Widely followed crypto analyst and trader Lark Davis ranks the 8 best DeFi coins/tokens from his list. The analyst believes that Aave in particular has the potential to turn into a “real return”.

Lark Davis shared his pick of the 8 best DeFi coins

The popular crypto analyst shared his views on the top 8 DeFi protocols and tokens in his recent tweets. DeFi is a crypto industry that provides financial services without intermediaries. Davis ranks protocols according to their TVL, which measures how much crypto has accumulated in them. It also evaluates its tokens based on their use cases, management features, return opportunities and price potential. Before going into details, here are the 8 DeFi coin selections that Davis included in the list:

- Lido DAO (LDO)

- Maker (MKR)

- Curve DAO Token Price (CRV)

- AAVE (AAVE)

- Convex Finance (CVX)

- Uniswap (UNI)

- JUST (JST)

- PancakeSwap (CAKE)

🚨🔥 Top 8 DeFi Protocols & Token Utility 🔥🚨

The top 8 #crypto #defi DeFi protocols collectively manage $40B. But are the tokens any good?

Let's investigate with a no BS 🧵👇 to give you the down and dirty on the use-cases of these tokens.

Source: TVL per @DefiLlama pic.twitter.com/YSUsylikam

— Lark Davis (@TheCryptoLark) February 28, 2023

Here are Lark Davis’ DeFi choices and why

First up was the liquid staking protocol Lido (LDO), which allows users to stake their crypto on multiple POS networks and receive daily rewards. Davis concluded that Lido’s cryptocurrency LDO is for management purposes but has no incineration or yield farming mechanism.

Maker (MKR), the protocol behind DAI, a decentralized stablecoin, took second place. Davis noted that MKR is for management and has a burning feature that reduces its supply as loan fees are paid. As such, he believes the project could potentially increase value for token holders.

In third place is Curve (CRV), the DEX platform running on many Blockchains. Curve’s cryptocurrency CRV is for management and rewards LPs who deposit their crypto into their pool. CRV stakers also get real returns on protocol fees and LP reward increases. The analyst believes that CRV can be a great option for those looking to provide liquidity.

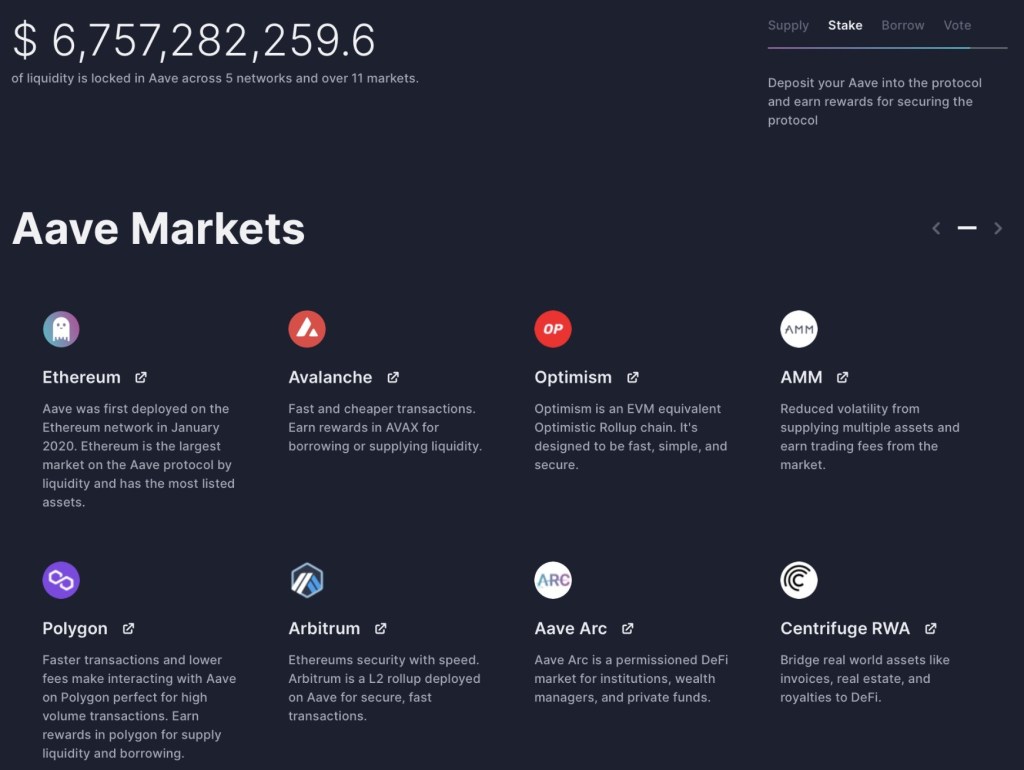

Aave (AAVE), a decentralized lending marketplace, took fourth place. Aave’s cryptocurrency, AAVE, is management focused and is a reserve for the stability of the protocol. According to Davis, AAVE stakers are already receiving AAVE rewards for securing the protocol, but will also be able to take advantage of the upcoming GHO stablecoin, which can pay stakes a fee. Lark believes that Aave could potentially turn into a “true returns altcoin.” cryptocoin.comWe have included details about GHO Stabecoin in this article.

last words

Other DeFi coin projects on the list are Convex Finance (CVX), Uniswap (UNI), JustLend (JST), and Pancake (CAKE). Lark Davis concludes his analysis thus:

Many leading DeFi protocols only offer token holders participation in governance. While addressing some of them, you would generally like to see additional factors such as burns, real returns, vote locking, or other mechanisms that encourage holding these tokens.