Price Action

FTX crashed. Cryptocurrency prices tumbled on Friday as fretful investors returned to their defensive postures of earlier in the week.

Bitcoin (BTC) was recently trading at about $16,675, down nearly 7%. The largest cryptocurrency by market capitalization was still hovering near $17,000 when CoinDesk reported that FTX, the once-widely revered exchange, had filed for bankruptcy after a fruitless search for a rescuer. The ongoing fallout for an already shellshocked crypto sector remains uncertain.

This article originally appeared in Market Wrap, CoinDesk’s daily newsletter diving into what happened in today’s crypto markets. Subscribe to get it in your inbox every day.

“The collapse of FTX and the uncertainty it has brought to the industry has been another damaging blow,” wrote Craig Erlam, senior market analyst for foreign exchange market maker Oanda. “How damaging it will be will depend on what further details appear in the coming days but right now, prices remain under pressure and vulnerable to further sharp declines.”

Ether (ETH) was recently changing hands just above $1,260, off more than 4.5%. Most other major cryptos by market value spent their day in the red, victims of FTX contagion. FTX’s FTT token recently plunged more than 30% to approach its low perch from earlier in the week.

As CoinDesk reported, the Solana blockchain’s SOL token, one of the hardest-hit digital assets this week, slid nearly 12%. SOL’s decline stemmed from speculation about Solana’s close connection to Alameda Research, a trading firm that was founded by FTX CEO Sam Bankman-Fried. SOL was Alameda’s second-largest holding, according to Riyad Carey, a research analyst at crypto data firm Kaiko.

The CoinDesk Market Index, a broad-based index designed to measure the market capitalization weighted performance of the digital asset market, dropped 4.2%.

Equity markets continued their momentum from Thursday, especially the tech sector. The Nasdaq rose 1.8%, while the S&P 500 increased 0.9%.

Yet, consumer attitudes about the U.S. economic future slumped in November, according to the University of Michigan’s much-watched monthly consumer sentiment index. The index had risen unsteadily in recent months after falling to an all-time low in June.

Although buoyed by stocks’ recent rise, Oanda’s Erlam noted that investor “sentiment [could] cool again in the coming weeks.”

Latest Prices

Technical Take

Post-FTX, What Happens to Crypto Markets?

By Glenn Williams Jr.

Since 2015, BTC’s RSI has fallen between 30 and 50 on 1,005 occasions. Since 2017, ETH’s RSI has maintained the same range 682 times.

The average 30-day performance following those occurrences since that time has been -1.1% for ETH and 3.03% for BTC.

Bitcoin and ether’s respective $20,000 and $1,300 support levels of a week ago will now likely represent resistance.

Bitcoin 11/11/2022 (TradingView)

Read the full technical take here.

Altcoin Roundup

-

Ether Turns Deflationary as Amount of ETH Burned Spikes Amid FTX-Induced Market Volatility: Ether (ETH)’s net supply increase has turned negative for the first time since the Merge. There has been a recent increase in Ethereum network activity prompting an uptick in the amount of ether burned. The latest increase in network usage could be attributed to market volatility triggered by the collapse of the cryptocurrency exchange FTX. Read more here.

-

Solana Volatility Returns After FTX Bankruptcy, But What Comes Next?: The Solana blockchain’s SOL token has been hit hard this week amid a sell-off across crypto markets triggered by the collapse of Sam Bankman-Fried’s business empire. The SOL price was down 50% in the past seven days. The volatility has sparked a debate over Solana’s long-term future. Read more here.

