Bitcoin started March on a positive note, but historically the month has recorded mediocre gains, which could be an early warning sign for crypto investors. What are the critical levels that could act as major barriers to recovery in altcoins like Bitcoin and MATIC? Crypto analyst Rakesh Upadhyay examines the top 10 cryptocurrencies to find out.

An overview of the cryptocurrency market

cryptocoin.com As you follow, Bitcoin was marginally positive in February, although the S&P 500 index (SPX) fell 2.61%. On the first day of March, Bitcoin started off on a positive note as the US stock markets struggled. This shows that Bitcoin is trying to leave the US stock markets. A positive sign is that individual traders seem to have made the most of the crypto bear market. Instead of panicking and selling their holdings, traders bought at lower levels. Glassnode data shows that wallets holding at least one Bitcoin are steadily increasing, approaching 1 million for the first time.

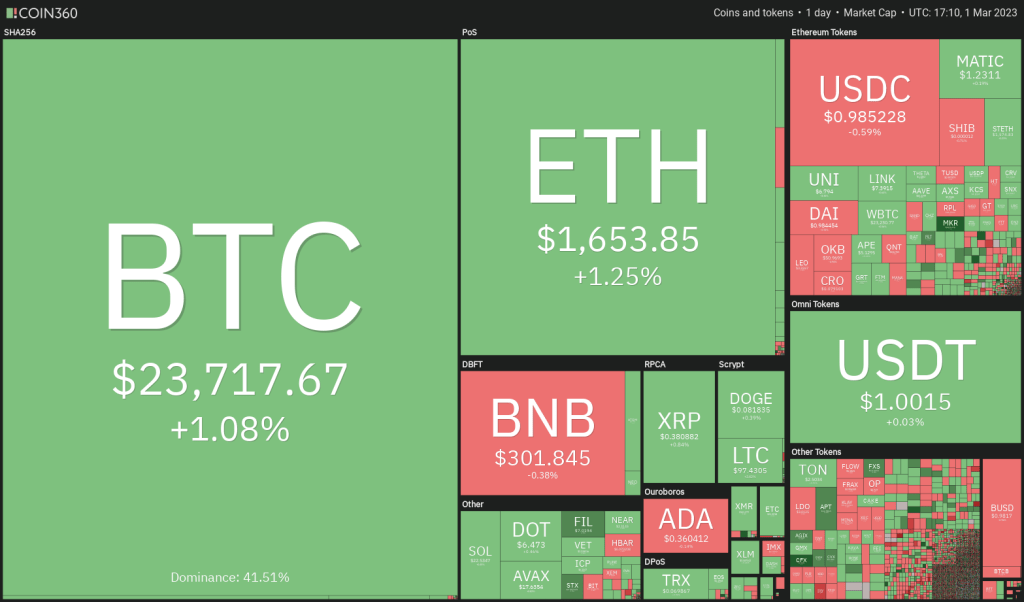

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360Historically, March has been a mediocre month for Bitcoin. Coinglass data shows that Bitcoin closed March with double-digit gains in 2013 and 2021, only twice in the past decade. Therefore, consolidation is likely to continue in March. Now it’s time for analysis…

