Bitcoin (BTC) suffered its largest price drop in a year as signs emerged that the steep correction in crypto markets is hurting big industry players and putting extreme stress on digital-asset projects.

As of press time, bitcoin was changing hands around $23,200, down 16% over the past 24 hours. Ether (ETH), the native token of the Ethereum blockchain, slumped 18% to $1,222.

The latest leg down came as the big crypto lender Celsius, which as recently as April claimed to hold at least 150,000 bitcoin, worth about $3.5 billion at current prices, halted withdrawals. (Nexo, another crypto firm, expressed interest in buying some of the platform’s assets.)

It was a day of fast-moving developments and announcements that all seemed to confirm how bleak crypto markets are suddenly looking.

The overall market capitalization of cryptocurrencies fell below $1 trillion for the first time since early 2021, with big losses in tokens including SOL and DOGE. Crypto-related stocks, led by MicroStrategy (MSTR), plunged.

Binance temporarily paused bitcoin withdrawals (reportedly due to technical issues). Crypto.com and the crypto lender BlockFi announced job cuts. Tron’s USDD stablecoin wobbled off its $1 peg.

“Sentiment for cryptos is terrible,” Edward Moya, senior market analyst at the foreign-exchange broker Oanda, wrote Monday in an emailed briefing. “Bitcoin is attempting to form a base, but if price action falls below the $20,000 level it could get even uglier.”

The pain in crypto mounted as traditional markets also came under severe pressure. The Standard & Poor’s 500 Index tumbled 4% to a new low for the year. The biggest driver appeared to be renewed investor fears the U.S. Federal Reserve will have little choice but to tighten monetary policy aggressively to tamp down inflation, which is running at its hottest in four decades.

The next two-day Fed monetary policy meeting starts Tuesday, culminating Wednesday with a statement and press conference hosted by Chair Jerome Powell.

Latest prices

●Bitcoin (BTC): $23503, −14.39%

●Ether (ETH): $1264, −14.84%

●S&P 500 daily close: $3750, −3.88%

●Gold: $1821 per troy ounce, −2.70%

●Ten-year Treasury yield daily close: 3.37%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

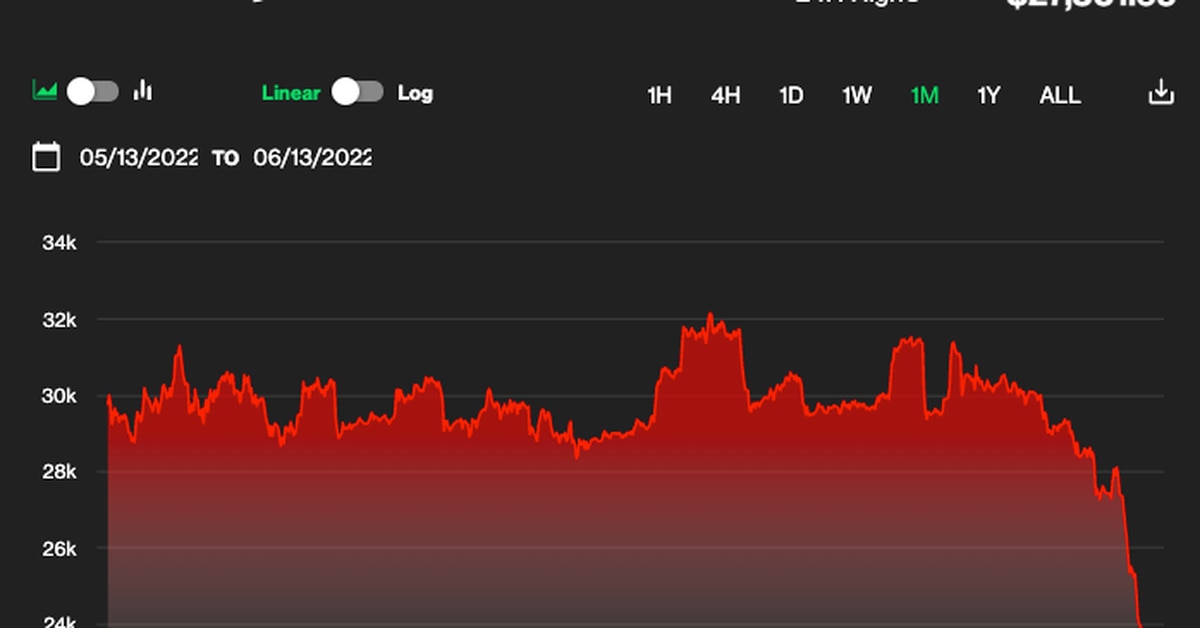

The violent sell-off contrasted with the price action for most of May, where bitcoin mostly stabilized around the $30,000 level.

