Bitcoin and certain altcoins continue to come under pressure as support levels sell out. Can altcoins including Bitcoin and MATIC initiate a short-term recovery? Crypto analyst Rakesh Upadhyay examines the charts of the top 10 cryptocurrencies to find out.

An overview of the cryptocurrency market

Stocks, bonds, and the cryptocurrency market witnessed sharp declines in 2022. Therefore, investors faced a very turbulent year. As of November 30, the performance of a traditional portfolio of 60% stocks and 40% bonds was at its worst since 1932, according to a report by the Financial Times.

cryptocoin.com The next big question plaguing crypto investors is whether the pain in Bitcoin (BTC) is over or whether the downtrend will continue in 2023. Analysts are divided in their views for the new year’s first quarter. Some expect a drop to $10,000, while others expect a rally to $22,000.

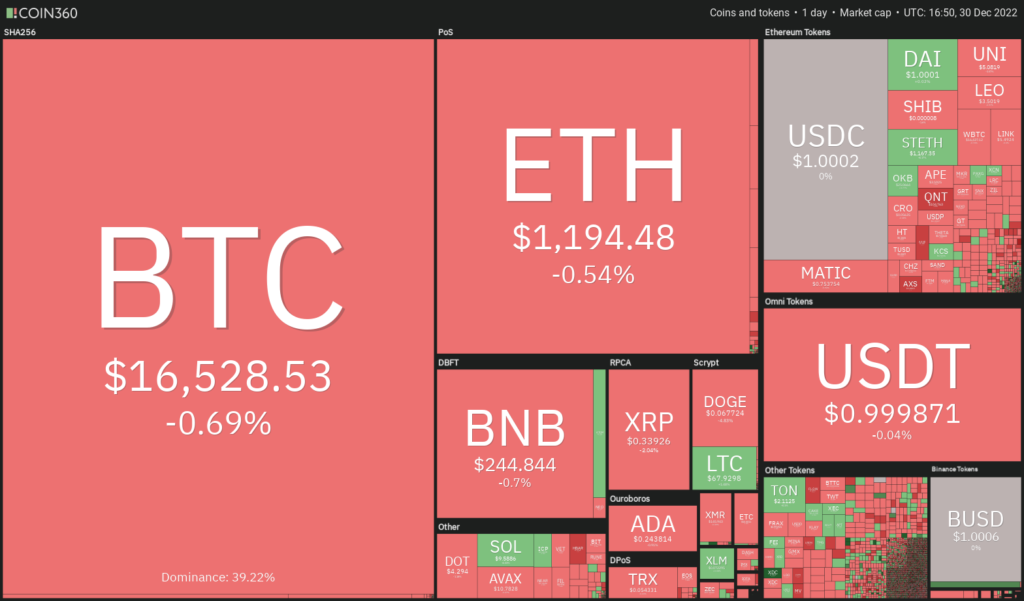

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360Research and trading firm Capriole Investments remains uncertain about the near-term. But he says in the latest edition of the Capriole Bulletin that Bitcoin’s gold could replicate the explosive bull run of the 1970s. If this happens, he predicts that Bitcoin will likely exceed $600,000 in the next few years. Now it’s time for analysis…

BTC, ETH, BNB, XRP and DOGE analysis

Bitcoin (BTC)

Bitcoin dropped below the close support of $16,559 on Dec. This indicated that the narrow gap was resolved in favor of the bears. The next support on the downside is $16,256.

The bears tried to push the price below $16,256 on Dec. However, the long tail on the candlestick indicates that the bulls are trying to hold the level. It is possible for buyers to face strong resistance in the moving averages. If the price declines from the 20-day exponential moving average ($16,820), the probability of a break below $16,256 increases. BTC is likely to dive into the $16,000 and $15,476 support zones later on. Conversely, if the price rises from the current level and rises above the moving averages, it will suggest a strong buy from the lower levels. It is possible that this will trigger a rally towards the $18,000-$18,388 region.

Ethereum (ETH)

ETH continues to trade between the support at $1,150 and the 20-day EMA ($1,218). This shows that sentiment remains negative and traders are selling on rallies.

The bears will try to push the price towards $1,150. This is an important support to watch out for in the near term. Because if it breaks, ETH could drop to $1,075, completing the downtrend. The bulls successfully defended this level on the previous two occasions. So it’s possible that they’re trying to do it again. If they do, ETH is likely to extend its range-bound action between $1,075 and $1,352 for a few more days. On the other hand, if the bears pull the price below $1,075, ETH is likely to drop to the psychologically critical level of $1,000 and later to the pattern target of $948.

Binance Coin (BNB)

BNB continues to trade in a tight range near the overhead resistance area of $250 and $255. This shows that both bulls and bears are fighting for supremacy.