BTC, ETH, BNB, XRP and ADA analysis

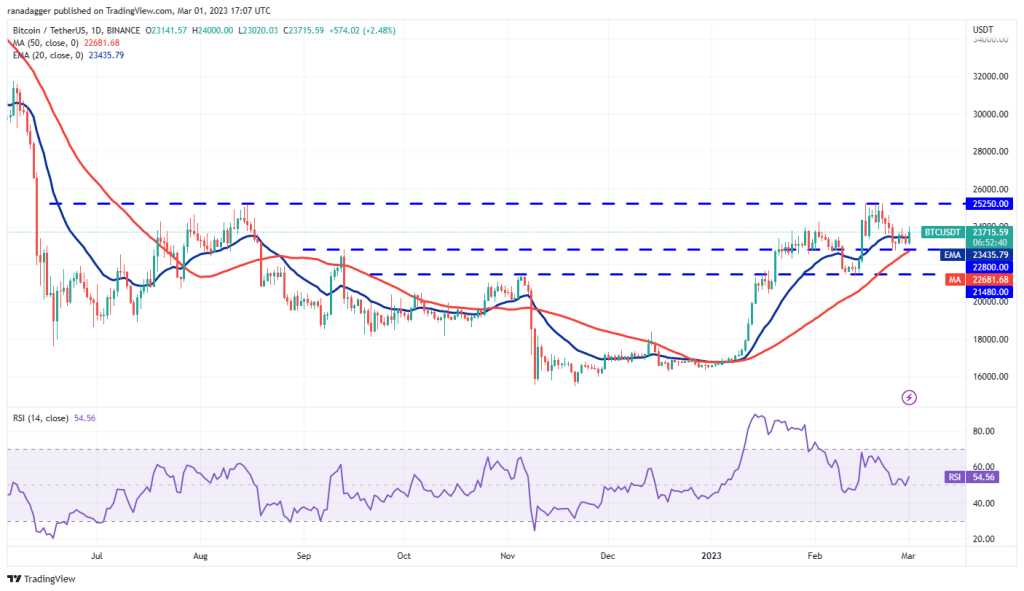

Bitcoin (BTC): Traders buy the dips

Bitcoin’s $22,800 level has been acting as solid support for the past few days, which is a positive sign. This shows that sentiment continues to rise and traders see the dips as a buying opportunity.

The bulls broke the first hurdle at the 20-day exponential moving average ($23,435) and will then try to push the price towards the critical resistance at $25,250. This is an important level for bears to defend. Because a break and close above this can attract large purchases. BTC could skyrocket to $31,000 later on as there is no major resistance in between. On the contrary, if the price drops from $25,250, this will suggest that BTC could stay range bound for a few days. A consolidation near local tops is a bullish sign as it shows buyers in no rush to exit. The bears will have to push and sustain the price below $22,800 to break the bullish sentiment. This could start a correction towards $20,000.

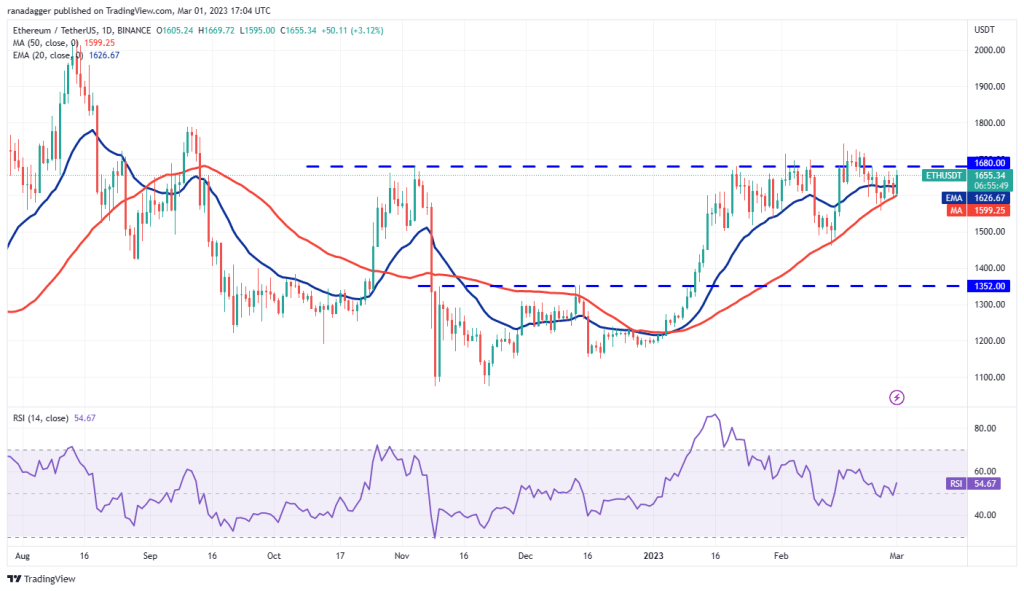

Ethereum (ETH): Bulls buy lows

Even after repeated attempts, the bears failed to get ETH below the 50-day SMA ($1,600). This indicates that the bulls are buying dips to the 50-day SMA.

Buyers will try to strengthen their position by launching the price above the overhead resistance zone between $1,680 and $1,743. If they do, ETH could start a rally towards $2,000. The bears could pose a strong challenge at $1,800, but this level is likely to be surpassed. The first sign of weakness will be a break and close below the 50-day SMA. If this happens, short-term bulls may turn to take profits. ETH could decline to support near $1,500 later.