But bitcoin is now in the throes of a seven-day losing streak.

Crypto fund investors not buying the dip

By Jimmy He

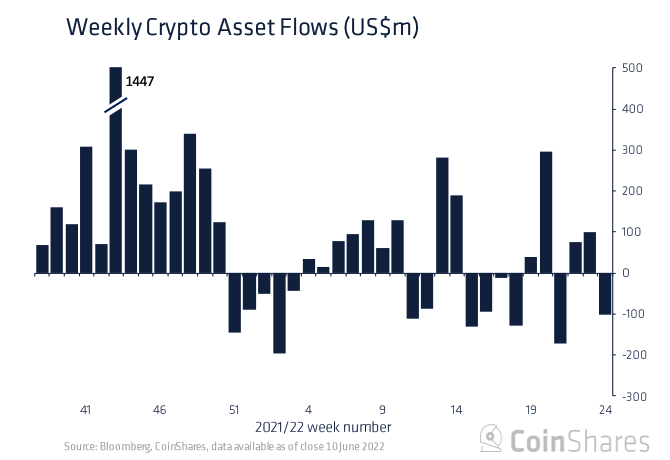

Chart of investors’ net flows into crypto funds shows a burst of redemptions last week. (CoinShares)

Investors pulled $102 million out of digital asset funds during the week through June 10, according to a CoinShares report. Some $57 million of the outflows were attributed to bitcoin-focused funds.

Ether-focused funds saw $41 million in outflows, bringing month-to-date outflows to $72 million and year-to-date outflows to $386.5 million. Blockchain-related equities saw outflows of $5 million.

Regionally, the majority of outflows were attributed to the Americas, which totaled $98 million. In comparison, funds listed in Europe only experienced $2 million in outflows.

Relevant insight

-

Tron’s Stablecoin Peg to Dollar Wobbles; Justin Sun Swears to Deploy $2B to Prop Up. Decentralized USD (USDD) fell to as low as 91 cents on crypto exchanges early Monday and was changing hands around 99 cents at press time.

-

SOL, DOGE Lead Plunge in Major Cryptos as Traders Warn of ‘Severe Losses’ Ahead. Higher inflation will continue forcing higher interest rates, a potential negative for economic growth, one analyst said.

-

Bank of England Chief Takes Victory Lap as Crypto Crumbles. Andrew Bailey, the head of the U.K. central bank, was testifying in Parliament on Monday afternoon.

-

Silvergate Capital Could Benefit From Institutional Crypto Adoption, Wells Fargo Says. The Wall Street bank initiated coverage of the stock with an “overweight” rating and a $120 price target.

-

Michael Saylor’s MicroStrategy Leads Plunge in Crypto-Related Stocks. Bitcoin has tumbled below $24,000 for the first time in 18 months, and ether dropped to a 15-month low.

-

Goldman Sachs Executes Its First Trade of Ether-Linked Derivative: Report. London-based Marex Financial was the counterparty for the trade.

-

Crypto Market Cap Falls Below $1T for First Time Since Early 2021. Bitcoin lost some 13% of its value in the past 24 hours.

-

Binance.US Accused of Misleading Investors in Class Action Lawsuit Over Terra. A class action lawsuit against Binance.US has been filed on behalf of investors in connection to the collapse of terraUSD (UST).

-

Nexo Proposes Celsius Buyout as Rival Halts Withdrawals. Celsius said it also paused its swap and transfer products and did not provide a timeline for resuming withdrawals.

-

Bitcoin Plunges Below $25K, Lowest Level Since December 2020. A weak macroeconomic environment and systemic risk from within the crypto space have caused nearly 12 successive weeks of losses for the asset.

-

Crypto Lending Service Celsius Pauses Withdrawals, Citing ‘Extreme Market Conditions.’ The company will also pause its swap and transfer products, according to a blog post. It did not provide a timeline for resuming withdrawals.

-

How Much ETH Does Joe Lubin Hold? As Ethereum gears up for the switch to proof-of-stake, how the network’s tokens have been distributed comes back into focus.

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Biggest Gainers

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Ethereum | ETH | −14.8% | Smart Contract Platform |

| Bitcoin | BTC | −14.4% | Currency |

| Dogecoin | DOGE | −14.3% | Currency |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

Read more about

Save a Seat Now

BTC$23,248.02

BTC$23,248.02

15.03%

ETH$1,246.07

ETH$1,246.07

15.70%

BNB$227.52

BNB$227.52

13.19%

XRP$0.321294

XRP$0.321294

9.67%

BUSD$1.00

BUSD$1.00

0.04%

View All Prices

Sign up for Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor.