Bitcoin (BTC) struggled to make a decisive move above or below $30,000 on Tuesday. The cryptocurrency appears to be stabilizing, although sentiment among traders remains bearish.

Some alternative cryptos (altcoins) underperformed bitcoin on Tuesday, which indicates a lower appetite for risk among short-term traders. For example, Decentraland’s MANA token was down by 3% over the past 24 hours, compared with BTC’s flat performance over the same period. Still, some alts gained on Tuesday such as Litecoin’s LTC, which was up by 4%.

Just launched! Please sign up for our daily Market Wrap newsletter explaining what happens in crypto markets – and why.

Stocks were also mixed on Tuesday while the Chicago Board Options Exchange’s CBOE Volatility Index (VIX), a popular measure of the stock market’s expectation of volatility based on S&P 500 index options, has declined for four consecutive trading sessions.

Further, from a technical perspective, global equity markets appear to be oversold with initial signs of downside exhaustion, which could keep short-term buyers active over the next week. A similar set-up appeared on bitcoin’s daily chart, so long as the $30,000 price level is maintained.

Latest prices

●Bitcoin (BTC): $30,077, +1.81%

●Ether (ETH): $2,045, +1.99%

●S&P 500 daily close: $4,089, +2.02%

●Gold: $1,814 per troy ounce, +0.04%

●Ten-year Treasury yield daily close: 2.97%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Realized losses add up