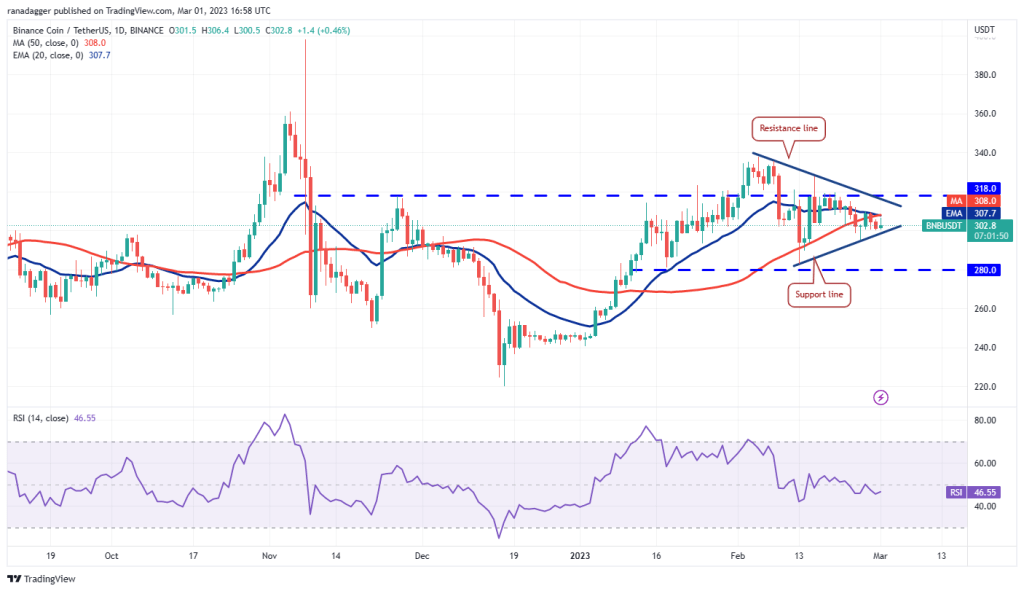

Binance Coin (BNB): Indecision between buyers and sellers

The price action of the last few days has formed a symmetrical triangle pattern on BNB. This indicates indecision between buyers and sellers.

The bulls bought the dip to the support line on March 1, but the long wick on the day’s candlestick indicates that the bears are fiercely protecting the moving averages. If the price breaks below the triangle, BNB could drop to $280. On the contrary, if the buyers push the price above the moving averages, BNB may reach the resistance line of the triangle. This remains the key level to watch out for in the near term. Because a break above this could start a rise towards $340 and then the $371 pattern target.

