Hi, I’m Jimmy He, here to take you through the day’s crypto market highlights and news.

Bitcoin was on the rise in Friday trading, even cracking $22,000 at one point early in the day before dipping to its previous day’s perch closer to $21,500.

The largest cryptocurrency by market capitalization was trading at about $21,800, roughly flat although more on the green side over the past 24 hours.

Bitcoin has enjoyed a rare up week so far, jumping over 14% since Monday, swept up in the same optimism that has carried equities higher this week amid encouraging signs the U.S. Federal Reserve will be undeterred in its battle with inflation. Bitcoin has risen for three consecutive days.

Still, the rally has done little to impress a number of analysts, who have yet to see evidence of a longer-term price surge that would carry bitcoin further beyond the current upper threshold in the low $20,000 range of the past month.

“Since the beginning of the month, BTC/USD has gained more than 17%, which looks like an impressive result but only at first glance,” FxPro senior market analyst Alex Kuptsikevich wrote in an email about the bitcoin/U.S. dollar pair. “The thing is, bitcoin was driven as low as possible by the end of June, and the current remarkable rise is just a recovery to the levels of three weeks ago.”

Kutpsikevich said that BTC is still below its 200-week average and its Friday morning sell-off indicates there is still “a significant supply overhang from sellers.”

Bitcoin is over 50% down from early 2022 levels and over 68% from its all-time high in November 2021.

Analysts at crypto exchange Bitfinex said on Friday that the S&P 500’s rally this week and rebounding tech stocks increased risk appetite, supporting BTC’s price despite a wave of recent liquidations and solvency issues in the crypto space.

“It will be interesting to see if a buoyant cryptocurrency market over the past 24 hours carries forward into more buying this month,” Bitfinex wrote to CoinDesk.

Most altcoins were recently higher on Friday, with Internet Computer’s ICP leading the charts, up 7% over the past 24 hours. Ether (ETH), the second-largest cryptocurrency by market capitalization, was down 0.4% over the same period.

Latest prices

●Bitcoin (BTC): $21,800 +0.9%

●Ether (ETH): $1,238 +0.2%

●S&P 500 daily close: 3,899.38 −0.1%

●Gold: $1,741 per troy ounce +0.2%

●Ten-year Treasury yield daily close: 3.10% +0.09

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Binance Volume Surges After Zero Trading Fee Policy Goes Live