-

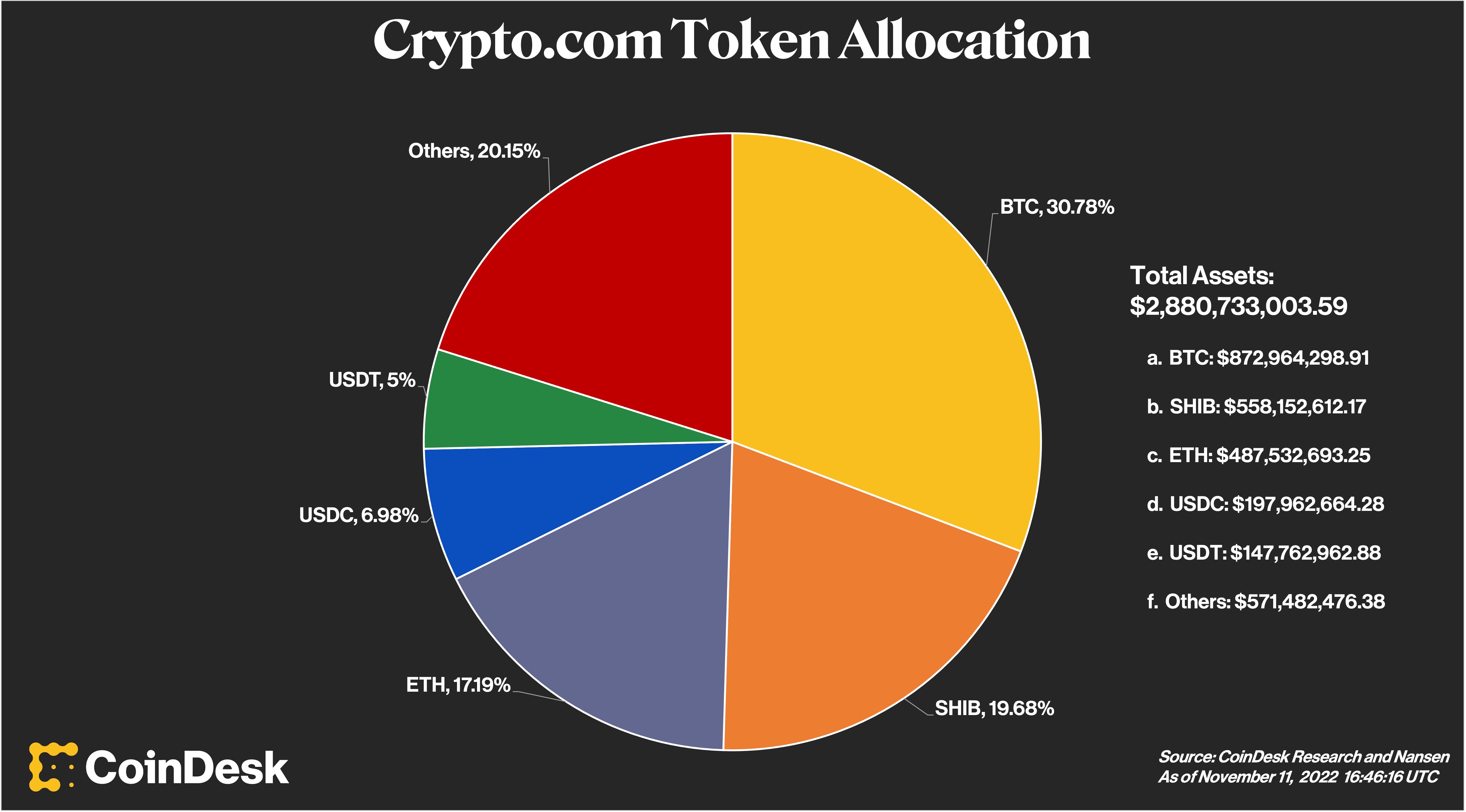

Crypto.com Preliminary Audit Shows That 20% of Its Assets Are in Shiba Inu Coin: As large crypto exchanges push to prepare “proof-of-reserves” audits, an initial effort reveals just how much of Crypto.com’s reserves are in the dog-inspired meme ERC-20 token, SHIB. Of the $2.88 billion in total assets in the wallets, roughly $558 million, or about 20%, are in SHIB, according to the graphic. Read more here.

(CoinDesk and Nansen)

Trending posts

-

Listen 🎧:Today’s “CoinDesk Markets Daily” podcast discusses the latest market movements and an inside look at the fast and loose kids who ran the FTX empire.

-

Bitcoin Slides Anew After FTX Bankruptcy Filing:The CoinDesk Market Index (CMI) dropped 3.3% during early U.S. trading hours on Friday.

-

From Enron to FTX: Wall Street Turnaround Titan John Jay Ray III Takes Reins from FTX CEO Sam Bankman-Fried:Sam Bankman-Fried handed over control of his company to the veteran Wall Street bankruptcy lawyer who will guide the company’s Chapter 11 process.

-

Justin Sun Moved $6M Stablecoins From TrueFi Lending Pools Before FTX-Alameda Bankruptcy: Bankrupt trading firm Alameda Research has $7.2 million in outstanding debt from a TrueFi credit facility.

-

FTX Withdraws US CFTC Derivatives Clearing Plan, Bloomberg Reports:The company previously submitted a plan that it hoped would allow customers to assess and respond to derivatives risks in real time.

-

SEC Commissioner Hester Peirce: FTX’s Collapse Could Finally Be ‘Catalyst’ for Regulation:“Having the SEC and CFTC work together makes a lot of sense,” Peirce told CoinDesk TV.

-

Meet the Metaverse Night Club–Loving Audit Firm That Presided Over FTX’s Financials:FTX auditor Prager Metis reported the company earned $1 billion in revenues in 2021. An investigation by CoinDesk reveals Prager Metis also operates in Decentraland, where it sponsors the “Decentraland Babydolls.”

-

Crypto Investment Firm DCG Gives $140M Equity Infusion to Trading Firm Genesis:CoinDesk sister company Genesis reported earlier that its derivatives business has about $175 million in locked funds in its FTX trading account.