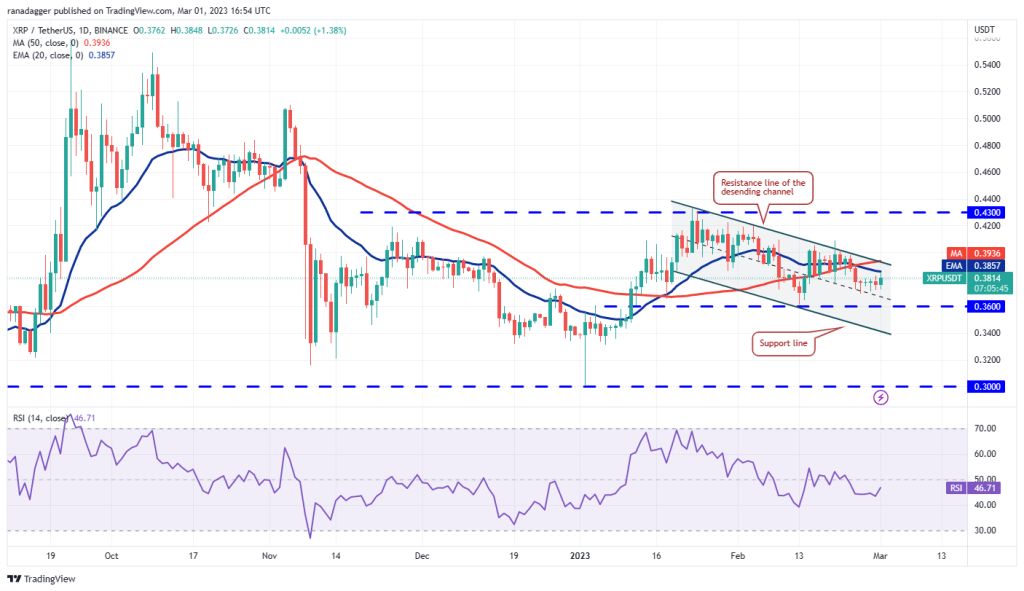

Ripple (XRP): Selling pressure has subsided

Even after repeated attempts, the bears failed to pull XRP to the strong support at $0.36. This shows that the selling pressure is decreasing.

The bulls will now try to push the price above the resistance line of the descending channel. If they are successful, XRP could rally to the overhead resistance of $0.43. Buyers will have to pierce this resistance to clear the path to $0.52 for a possible rally. The bears may have other plans. Again, they will try to stop the recovery at the resistance line of the channel. If the price turns down from this, the probability of a break below $0.36 increases. XRP could slide to $0.33 later.

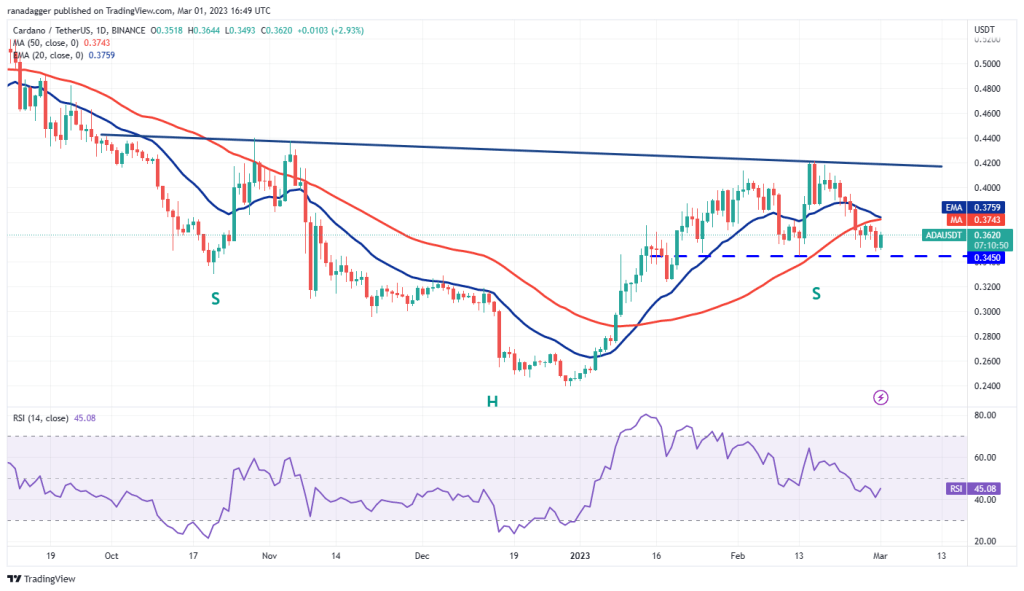

Cardano (ADA): Recovery may meet resistance!

ADA is attempting to bounce off the strong support near $0.34. The recovery may face resistance at the 20-day EMA ($0.37) as the bears will try to turn this level into resistance.

If the price breaks from the 20-day EMA, the bears will attempt to push ADA below the $0.34 support. If they do, ADA could start a deeper correction towards $0.32 and then $0.30. Instead, if the bulls push the price above the moving averages, it will suggest aggressive buying at the lower levels. The ADA may then attempt a recovery towards the neckline of the developing inverted head and shoulders (H&S) pattern.

