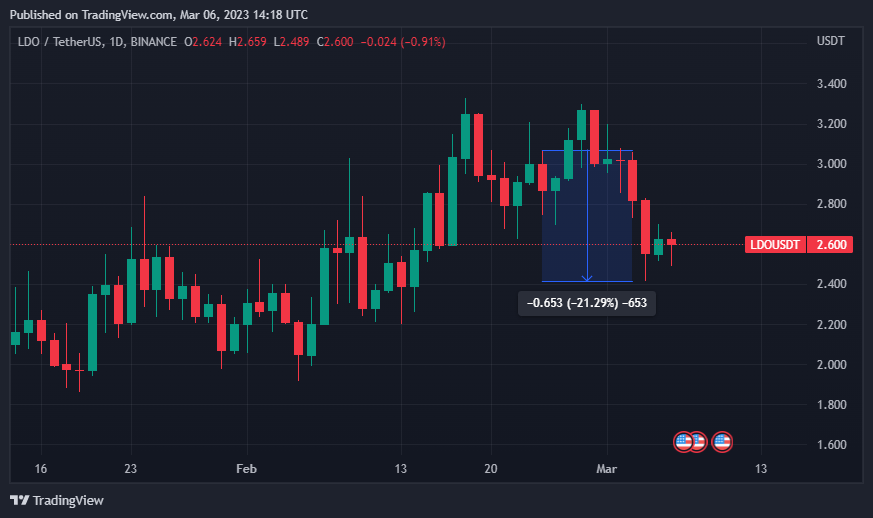

Lido DAO (LDO) price melts after SEC news

LDO, the native token of the liquid staking protocol Lido, fell by up to 20% after rumors of a Wells Notice (a letter detailing the charges) by the US regulator SEC. While the SEC has put pressure on Web3 companies, a rumor from the Bankless Show has negatively impacted the Lido price.

The decline was fueled by rumors of the Wells Statement brought up by Bankless co-founder David Hoffman. Lido price soon faced highly speculative bulk selling.

David Hoffman later apologized

David Hoffman later apologized for spreading the false rumor and reported that Lido had not received a Notice from Wells. In his statements, Hoffman stated that the DeFi industry was under pressure from the SEC throughout the week, and apologized by stating that this definition was wrong.

Talked with a Lido dude he said Lido did indeed not receive one.

Sorry for spreading a rumor, I thought it might have been news. https://t.co/IQPSimwPhO

— DavidHoffman.bedrock 🏴🦇🔊🔴_🔴 (@TrustlessState) March 3, 2023

The price of Lido dropped 20% after the video in which Hoffman spread the SEC news about LDO went viral on Twitter. Lido price has been picking up slightly since the rumors were clarified. Meanwhile, the SEC is wreaking havoc among crypto companies. cryptocoin.comAs we report, an SEC attorney recently claimed in a hearing that Binance.US offers unregistered securities.

Regulatory pressure is felt more than ever

SEC chairman Gary Gensler believes that any digital asset other than Bitcoin is a security. Last month, Paxos, the company authorized to issue BUSD, had to terminate its relationship with Binance due to pressure from the SEC. Prior to that, cryptocurrency exchange Kraken was fined $30 million and ordered to shut down its staking reward services.