Price Action

Bitcoin and ether took different paths on Monday, with bitcoin declining and ether going higher.

-

Bitcoin (BTC) was up 0.30% on strong daily volume. The price fluctuated widely throughout the day as the largest cryptocurrency by market cap at one point fell below $19,000. A sharp drop of 3.47% took place during the 02:00 UTC (6 a.m. ET) hour but prices reversed course as U.S. markets opened. The decline occurred on six times the average trading volume and implies an overreaction to the downside that was subsequently corrected. There was little in the way of economic data reports that could account for the decline.

-

Ether (ETH) was 1.72% higher, ending a slide that began after last week’s successful Ethereum Merge. A look at ether’s hourly chart indicates a similar pattern to BTC in that it also fell on higher volume during the 02:00 UTC hour, only to reverse course later. Ether has fallen approximately 17% since the Merge.

The CoinDesk Market Index (CMI), a broad-based market index that measures crypto performance across a basket of currencies, declined 0.35%

Economic Calendar: The highlight of the economic calendar this week will be Wednesday’s Federal Open Market Committee (FOMC) meeting and its expected interest rate decision.

Markets are ascribing an 80% chance that the Fed funds rate will increase by 75 basis points and a 20% chance that it will increase by 100 basis points, or 1%. Rates have not increased by 1% in over 40 years.

Between 1978 and 1981, the Federal Reserve raised rates by 1% seven times during the term of then-Chairman Paul Volcker because of soaring inflation.

U.S. Equities: Traditional equities rose. The Dow Jones Industrial Average (DJIA), tech-heavy Nasdaq composite and S&P 500 increased by 0.6%, 0.8%, and 0.7%, respectively.

Commodities: In energy markets, the price of WTI crude oil moved 0.42% higher, with natural gas increasing 1.6%. In metals, traditional safe haven gold rose just 0.01%, while copper futures increased 0.26%.

The Dollar Index (DXY) was relatively flat, down 0.03%.

Latest Prices

● Bitcoin (BTC): $19,465 −1.3%

● Ether (ETH): $1,361 −1.3%

● CoinDesk Market Index (CMI): $960 −1.3%

● S&P 500 daily close: 3,899.89 +0.7%

● Gold: $1,684 per troy ounce +0.7%

● Ten-year Treasury yield daily close: 3.49% +0.04

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Technical Take

Bitcoin and ether face challenges

Traders will have difficulty pinpointing a price direction for BTC and ETH because both assets appear tied to macroeconomic data and overall appetite for risk. Ether’s most recent catalyst, i.e., the Ethereum blockchain’s Merge upgrade, has come and gone.

While the Merge has been widely deemed as successful, ether’s price is down 17% since the upgrade took place because investors appear to have taken a “sell-the-news” approach to the second-largest cryptocurrency.

One factor lately for the BTC and ETH prices is the strength — or lack thereof against — of the U.S. dollar, as the dollar index (DXY) has a strong inverse relationship to bitcoin’s price. BTC’s price is down approximately 58% year to date but the DXY has risen 15% over the same period.

M2 money supply, a measure of money supply within the economy, has declined 5% since January, in line with the Federal Reserve’s stance on reducing inflation.

Market participants are likely eyeing data that affects the strength of the U.S. dollar as a signal for digital assets’ price direction. Ultimately, what strengthens the dollar weakens digital assets, and vice versa. Decreasing money supply and the anticipated increase in the Fed funds rate are actions that do just that.