DOGE, MATIC, SOL, DOT and LTC analysis

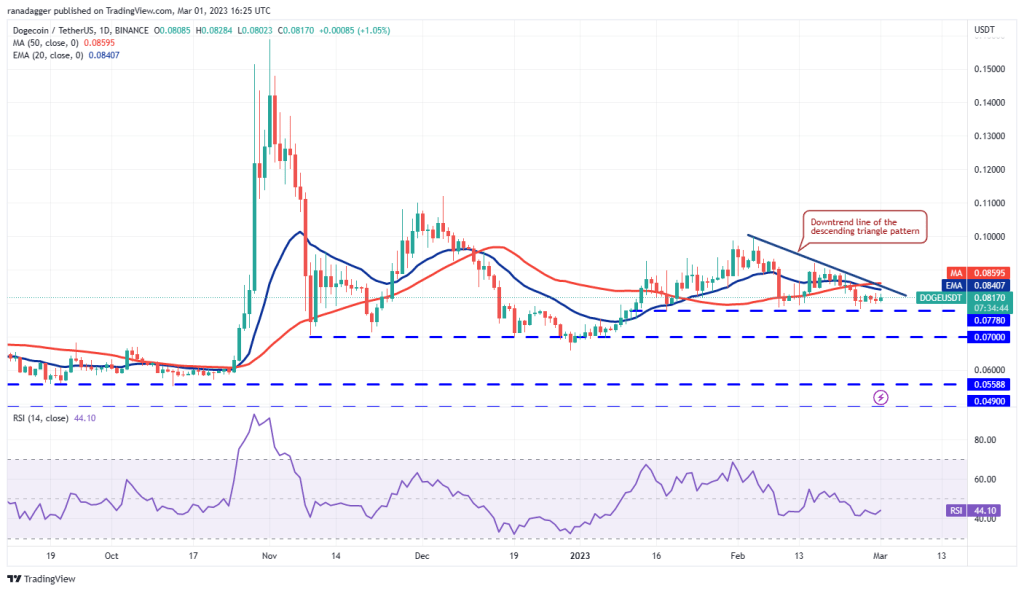

Dogecoin (DOGE): Demand is drying up at higher levels

The bulls have successfully defended the support near $0.08 over the past few days, but have been unable to find a strong rebound in DOGE. This indicates that demand is drying up at higher levels.

The price action of the last few days has formed a bearish trend triangle that will complete on a break and close below the support near $0.08. This downside setup has a target of $0.06. Conversely, if buyers push the price above the moving averages, it will invalidate the downtrend. This can result in short-term protection by aggressive bears. DOGE may then attempt to rally to $0.10.

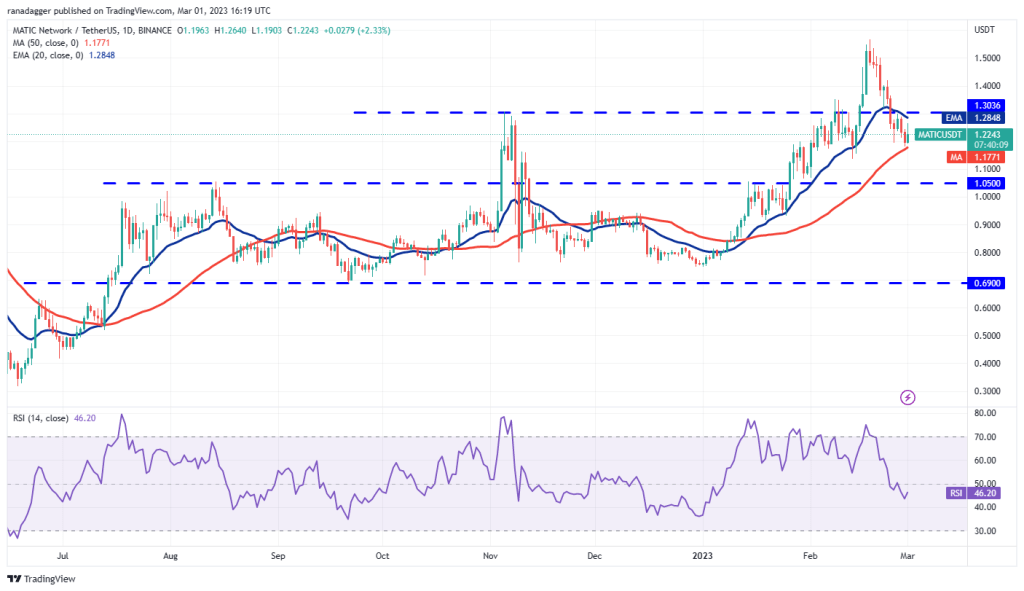

Polygon (MATIC): Sharp correction finds support at $1.17

Sharp correction in MATIC price finds support at the 50-day SMA ($1.17). The bulls are trying to start a recovery, but the long wick on the day’s candle indicates that the bears have sold the rally to the 20-day EMA ($1.28).

