Bitcoin and altcoins have experienced significant moves this week. Frankly, they felt the impact of the regulatory pressure deep down. So what to expect next? Let’s look at our article.

Altcoins in a bloodbath as Bitcoin drops

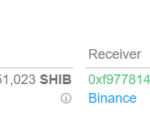

The data shows that BTC/USD has slumped above $1,200 from the previous day’s high. BTC currently sits at $25,483. While showing weakness, Bitcoin presented a different situation. While altcoins fell hard, the fall in BTC was relatively mild. Trading app Robinhood has announced that it will remove support for several cryptocurrencies named in the lawsuit filed by the US Securities and Exchange Commission (SEC) against Binance and Coinbase. As we stated as Kriptokoin.com, support for Cardano and Solana has been removed. As such, there were decreases of over 20% for these two altcoins.

“As expected, there was action taking place on the regulatory front this week,” said Kris Marszalek, CEO of Crypto.com. For this reason, we have seen some delistings that cause sales in the market. I think we’re in the ‘then they fight you’ phase of the crypto adoption curve. Make no mistake: the crypto industry will get through this. It will emerge stronger than ever before.” made the statement

BTC price failed 200-week trendline support

These events have had a huge impact on the overall value of Bitcoin and the cryptocurrency market. Michaël van de Poppe, founder and CEO of trading firm Eight, warned that worse could happen. As with Bitcoin/USD, if the total crypto value loses its 200-week moving average (MA), this will create a clear bearish signal. Bitcoin BTC’s moving average trendline currently stands around $26,400.

Along with a chart, he told his Twitter followers, “This is not the weekly candle you want to see in total market cap for Crypto. Losing the 200-Week MA is screaming for the downward continuation of the trend.”

Van de Poppe, like some other popular traders, nevertheless showed interest in buying altcoins at lower prices. Accompanying him, Crypto Tony predicted “amazing entries” on the table for 2023. But for existing traders, the damage is serious.

These #Altcoin drops get me way too excited in Crypto as they really do not come by that often 💯

Got some incredible entries lined up later this year. I will share a few later today with you all and they are super realistic .. WHO IS READY

— Crypto Tony (@CryptoTony__) June 10, 2023

Long liquidations totaled $320 million on June 10, according to data from CoinGlass. Also, the day isn’t over yet. In short positions, 70 million dollars evaporated.

On the other hand, Bitcoin and the crypto money market do not seem to get over the shock. Now it’s time for the Fed’s interest rate decision to be announced. The market will obviously take shape accordingly. Let’s see how the cryptocurrency market will deal with a second shock wave.