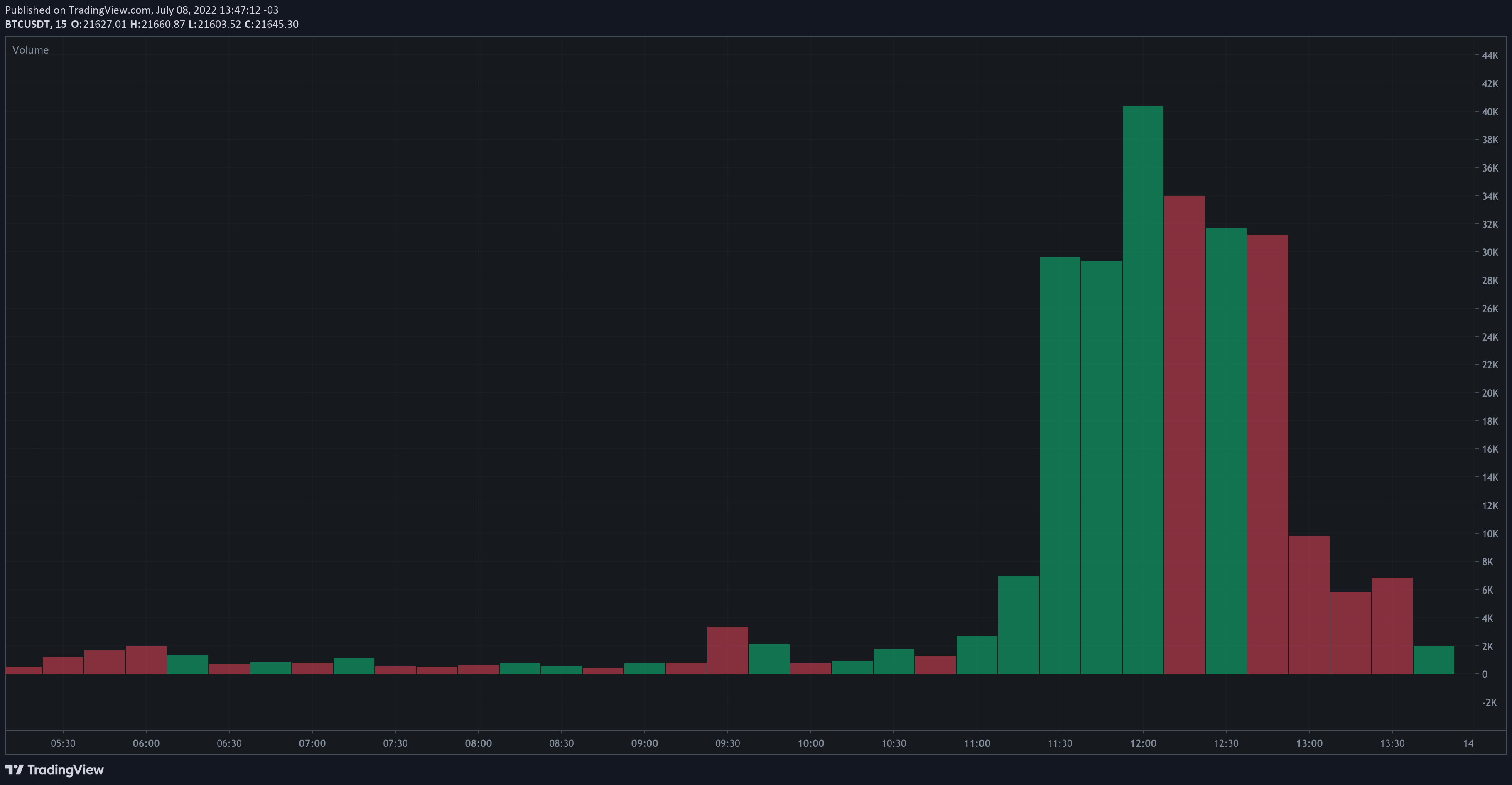

Chart from Binance website shows skyrocketing bitcoin trading volume on the crypto exchange immediately after 0% commission trading went live earlier Friday. (Binance)

Trading volume spiked higher at Binance, the world’s largest crypto exchange by trading volume, after its worldwide, zero trading fee policy went live on Friday morning. The zero trading fees for 13 crypto pairs began Friday at 14:00 UTC (10 a.m. ET). The move caused an explosion in trading at the exchange, with bitcoin/tether (USDT) spot volume surging to 320,000 coins within hours. The exchange hasn’t seen volume that high for even a full day since March 2020.

Binance CEO Changpeng Zhao attributed the surge to people trying to gain VIP tiers via high trading volumes. “We will exclude BTC trading from VIP calculations,” he tweeted. “Remove all incentives to wash trade. Announcement with details coming shortly.” A wash tradeoccurs when an investor buys and sells an asset for the purpose of artificially inflating the price. Read more here.

Altcoin roundup

-

AAVE proposes decentralized stablecoin: The U.S. dollar-pegged algorithmic stablecoin GHO will be minted by users and generate interest yields. It will be native to the Aave ecosystem and available on the Ethereum network initially but is expected to be offered on other Aave-supported blockchains based on future community votes. Read more here.

-

Ethereum name service spikes: Ethereum Name Service (ENS) domain registrations spiked this week as a prominent address sold for hundreds of ether (ETH), sparking retail interest. ENS is a decentralized domain name protocol that runs atop the Ethereum network, providing users with easily readable names for their crypto wallets. Read more here.

-

XRP leads crypto recovery: XRP rose by more than 5% as major cryptocurrencies recovered over the past 24 hours and broader equity markets strengthened, even with two U.S. Federal Reserve policymakers calling for higher rate increases in the coming months. Read more here.

Relevant insight

-

Listen ????: Today’s “CoinDesk Markets Daily” podcast discusses the latest market movements and takes a closer look at BlockFi’s fire sale.

-

Binance Volume Surges After Zero Trading Fee Policy Goes Live: As a result, CEO Changpeng Zhao said the exchange will make some changes “shortly” to “remove all incentives to wash trade.”

-

Three Arrows Wanted a $100M NFT Collection. Instead, It’s Worth Less Than $5M”: The company had dreams of institutional interest in non-fungible tokens. But as the firm declares bankruptcy, the NFT collection is worth a paltry sum. One investor has written off its entire investment in the “Starry Night” fund.

-

US Fed Vice Chairwoman Brainard Doesn’t Like What She’s Seeing in Crypto: Lael Brainard argued aggressive regulation is needed for the sector before things get out of hand.

-

Crypto Exchange Blockchain.com Faces $270M Hit on Loans to Three Arrows Capital: Blockchain.com “remains liquid, solvent and our customers will not be impacted,” wrote CEO Peter Smith in a letter to shareholders.

-

US Job Growth Remains Historically Strong, Exceeding Economists’ Expectations: The employment report will be a key data point for the Federal Reserve’s next rate hike decision later this month.

-

India’s Law Enforcement Agency Probes Crypto Exchanges for Forex Violations: The investigation comes amid a slide in the rupee to a record low versus the U.S. dollar.

-

Binance Secures Registration in Spain Through Its Moon Tech Subsidiary: The company can now offer crypto trading and custody services in the country.

-

Crypto Mining Stocks Bounce Amid Bitcoin Recovery: Investors are likely feeling comfortable as the price of the largest cryptocurrency has stabilized over the past few days.

-

GameStop CFO Fired Amid Cost-Cutting Drive: Mike Recupero had been the financial chief at the video-game retailer since June 2021.

-

Swiss Cybersecurity Firm WISeKey Ends Share Buyback Program: The Zug-based firm repurchased 1,074,305 shares for about $1.5 million.

Other markets

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Polygon | MATIC | +5.5% | Smart Contract Platform |

| Shiba Inu | SHIB | +3.9% | Currency |

| Solana | SOL | +1.0% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Gala | GALA | −3.2% | Entertainment |

| Loopring | LRC | −3.2% | Smart Contract Platform |

| Cosmos | ATOM | −3.1% | Smart Contract Platform |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.