Price Action

Bitcoin and ether sold off sharply before reversing course following the release of unexpectedly high inflation numbers from Thursday’s Consumer Price Index (CPI).

Bitcoin (BTC) sold off immediately after the report, declining 3% within minutes of the data release. Volume during the sell-off was eight times higher than average BTC volume for that time of day. BTC declined below $19,000 and approached lows of $18,100 on the day.

Ether (ETH) declined as well, falling 5% on excessive volume. The second-largest cryptocurrency by market capitalization after bitcoin is now trading at just below $1,300

In broader crypto markets, the CoinDesk Market Index (CMI), a broad-based market index that measures the performance of a basket of cryptocurrencies, increased by 0.26%.

Macro View

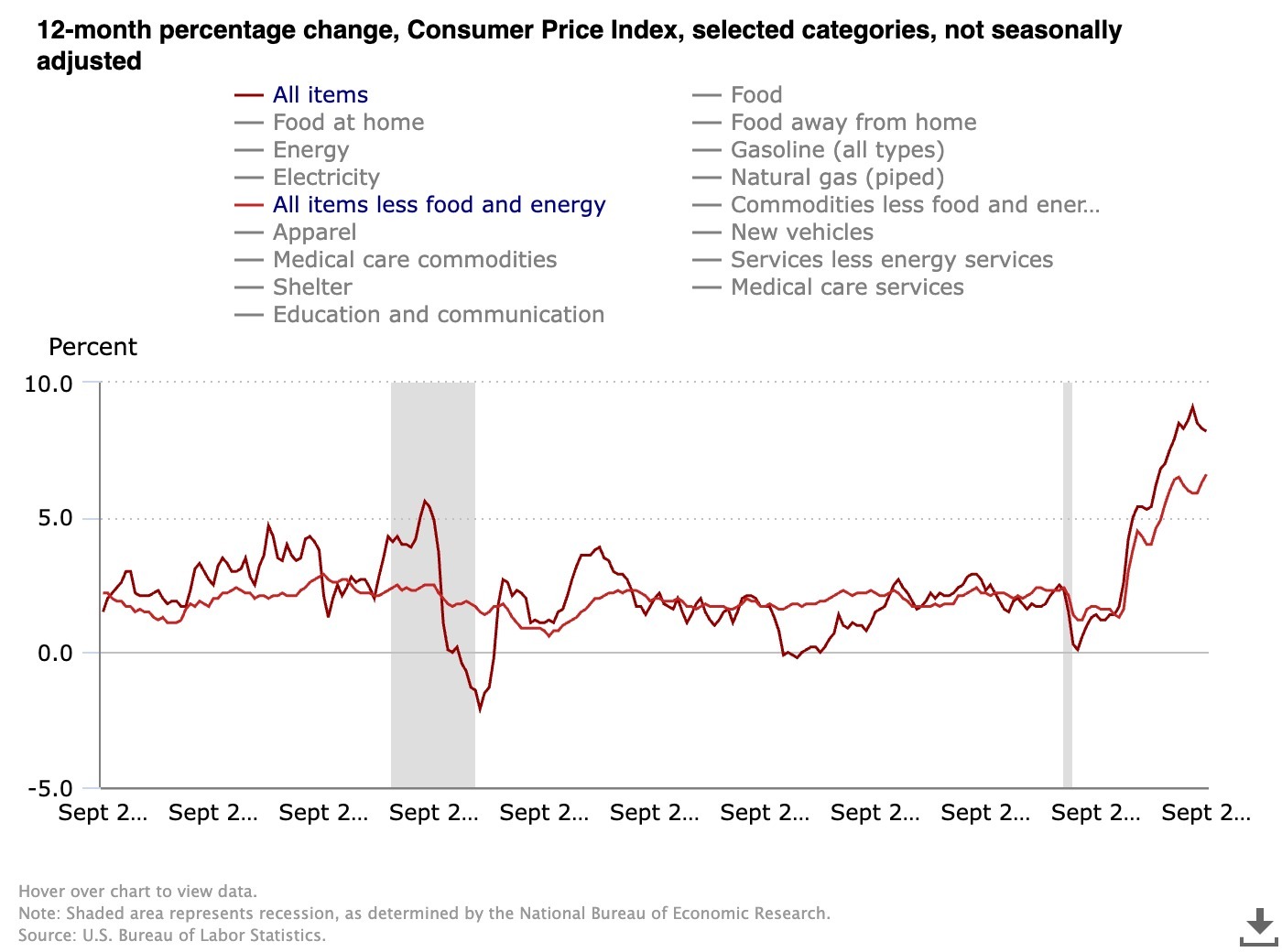

The Consumer Price Index (CPI) data that markets have been waiting for arrived on Thursday morning with what appeared to be bad news for anyone bullish on risk assets, cryptocurrencies included.

CPI and “Core” CPI (U.S. Bureau of Labor Statistics)

-

The CPI, which monitors U.S. inflationary pressures, increased 8.2% in September versus the consensus estimate of 8.1%. “Core” CPI, which strips out volatile energy and food prices, rose 6.6% compared with expectations of 6.5%. September’s inflation figures are the highest in 40 years,

-

Month-over-month inflation rose 0.4%, the highest reading in three months, and above the consensus of estimates for a 0.2% increase. The increase stemmed from increases in the price of shelter and food, which were offset in part by declining gas prices.

-

Aside from a summertime dip in energy prices, inflation has remained stubbornly high. Energy costs could potentially be pushed higher by OPEC’s recent decision to reduce oil production.