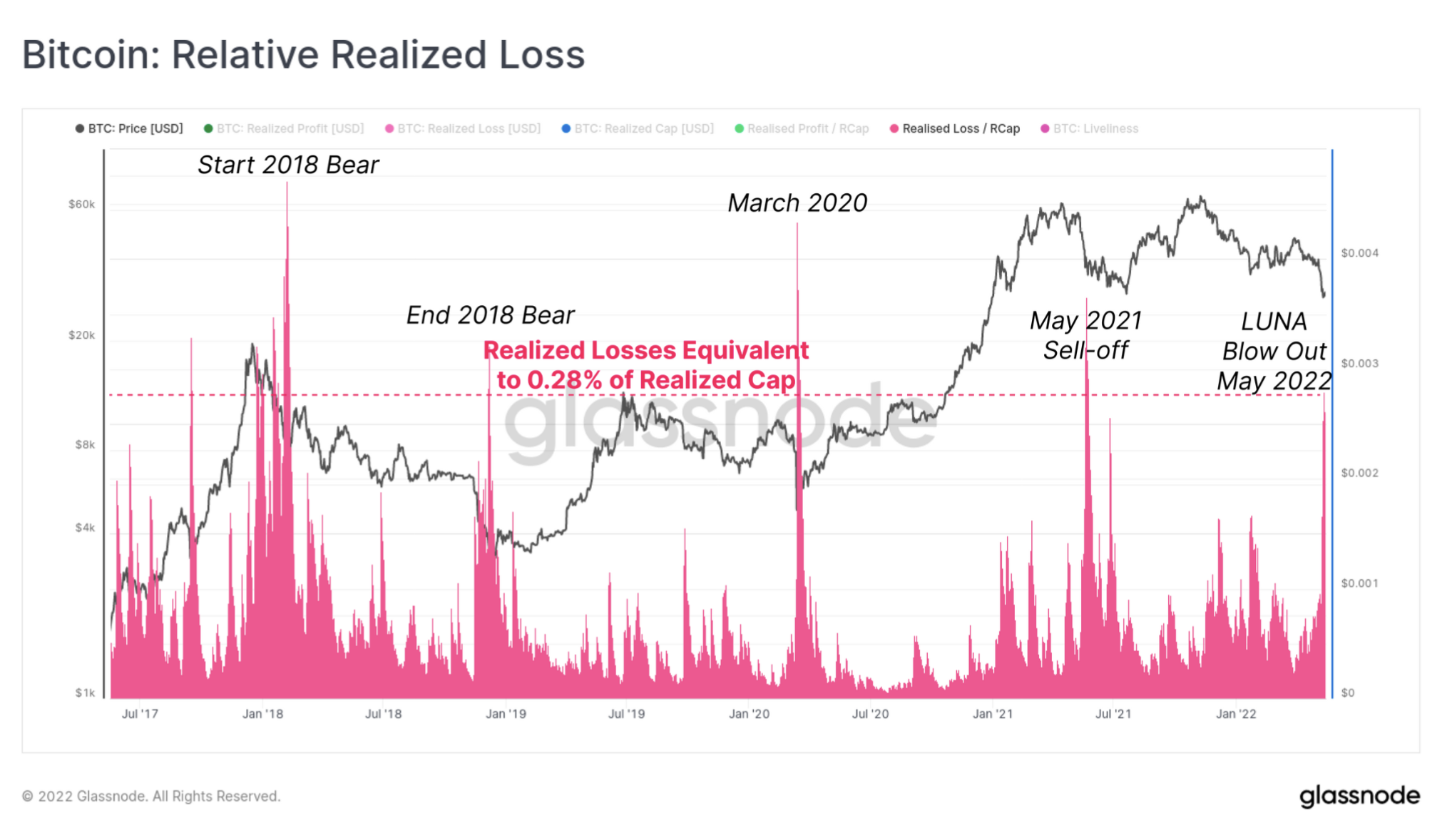

Last week’s sell-off triggered a spike in realized losses among bitcoin holders.

The chart below shows the realized loss metric relative to the realized market cap, which reached its highest level since the crypto sell-off in May of last year. Typically, a spike in losses occurs during the beginning or late stage of a bear market, similar to 2018 and 2019.

A loss occurs when BTC’s market price falls below the average bitcoin holders’ cost basis, which is recorded on the blockchain. The realized price (aggregate cost basis) is calculated by dividing the sum of all coin values at the time when they were last moved, by the circulating supply, according to Glassnode.

Currently, the realized price is around $23,000 and $24,000, which could be an important support level for BTC. In previous bear market cycles, however, BTC can trade below the realized price for about 100 days before buyers start to accumulate long positions.

Bitcoin relative realized loss (Glassnode)

Blockchain data also shows strong buying activity around the $30,000 price level in BTC.

