Price Action

Bitcoin, ether and most other major cryptos were holding steady, even as investors wrestled with the widening gloom from exchange giant FTX’s implosion.

The largest cryptocurrency by market capitalization was recently holding steady above its most recent $16,000 support, up a fraction of a percentage point over the past 24 hours, although some crypto market observers believe that it could dip to lower levels.

This article originally appeared in Market Wrap, CoinDesk’s daily newsletter diving into what happened in today’s crypto markets. Subscribe to get it in your inbox every day.

“We have seen broader market instability despite some positive macro developments for risk assets as a whole,” David Duong, head of institutional research, at crypto exchange Coinbase, wrote, adding: “It’s still emerging which counterparties may have lent or interacted with either FTX or Alameda (FTX’s sibling company) and what those exact liabilities are. BTC could not only retest 2022 lows but touch the $13K level. We think there is support at $13.5K.”

Ether was recently changing hands at about $1,200, up slightly. The second-largest crypto in market value and other major altcoins have been caught in the FTX fallout. The exchange filed for bankruptcy protection on Friday, suffered a major hack over the weekend and is the target of regulators worldwide.

SRM led a rogues’ gallery of tokens in the red, recently falling close to 20%. On Saturday, DeFi protocols across the Solana ecosystem began unplugging from Serum for fear that they didn’t know who wielded control – a concern fueled by the late-Friday hack at FTX. The Solana Foundation said Monday it has tens of millions of dollars in cryptocurrencies stranded on FTX – as well as 3.24 million common stock shares in Sam Bankman-Fried’s bankrupt crypto exchange.

Embattled crypto lender Celsius’ CEL token was down nearly as much, while FTX’s FTT coin fell more than 13% to $1.27, a fraction of its pricing near $36 earlier in the year. XRP was recently up more than 10%.

The CoinDesk Market Index, a broad-based index designed to measure the market capitalization weighted performance of the digital asset market, was trading flat.

Equity markets broke a recent trend upward with the Nasdaq dropping 1.1%, and the S&P 500 and Dow Jones Industrial Average declining 0.8 and 0.6%, respectively after online retailer Amazon pushed forward with layoffs, part of a larger cost-cutting campaign tied to the company’s pessimistic expectations for the months ahead.

FTX’s collapse doesn’t mean it will be the end for crypto, venture capitalist Kevin O’Leary told CoinDesk TV’s First Mover program, describing the debacle as a “defining” moment that will “stabilize” the industry.

“This does not kill crypto,” added O’Leary, who said that he had considered rescuing FTX before SEC chief Gary Gensler highlighted anew the industry’s lack of regulation. “There’s going to be a silver lining to this disaster. There’s no question about it. It’ll be called regulation.”

Latest Prices

Technical Take

Crypto Turns to an Oil-Patch Tradition to Right Itself

By Glenn Williams Jr.

The growing push for crypto firms to adopt proof-of-reserves balance sheet validation emulates a practice long used in the physical commodities world.

The commodities industry has been using validation for years to assure investors of their solvency and build confidence in those markets and companies. That bitcoin and ether are often referred to as “digital gold” and “digital oil” now seems more appropriate than ever.

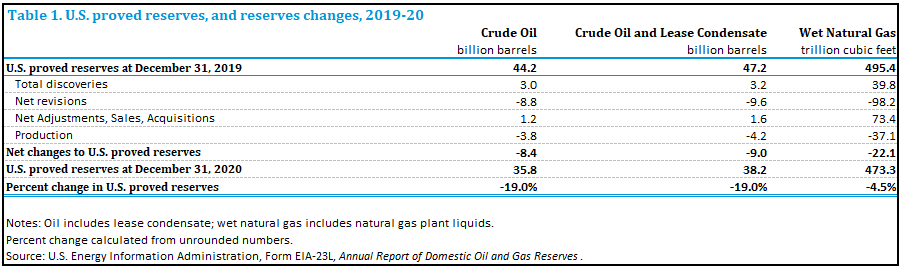

Oil and gas entities attest to their reserve balances at the end of each year. Investors, analysts and traders are accustomed to reading through these attestations and determining the extent to which a firm’s valuation may or may not have changed.

Below is the most recent oil and gas proved reserves report for the U.S., released Jan. 13, 2022. As you can see, the U.S. proved reserves declined 19% between Dec. 31, 2019 and Dec. 31, 2020.

U.S. Proved Reserves (Energy Information Association)

Read the full technical take here.

Altcoin Roundup

-

Solana Foundation Invested in FTX, Held Millions in Sam Bankman-Fried-Linked Cryptos on Exchange: The Solana Foundation said Monday it held 134.54 million SRM tokens and 3.43 million FTT tokens on FTX when withdrawals went dark on Nov. 6. The Foundation also said it has 3.24 million common stock shares in Sam Bankman-Fried’s bankrupt crypto exchange. Following the collapse of FTX, there has been severe sell pressure on the price of SOL as the token is down over 56% in the past seven days to around $13. Read more here.

Trending posts

-

Listen 🎧: Today’s “CoinDesk Markets Daily” podcast discusses the latest market movements and a look at one way to embrace regulation.

-

FTX’s Failure Is Sparking a Massive Regulatory Response:Lawmakers, regulators and criminal investigators are looking into FTX’s collapse, and Sam Bankman-Fried’s tweets aren’t helping.

-

FTX Hack or Inside Job? Blockchain Experts Examine Clues and a ‘Stupid Mistake’:Insolvent crypto exchange FTX suffered a $600 million exploit late Friday after filing for bankruptcy protection.

-

Crypto Fund Inflows Surged Last Week as Investors Bought on FTX-Induced Dip:The largest inflows in 14 weeks, at $42 million, coincided with the crypto market’s sharp downturn, triggered by the swift collapse of once-billionaire Sam Bankman-Fried’s business empire.

-

Ikigai Asset Management Had ‘Large Majority’ of Assets on FTX, Unclear Whether It Will Be Able to Continue:Chief Investment Officer Travis Kling tweeted that the hedge fund has only been able to withdraw “very little” of its funds.

-

Visa Ends Its Debit Card Pact With FTX:The original partnership to release crypto debit cards in 40 countries was reported on in October.

-

Health of FTX’s US Derivatives Arm Owed to Oversight, Says CFTC Chief Behnam:The former LedgerX unit seems to be in good shape, Behnam said at a Chicago event, though its controversial application to directly clear customers’ derivatives trades was withdrawn.

-

Bitcoin Miner Bitfarms Pays Down $27M of Debt:The miner is trying to improve its liquidity during the crypto market downturn.