Today, a large amount of Bitcoin (BTC) was in motion in the cryptocurrency accounts of the miners. Here are the details…

Bitcoin miners take action

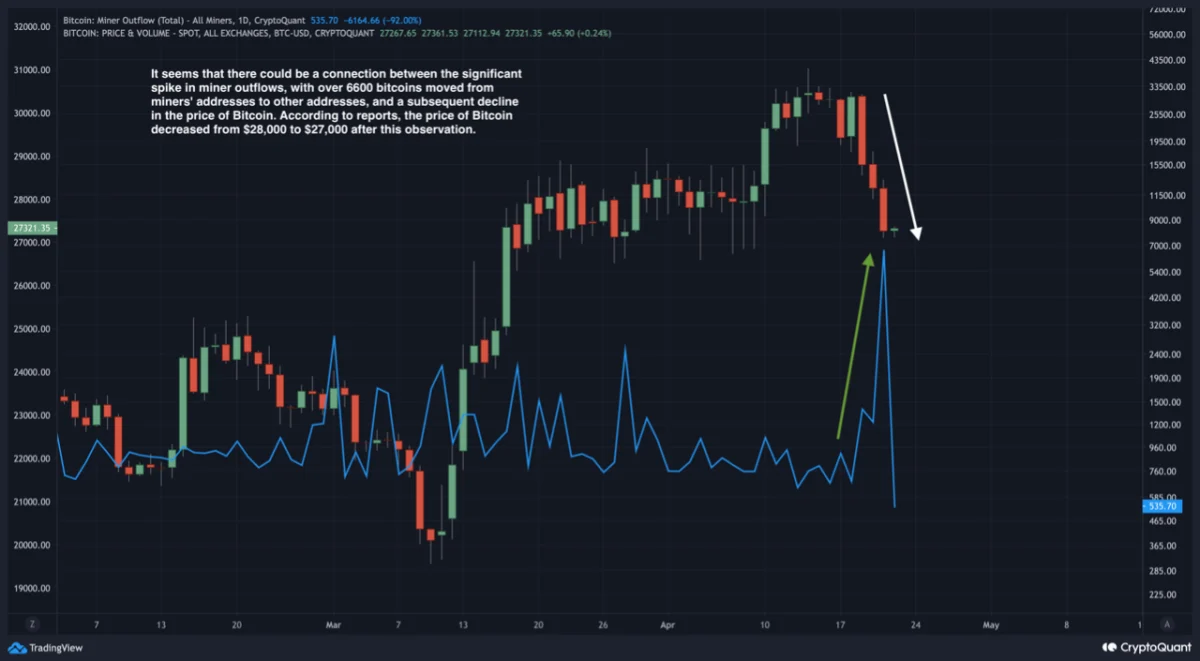

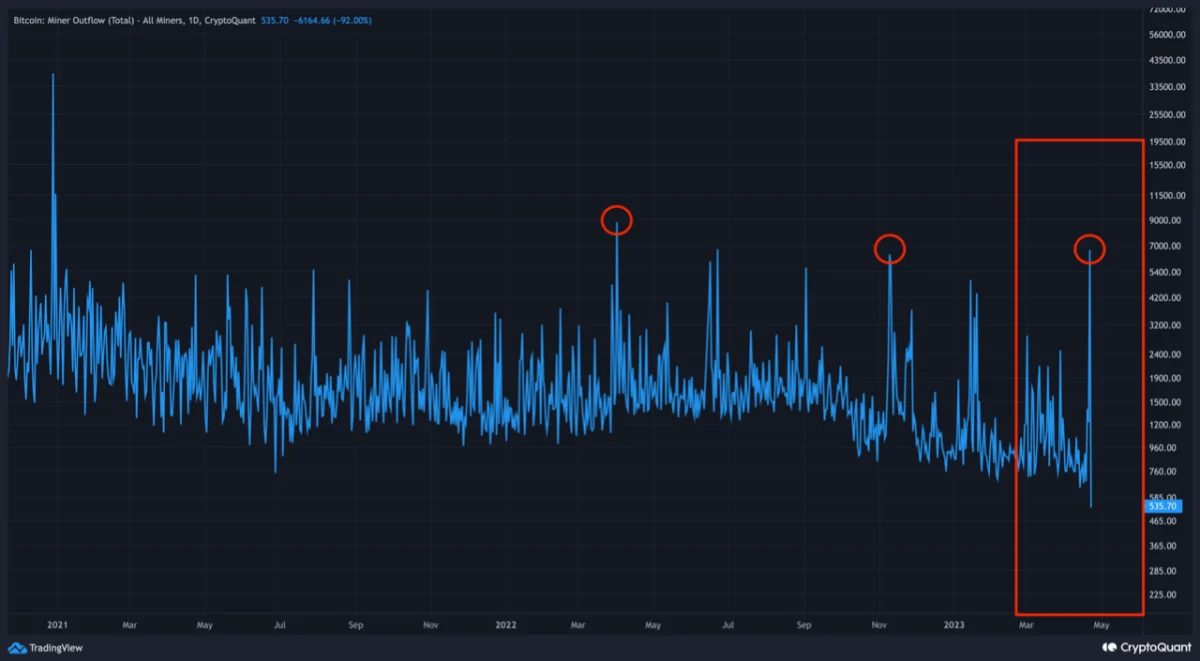

Today, more than 6600 BTC were transferred from miners’ addresses to other addresses, marking the third most notable event since March 2022, when an outflow of 8,000 BTC occurred. CryptoQuant, a cryptocurrency analysis firm, has reported this wallet issue that could point to changes in market dynamics or miner behavior.

While the reasons behind the exit are unclear, it is important to note that wallet exits do not mean that miners are selling their Bitcoins. Miners can use multiple wallets for various reasons and transfer their Bitcoins between these wallets. Some miners may hold their Bitcoins for different purposes, such as to cover operational expenses, invest or speculate with their earnings, diversify their holdings, use Bitcoins for personal transactions, or pay stakeholders.

However, the correlation between the massive miner exit and the subsequent drop in Bitcoin price is notable. Bitcoin price has reportedly dropped from $28,000 to $27,000 following this move, suggesting that investors are noting the outflows and may be reacting accordingly.

What does this mean for BTC?

The effects of this trend on the Bitcoin market are currently unclear. It is important to monitor such trends closely to better understand the dynamics of the market and the behavior of miners. As the cryptocurrency market is constantly evolving and fluctuating, any change can have a significant impact on the industry as a whole. The importance of this miner exit trend can provide insight into the behavior of miners and the overall health of the Bitcoin market. As the cryptocurrency market continues to mature and gain general acceptance, investors and analysts should understand the key factors driving market dynamics.

cryptocoin.com Cryptocurrency mining is a process where transactions are verified and added to the Blockchain ledger. Miners earn Bitcoin as a reward for their efforts. The amount of BTC produced per mined block decreases over time and the current reward is 6.25 Bitcoins per block. This halving of rewards happens every four years.

The mining process is energy-intensive and requires a significant amount of computational power. Therefore, it can be an expensive undertaking as miners have to cover their operational costs. The current price of Bitcoin is also a very important factor in determining the profitability of mining. Recent miner exits may indicate that miners want to cover their operational expenses or invest their earnings elsewhere. It may also indicate a shift in market dynamics as miners become more active in the market.