If the price continues to decline, the bears will make another attempt to push the MATIC below the 50-day SMA. If they manage to do so, the MATIC could drop to the vital support at $1.05. This level is likely to attract solid buying by the bulls. Conversely, a break above $1.30 might encourage the bulls. They will then try to push MATIC price towards the overhead resistance of $1.57. The MATIC rally could also face roadblocks at $1.42 and again at $1.50.

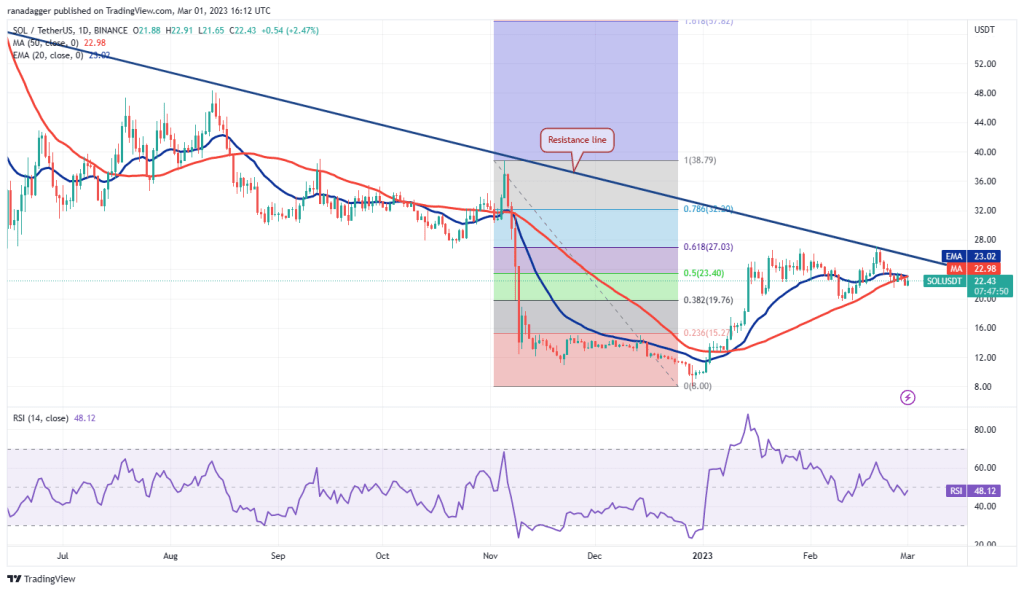

Solana (SOL): Bears try to turn $23.02 into resistance

The SOL bounced back from the 20-day EMA ($23.02) on Feb. 27, showing that the bears are trying to turn this level into a resistance.

However, the bulls did not give up and are trying to push the price back above the 20-day EMA. Repeated testing of a resistance over a short period of time tends to weaken it. If the buyers push the price above the 20-day EMA, it could reach the SOL resistance line. This remains the key level to watch out for in the near term. Because a break and close above this will signal a potential trend change. If the bears want to gain the upper hand, they will need to break the SOLU below the $19.68 support.

