Price Action

Bitcoin (BTC) drooped but was still trading comfortably over $20,000 as investors chewed over a surprising gain in the latest U.S. GDP report. The U.S. Commerce Department reported that gross domestic product rose 2.6% in the third quarter, instead of the projected 2.4% gain. The increase followed two consecutive declines that, according to traditional definitions, placed the economy in a recession and suggested the contraction would heighten. Central bankers have been trying to tame inflation without casting the economy into a steep recession. The latest GDP suggested their monetary hawkishness has yet to have a full impact. On Tuesday BTC topped $20,000 for the first time since Oct. 5.

Ether (ETH) remained near $1,550, down more than a percentage point from Wednesday, same time, ending two consecutive days of healthy gains that took the second largest crypto to its highest point since mid-September.

Dogecoin (DOGE) continued to soar, climbing more than 11% over the past 24 hours as billionaire entrepreneur Elon Musk neared the completion of his $44 billion purchase of social media platform Twitter. Other major altcoins were mixed, although tinted more red than green. ADA and CRO were both down about 2%.

The CoinDesk Market Index (CMI), a broad-based market index that measures the performance of a basket of cryptocurrencies, recently fell 0.37% over the past 24 hours.

Macro View

In traditional markets, the tech-focused Nasdaq was down a few fractions of a percentage point amid a so far disappointing earnings season for major technology brands, including Meta Platforms, whose augmented and virtual reality operations missed badly on revenue projections. Meta founder and CEO Mark Zuckerberg remained defiant even as his company’s stock plummeted nearly 25% in Thursday trading. S&P 500 also dropped, but the Dow Jones Industrial Average rose slightly

In commodities, Brent crude oil remained over $94 per barrel, roughly flat over the past 24 hours. The widely watched measure of energy markets has jumped more than 15% since the start of the year. Energy prices are an ongoing concern in the battle against inflation. Safe-haven gold was down 0.3% at $1,661 per ounce.

The University of Michigan’s monthly Consumer Sentiment Index on Friday will reflect the public’s perceptions about the economy. Earlier this week, the Conference Board reported a decline in its Consumer Confidence Index.

Latest Prices

● CoinDesk Market Index (CMI): 1,007.23 −1.1%

● Bitcoin (BTC): $20,422 −1.6%

● Ether (ETH): $1,532 −1.3%

● S&P 500 daily close: 3,807.30 −0.6%

● Gold: $1,666 per troy ounce +0.1%

● Ten-year Treasury yield daily close: 3.94% −0.1

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Technical Take

Crypto Markets Remain Stable Following GDP Release, Bitcoin Stays Over $20K

By Glenn Williams Jr

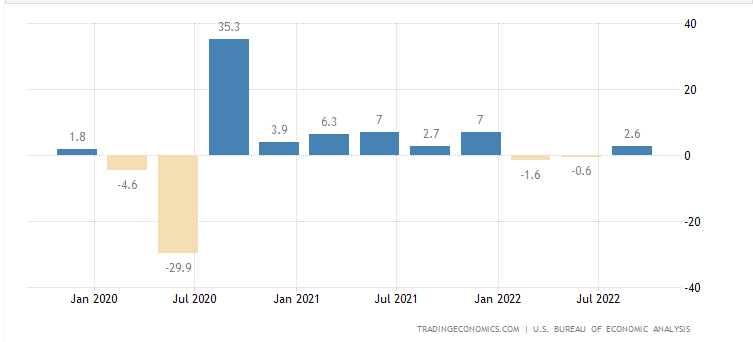

Quarterly GDP (Trading Economics/U.S. Bureau of Economic Analysis)

Crypto markets paused their recent two-day ascent, following an unexpectedly strong GDP report in the U.S. that failed to shake investors from underlying concerns about inflation and a potential steep recession.

U.S. economic growth expanded 2.6% in the third quarter, versus expectations for 2.4% growth.

The economic expansion is a reversal from the 1.6% and 0.6% contractions in the first and second quarters. But consumer spending and the once-hot housing market have been slowing as rising prices and interest rate hikes have an increasing impact on the economy.

Read the full technical take by CoinDesk analyst Glenn Williams Jr.

Altcoin Roundup

-

Aptos Token Rebounds After Upstart Blockchain’s Dismal Debut: Backed by FTX and the crypto-friendly venture capital firm Andreessen Horowitz (a16z), Aptos is a layer 1 blockchain led by ex-Meta employees who pioneered the company’s failed diem stablecoin. The price of the newly launched APT token has nearly rallied back to where it started trading last week before a swift crash. Read more here.

-

Coinbase Says Reddit’s Success Highlights the Potential for NFTs: Reddit non-fungible tokens (NFT) have dominated conversation in cryptocurrency markets this week after they generated $2.5 million in daily trade volume and prompted 3 million people to sign up for NFT wallets on the social media platform, Coinbase said in a report. Read more here.

Trending posts

-

Listen 🎧:Today’s “CoinDesk Markets Daily” podcast discusses the latest market movements and a look at building in a bear market.

-

US GDP Expands 2.6% in Q3, Faster Than Expected; Bitcoin Steady:Any growth in gross domestic product might be negative for the bitcoin market because the Federal Reserve will have to keep raising interest rates to bring down inflation – typically bad for prices of risky assets.

-

Bitcoin Miner Core Scientific’s Shares Plummet After Bankruptcy Warning:The world’s largest bitcoin miner said it will not make payments that are due in the next few days as its reserves dwindle.

-

Google Introduces Cloud-Based Blockchain Node Service for Ethereum: The move highlights the growing attention that technology giants are paying to blockchain, crypto and Web3 projects.

-

Crypto Exchange FTX Is Working on Creating a Stablecoin: Report:FTX CEO Sam Bankman-Fried also ruled out a potential acquisition of popular trading app Robinhood.

-

Bear Market Didn’t Slow Institutional Interest in Crypto, Says Fidelity Survey:The fourth annual study showed that 74% of institutional investors want to purchase crypto in the future.

-

Crypto Launchpad Team Finance Suffers $14.5M Exploit:The platform has paused all activity till the exploit has been mitigated.

CoinDesk Market Index

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Tribe | TRIBE | +7.22% | DeFi |

| Chain | XCN | +5.49% | Currency |

| Enzyme | MLN | +2.62% | DeFi |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Samoyedcoin | SAMO | -15.76% | Currency |

| Optimism | OP | -14.09% | Smart Contract Platform |

| Dogecoin | DOGE | -13.68% | Currency |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.