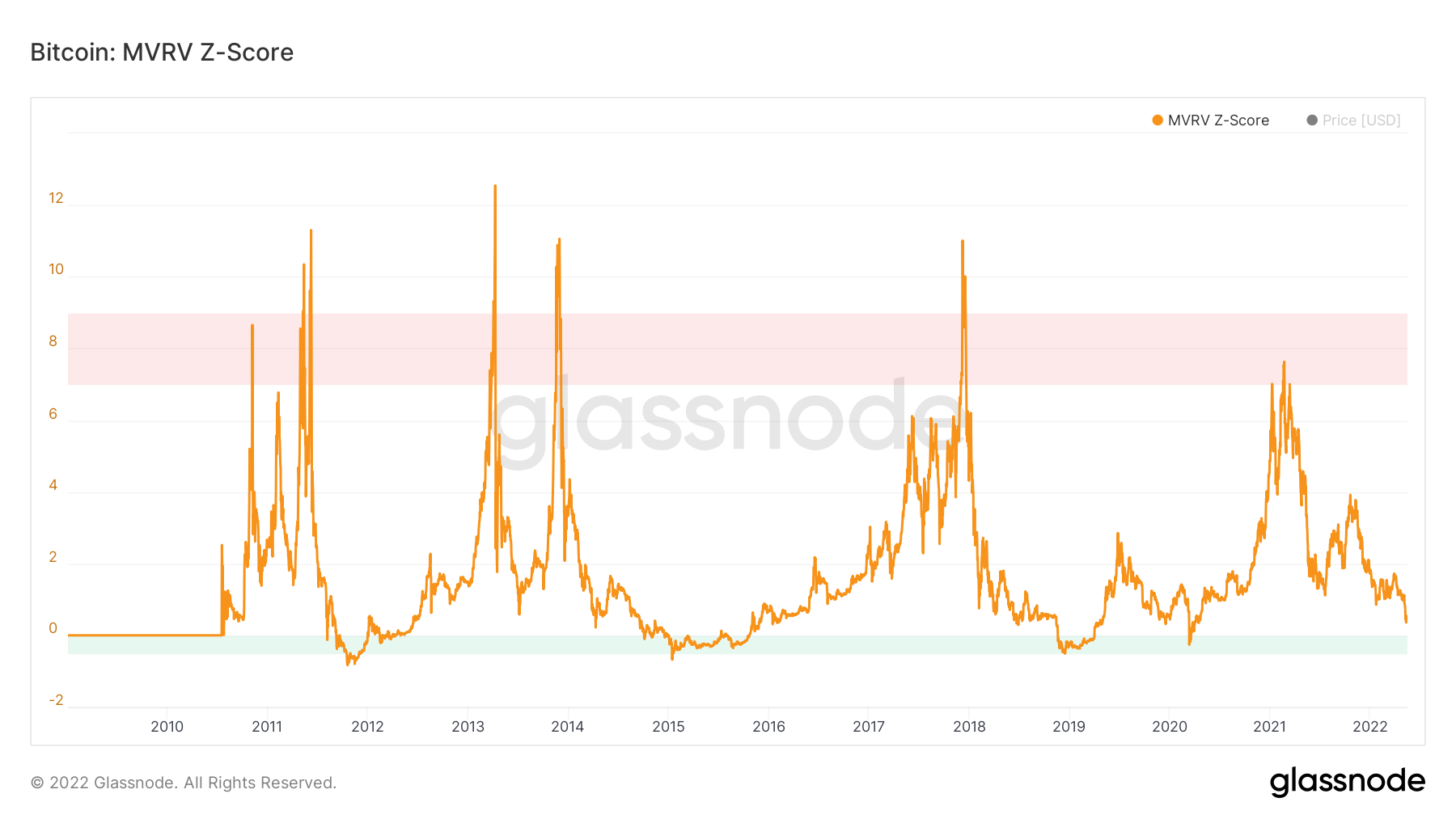

Still, longer-term metrics suggest new buying could be short-lived until the bearish cycle reaches a trough. For example, the chart below shows a z-score of BTC’s market value relative to its realized value, or the value paid for all BTC in existence (MVRV). It’s essentially a measure of bitcoin’s “fair value,” and is not at an extreme low, which typically coincides with the end of a bear market.

Bitcoin MVRV z-score (Glassnode)

Altcoin roundup

-

ApeCoin looks for a home: The Bored Ape Yacht Club-linked ApeCoin decentralized autonomous organization (DAO) is in talks with blockchain suitors about migrating its token ApeCoin (APE) from Ethereum. Yuga Labs’ disastrous non-fungible token (NFT) minting for its “Otherside” metaverse land sale cost investors more than $100 million in transaction fees on the Ethereum blockchain. Board members of the ApeCoin DAO are listening to offers, and Avalanche and Flow are in the front row. Read more here.

-

A16z’s State of Crypto: Famed venture capital firm Andreessen Horowitz (a16z) released its inaugural “State of Crypto” report. A16z has become one of the most active and prominent investors in the crypto space, raising $2.2 billion for its third and latest fund last summer. The report addresses the current downturn on the crypto markets, benefits of Web 3 and Ethereum’s continued blockchain dominance. Read more here.

-

Robinhood’s upcoming crypto wallet for pros: Broker platform Robinhood’s (HOOD) plans a Web 3 crypto wallet for decentralized finance (DeFi) traders and non-fungible token (NFT) buyers. The firm’s Johann Thompson said the new custodial wallet will cater to “advanced” crypto users and live separately from the existing wallet. The company plans to roll it out by the end of 2022. Read more here.

Relevant insight

-

El Salvador’s Nayib Bukele Promotes Bitcoin Adoption by Emerging Countries: The president is hosting financial representatives from 44 developing economies as part of annual meetings of the Alliance for Financial Inclusion.

-

Dutch Finance Official Wants to Ban Retail Investors From Trading Crypto Derivatives: The Dutch Authority for Financial Markets (AFM) doesn’t yet have the authority to issue a U.K.-style ban, however.

-

Bitcoin Mining Appears to Have Survived Ban in China: From September 2021 to January this year, China’s contribution to the bitcoin mining network was second only to that of the U.S.

-

EY Unveils Supply Chain Manager on Polygon Network: The EY OpsChain Supply Chain Manager, which is now available in beta, is the first joint project between EY and Ethereum scaler Polygon.

-

Jump-Backed Wormhole Bridge Expands to Algorand Blockchain: The cross-chain bridge is hoping to capture some of Algorand’s $136 million in DeFi total value locked (TVL).

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Litecoin | LTC | +6.9% | Currency |

| Bitcoin Cash | BCH | +4.8% | Currency |

| Polygon | MATIC | +3.9% | Smart Contract Platform |

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

Save a Seat Now

BTC$30,160.15

BTC$30,160.15

1.89%

ETH$2,050.67

ETH$2,050.67

1.85%

XRP$0.431058

XRP$0.431058

1.93%

SOL$55.78

SOL$55.78

3.29%

CRO$0.197920

CRO$0.197920

2.81%

View All Prices

Sign up for First Mover, our daily newsletter putting the latest moves in crypto markets in context.