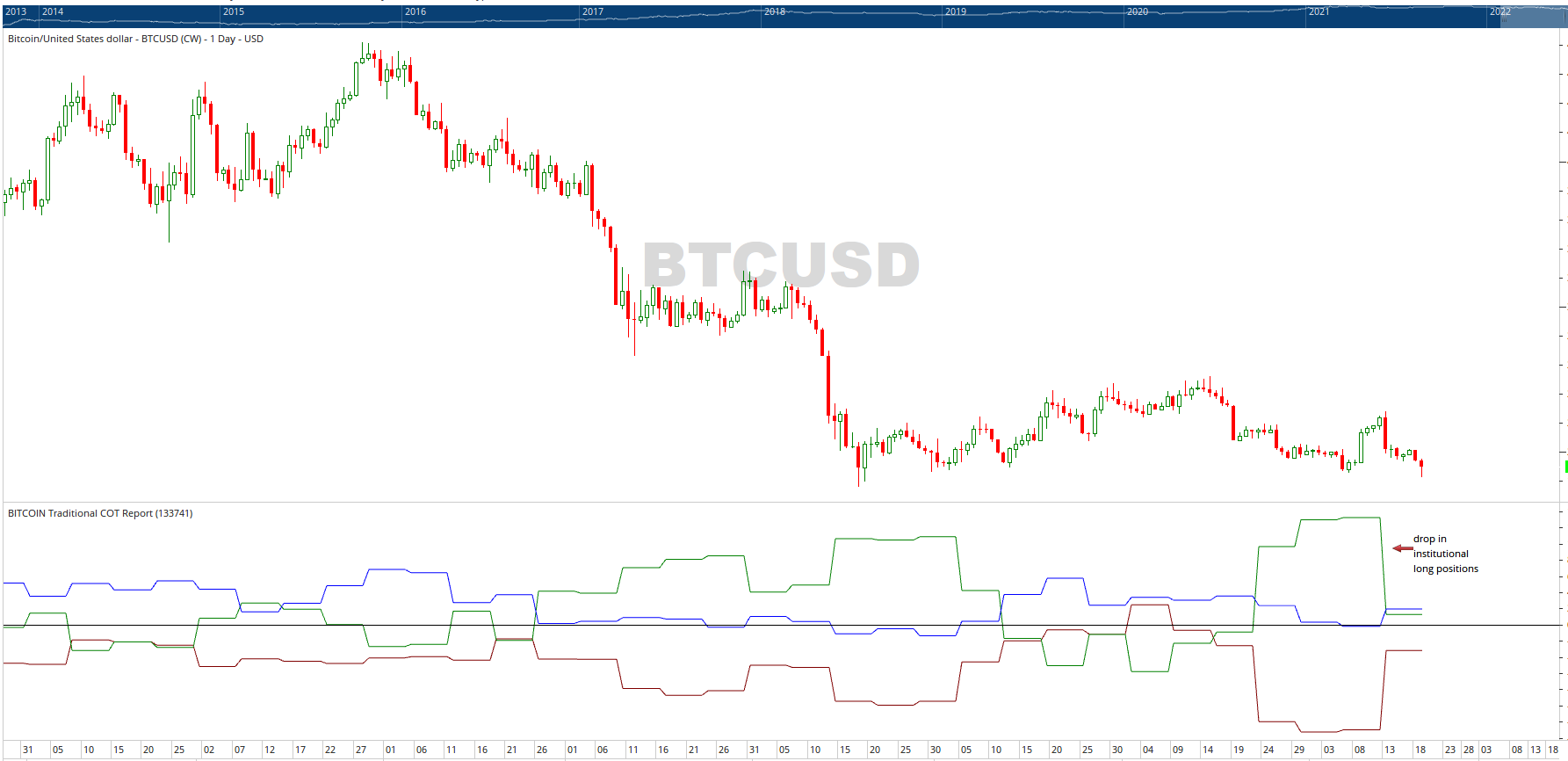

From a technical perspective, larger institutions have recently reduced their BTC holdings. The Commitment of Traders report, published by the Commodity Futures Trading Commission (CFTC) each Tuesday illustrates positions held by traders in futures markets.

Long positions of larger speculators, denoted in green, dropped sharply on Sept. 13, coinciding with the 10% decline that occurred on that day. Traditionally, the COT report offers an inside look at where institutional investors are allocating capital.

Oftentimes, though not always, larger speculators have tended to add to long positions near market bottoms and enter short positions near market tops.

Looking at price action compared to COT data for bitcoin indicates that it has not proven as simple for BTC as it has with other commodities. Still, absent an uptick in long positions by larger speculators, BTC prices are likely to trade within a tight range in the near term.

Bitcoin/U.S dollar daily chart (Glenn Williams Jr./Commodity Futures Trading Commission)

Altcoin Roundup

-

SEC, Ripple Call for Immediate Ruling in Suit Over Whether XRP Sales Violated Securities Laws: The U.S. Securities and Exchange Commission and Ripple Labs both filed motions for summary judgment, arguing that a judge overseeing the case has enough information to make a ruling without moving the case forward to a trial. Read more here.

-

THNDR Games Launches Play-to-Earn Bitcoin Solitaire Mobile Game: The new game, dubbed Club Bitcoin: Solitaire, aims to increase bitcoin adoption by specifically targeting female audiences and emerging markets. Read more here.

-

Eth.link Restored After Ethereum Name Service Wins Injunction Against GoDaddy: The company behind the Web3 domain service and Virgil Griffith sued GoDaddy earlier this month, alleging the domain registration platform falsely announced eth.link had expired, and then sold it to a third party. Read more here.

Trending Posts

-

Listen 🎧: Today’s “CoinDesk Markets Daily” podcast discusses the latest market movements and some thoughts on practical privacy from an iconic early cypherpunk.

-

Politicians, Not the Usual Bureaucrats, Take the Reins on Web3 in Japan: A handful of lawmakers are forming new policies, bypassing the usual lengthier route.

-

ICO Promoter Ian Balina Charged With Violating Federal Securities Laws: The SEC says Balina failed to disclose his compensation for his promotion of SPRK tokens in 2018.

-

Crypto PR Firm Wachsman Hires Cointelegraph’s CEO as Chief Growth Officer: Jay Cassano was previously editor-in-chief of the crypto news organization and a journalist at Fast Company and Newsweek.

-

US Treasury Wants Public to Comment on Crypto’s Role in Illicit Finance: The Treasury Department listed a number of questions, asking the general public to weigh in on how it’s approaching cryptocurrencies and cryptos’ possible role in illegal activities.

-

Crypto Exchange WazirX to Delist USDC in Boost for Binance’s Stablecoin: WazirX will automatically convert customer holdings into BUSD in an effort to boost the value of Binance’s stablecoin.

CoinDesk Market Index

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| ApeCoin | APE | +15.72% | Culture & Entertainment |

| Terra Luna Classic | LUNA | +9.63% | Smart Contract Platform |

| Ribbon Finance | RBN | +9.36% | DeFi |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| LCX | LCX | -10.06% | Currency |

| iExec RLC | RLC | -5.05% | Computing |

| Kyber Network Crystal | KNC | -2.68% | DeFi |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.