-

The month-over-month figures seem especially troubling, given the lack of short-term price improvement, despite the Federal Open Market Committee’s (FOMC) efforts to stem inflation.

The bottom line: Following the CPI release, the probability of a 75 basis point increase in the federal funds rate increased to 95% from 85% a day prior, according to the CME FedWatch tool. The probability of a 100 basis point jumbo increase now stands at 5%.

Economic Calendar

Another report that investors likely eyed is Thursday’s EIA report on U.S. gasoline and oil inventories. Inventories for both crude oil and gasoline were shown to have declined in the previous week. An increase in supplies would likely have pushed energy prices significantly higher.

Finally, initial jobless claims for the week ending Oct. 8 came in at 228,000, above expectations for 215,000 claims.

Latest Prices

● CoinDesk Market Index (CMI): 944.23 +0.4%

● Bitcoin (BTC): $19,373 +1.2%

● Ether (ETH): $1,294 −0.4%

● S&P 500 daily close: 3,669.91 +2.6%

● Gold: $1,673 per troy ounce +0.2%

● Ten-year Treasury yield daily close: 3.95% +0.05

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Technical Take

Bitcoin and Ether Dropped Sharply After Disappointing Inflation Figures

Bitcoin and ether both dropped sharply following the CPI release, but began to come back up in subsequent hours. After falling as sharply as 3% and 5% respectively in early trading, prices eventually rose 1% for BTC and declined 0.65% for ETH.

Traditional markets responded in similar fashion, with the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 declining as U.S. markets opened before reversing course. All three indexes finished the day in positive territory.

The extreme reversal over a two-hour span will likely confound most market participants expecting a steep, more permanent decline, and certainly not a return to the status quo of the last few weeks.

Investors may want to monitor the inflow of bitcoin onto exchanges within the coming days. Over the last week, wallets holding more than 1,000 BTC have been moving coins off exchanges, generally a bullish signal as those coins are often moved into cold storage.

A reversal of this trend would indicate that larger BTC investors were surprised by the inflation report and are now looking to reduce their positions. However, a continuation would signal ongoing bitcoin resiliency and sustained conviction by BTC holders.

If the latter is the case, today’s price reversal seems likely to have resulted from greater conviction among investors, who stepped in to acquire BTC at more favorable prices.

Put open interest at the $19,000 strike price sank approximately 39% as many investors exercised their puts while BTC fell close to $18,000. In spot markets, buying volume seemed to have increased as prices reached near the $18,400 level, with bullish investors stepping in to provide buying demand.

The Volume Profile Visible range tool shows BTC’s rapid descent through a low-volume node between $19,000 and $18,400 during the 12:00 UTC (8:00 a.m. ET) hour. The decline was matched in pace by the reversal higher through the same node during the 15:00 UTC (11:00 a.m. ET) hour.

BTC’s price now sits at just north of $19,150, coinciding with an area of significant agreement between buyers and sellers in recent weeks.

Despite markets’ hectic start, ultimately prices moved little on the day.

Bitcoin/U.S. dollar hourly chart (TradingView)

Altcoin Roundup

-

Ether Becomes Deflationary for First Time Since the Merge: Coinbase: The number of tokens fell by 4,000 over the last week as more ether was burned verifying transactions than was created, the report said. Read more here.

-

Huobi Token Surges 75% as Tron Founder Justin Sun Calls for Empowering the Exchange Token: The Huobi token rose to a four-month high of $7.60 early Thursday. Read more here.

Trending posts

-

Listen 🎧:Today’s “CoinDesk Markets Daily” podcast discusses the latest market movements and features the following story:”Inflation Is Bad (Again) and We’re Mad as Hell.”

-

Bitcoin Rebounds to Over $19K After Plunge Triggered by Hot Inflation Report: BTC was up 0.2% after the price tumbled to $18,198 – the lowest since Sept. 21.

-

October Becomes Worst Month for Crypto Hacks With Two Weeks to Go:Over $718 million has been stolen from DeFi protocols across 11 different hacks this month so far, per research firm Chainalysis.

-

TrueFi’s $4M Bad Debt in Limbo Shows Risk of Crypto Lending Without Collateral:Decentralized lending protocol TrueFi’s experience with loan default reveals its recourse for recovering bad debts: old-school solutions that can be time-sapping and costly, such as taking borrowers to court.

-

Stablecoin Issuer Tether Cuts Commercial Paper Holdings to Zero:The company has been gradually replacing its commercial paper holdings with U.S. Treasury bills.

-

Crypto Sleuth ZachXBT’s Efforts Lead to Prosecution of Alleged Bored Ape NFT Scammers:The phishing scam, where people were defrauded out of millions of dollars worth of non-fungible tokens (NFT), was brought to light in August.

-

Digital Asset Bank Custodia Files Petition in US Court Over BNY Mellon’s Crypto Approval:Custodia alleges the Kansas City Federal Reserve Board of Governors showed favoritism over approval delays, while giving BNY Mellon a green light to engage in crypto custody.

CoinDesk Market Index

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Ribbon Finance | RBN | +15.83% | DeFi |

| Ethereum Name Service | ENS | +13.11% | Digitization |

| Synthetix | SNX | +6.59% | DeFi |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Terra | LUNA | -7.17% | Smart Contract Platform |

| STEPN | GMT | -6.22% | Culture & Entertainment |

| Samoyedcoin | SAMO | -6.05% | Currency |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.