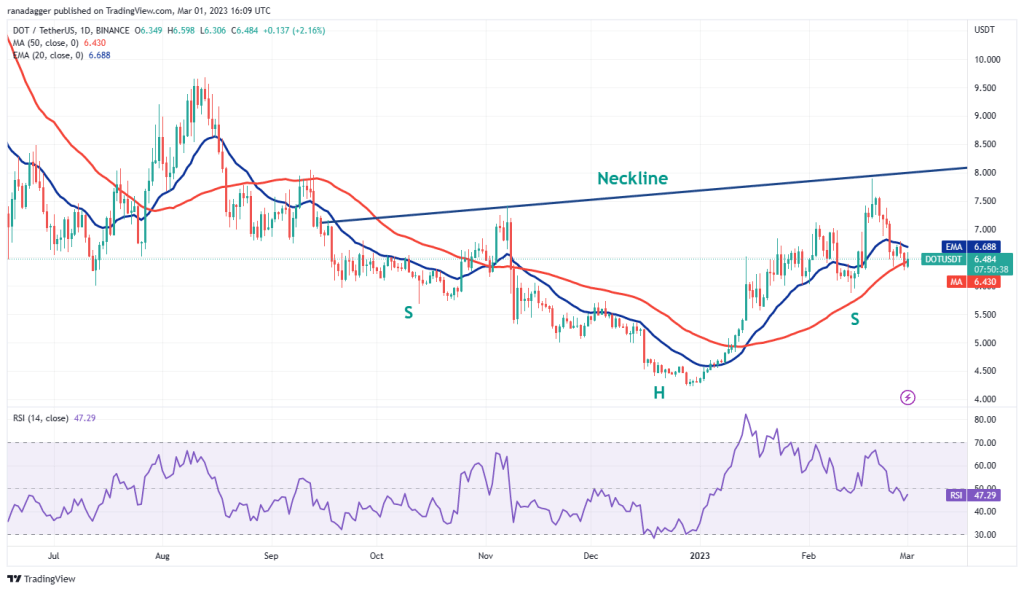

Polkadot (DOT): Buyers try to trap bears

The DOT fell below the 50-day SMA ($6.43) on Feb. 28, but the bears failed to develop this advantage. This suggests that the buyers are trying to trap the aggressive bears.

The 20-day EMA ($6.68) is an important level to watch in the near term. If buyers push the price above this level, it will indicate that the short-term correction phase may have ended. The bulls will then try to push the price towards the neckline of the developing inverted H&S pattern. Alternatively, if the DOT turns down from the 20-day EMA once again, this will indicate that the bears have turned the level into resistance. This will increase the probability of a drop to $5.50.

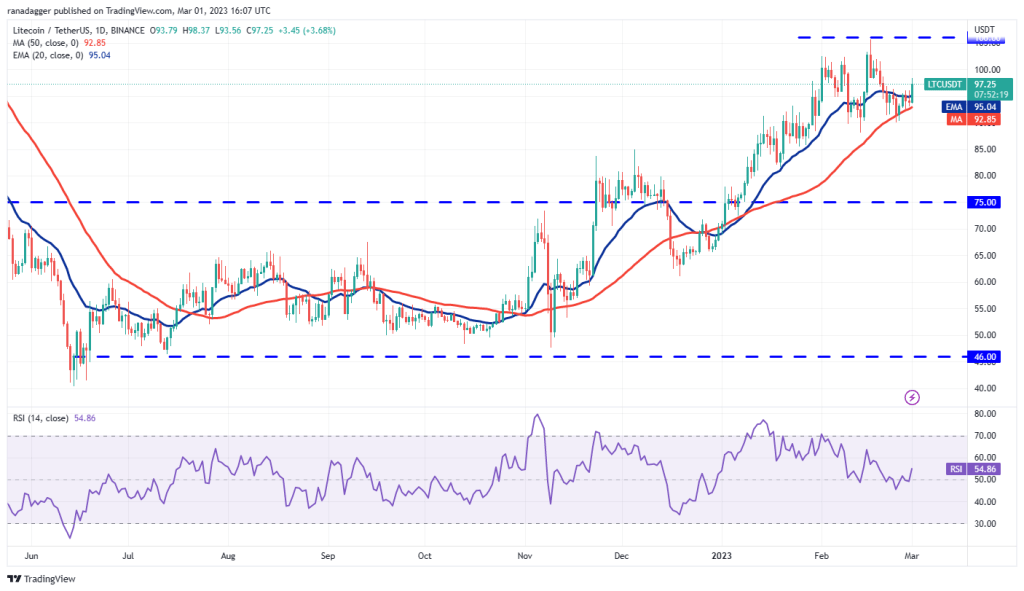

Litecoin (LTC): Lower levels attract buyers

LTC pullback found strong support at the 50-day SMA ($92). This indicates that lower levels continue to attract buyers.

The bulls pushed the price back above the 20-day EMA ($95) on March 1, opening the doors for a possible rally to the overhead resistance at $106. This level could act as a solid hurdle but if the bulls break it, LTC could rally to $115 and then $130. The key support to watch on the downside is the area between the 50-day SMA and $88. If this zone cracks, selling could gain momentum and the DOT could drop to $81 and then to $75.