Usually, such narrow ranges are followed by a sharp increase in volatility. However, the direction of the breakout is difficult to predict. Therefore, it is better to wait for the break to occur before jumping. If buyers push the price above $255, a few short-term bears are likely to fall into the trap. They will then rush to close their positions. It is also possible that this will throw BNB to the 50-day simple moving average ($272). Conversely, if the price declines and dips below $236, BNB is likely to drop to $220. It is possible that this level can act as a small support. However, if it gives way, BNB is likely to drop to $200.

Ripple (XRP)

XRP bounced off the support line of the symmetrical triangle on December 29. However, the bulls failed to initiate a rebound. The bears continued their dominance and pulled the price back to the support line on December 30th.

Both moving averages are tilting downwards and the relative strength index (RSI) is below 39. This indicates that the path of least resistance is to the downside. If the price drops below the support line, it will indicate that the bears have overpowered the bulls. It is possible for XRP to retest the June low of $0.29 later. Alternatively, if the price bounces back from the current level, the bulls will try to push XRP above the 20-day EMA ($0.36). If they do, it is possible for XRP to rise to the resistance line of the triangle.

Dogecoin (DOGE)

The bulls made a weak attempt to defend the crucial support at $0.07 on Dec. 29. The bears continued the selling pressure and pushed DOGE below key support on Dec.

A break and close below $0.07 will complete a descending triangle pattern with a major negative. It is possible for DOGE to continue its decline later and retest the critical support near $0.05. If this support collapses, DOGE is likely to start the next leg of the downtrend. If the bulls want to avoid the decline, they will have to push the price above the $0.07 breakout level quickly. It is possible that this could trap aggressive bears. Also, this is likely to cause a short squeeze. DOGE is likely to rise to the 50-day SMA ($0.09) first and then move up to $0.11.

ADA, MATIC, DOT, LTC and UNI analysis

Cardano (ADA)

ADA dropped below the support at $0.25 on Dec. 29, indicating a continuation of the bear trend. The decline has pulled the RSI into the oversold territory. It also indicates that a relief rally or consolidation is likely in the next few days.

Buyers have defended the support line of the falling wedge formation multiple times over the past few weeks. It is possible that they will try to do this again. If the price bounces off the support line strongly, the bulls will attempt to push the ADA above the 20-day EMA ($0.27). If they are successful, it is possible for ADA to rise to the bear trend line. Conversely, if the recovery at the support line is shallow, it will indicate a lack of demand by the bulls. The bears will then try to push the price below the support line and pull ADA to $0.20.

Polygon (MATIC)

MATIC is stuck in a wide range between $0.69 and $1.05. The bears pushed the price below the immediate support of $0.75 on Dec. 30, closing the doors to $0.69.

In a range, traders usually buy at the support level and sell near the resistance. Therefore, aggressive buying of the drop to $0.69 is possible. A strong rebound from this support will indicate that Polygon (MATIC) will continue its range-bound action for a while. Contrary to this assumption, a weak recovery from $0.69 might discourage MATIC bears and increase the likelihood of a collapse. If this happens, MATIC could start a fresh downward move to reach $0.52. If the bulls want to avoid the downtrend, they will have to quickly push the MATIC price above the moving averages.

Polkadot (DOT)

DOT remains in a tight bear grip. The bulls are trying to stop the decline near $4.22. However, it failed to achieve a meaningful leap. This increases the likelihood of a resumption of the downward move.

The next support on the downside is $4 followed by $3.60. This region served as a strong ground from September to November 2020. For this reason, the bulls will again try to defend the region with all their strength. On the upside, a rally above the 20-day EMA ($4.65) will be the first indication of strength. It is possible for the DOT to attempt a rally to the downtrend line later on. The bulls will have to break through this hurdle to signal a potential trend change.

Litecoin (LTC)

LTC fell below the moving averages on December 27. It also continued to decline on December 28. The price bounced off the lows on Dec. 29 and reached the 20-day EMA ($68).

The bears will try to turn the moving averages into resistance. If they do, it is possible for LTC to drop and slide below the close support at $65. This is likely to continue towards $61. This is an important level to watch in the near term. Because, if it fails to hold, it is possible that the selling will accelerate and LTC will drop to $56. Conversely, if buyers push the price above the moving averages, LTC is likely to break out of the overhead resistance at $75.

Uniswap (UNI)

UNI broke below the support line of the symmetrical triangle formation on December 28. This indicates that the uncertainty between the bulls and bears has been resolved in favor of the sellers.

The bulls tried to push the price back into the triangle on Dec. However, the bears held their ground. The downward sloping moving averages and RSI in the negative region suggest that the bears have the upper hand. If the price dips below $4.97, the next stop is likely $4.71 followed by $4.60. This negative view will be invalidated in the near term if UNI re-enters the triangle and rises above the moving averages.