The cryptocurrency market has had a strong start to 2023, with many major cryptocurrencies posting significant gains. Despite the latest concerns from regulators, the market has overcome this uncertainty and regained its upside momentum. However, the crypto sector is still trying to break the key resistance levels that could affect the future direction of the market. According to crypto expert Paul L, some cryptocurrencies are worth watching due to factors such as increased network activity that is likely to affect price movements.

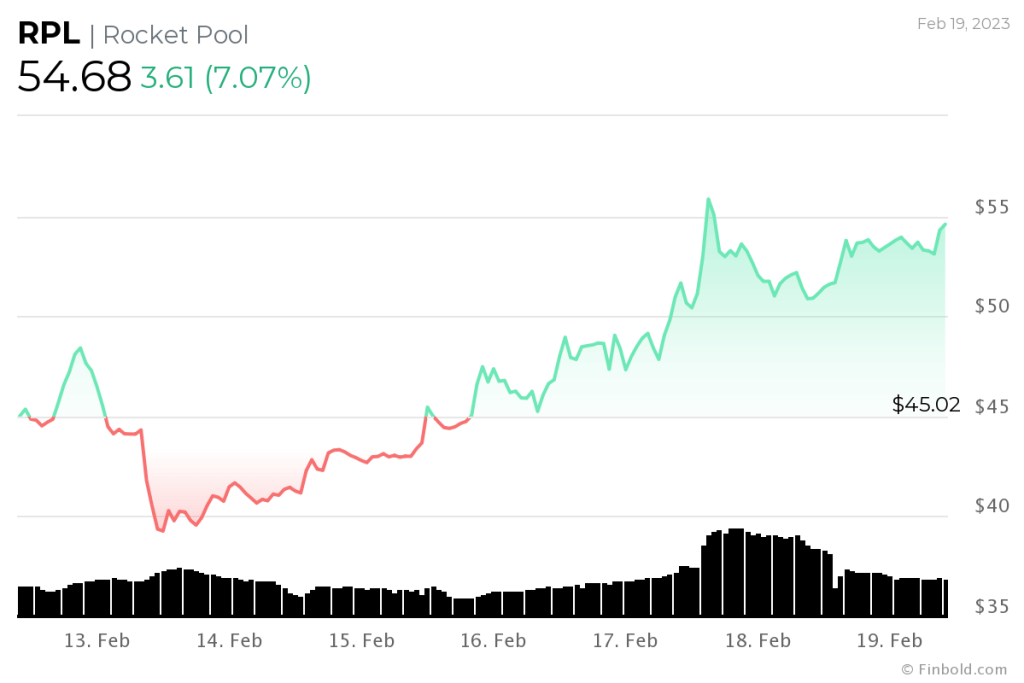

First cryptocurrency to watch: Rocket Pool (RPL)

Rocket Pool (RPL) is a decentralized Ethereum (ETH) staking pool. The Ethereum Blockchain gained prominence as it continued to record increased development activity. Specifically, Ethereum investors are looking forward to accessing their staked ETH before the Shanghai upgrade scheduled for March 2023. Therefore, the value of Roekct Pool is increasing.

Accordingly, Rocket Pool is among the destinations where investors lock their ETH, and the pullback is a highly anticipated event. The Shanghai upgrade, one of the leading staking services for Ethereum, represents a significant opportunity for the Rocket Pool network, which currently has a total value of more than $1 billion locked in locks. At the same time, RPL is an altcoin to watch, given that investors are already experimenting with the withdrawal process after the Zhejiang testnet went live. At press time, RPL was trading at $54.68 with daily gains of about 7%.

RPL seven-day price chart

RPL seven-day price chartFilecoin (FIL) should be on the radar too

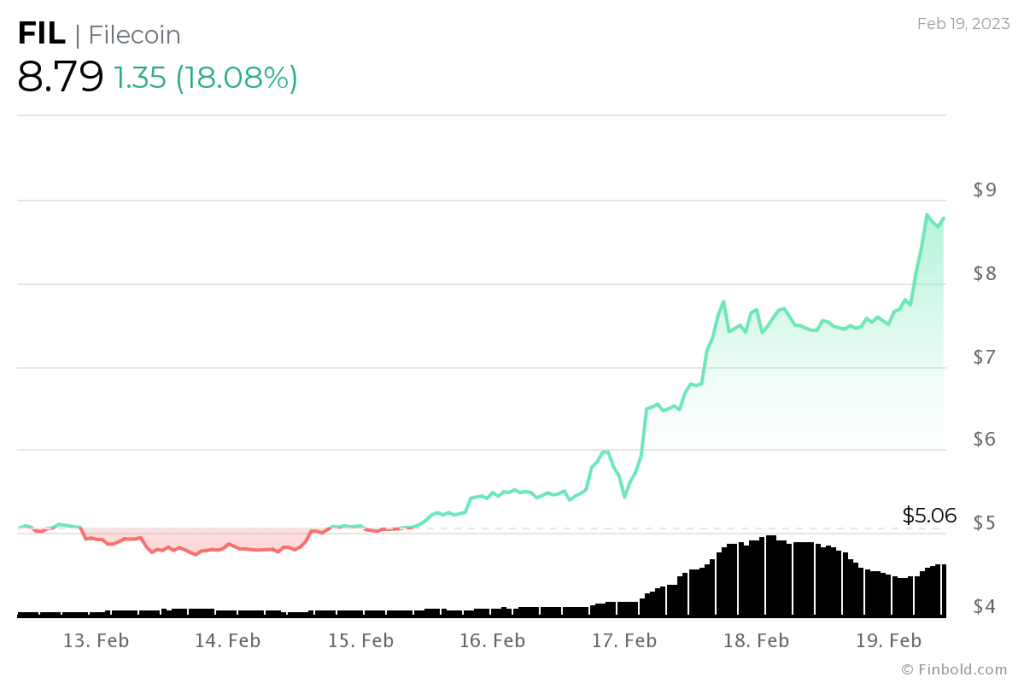

Facing significant challenges throughout 2022, Filecoin (FIL) has made impressive gains since the beginning of 2023. The growing excitement behind the launch of smart contracts on the network under the Filecoin Virtual Machine (FVM) on March 1 may be one of the reasons for the continued increase in value. To celebrate the release of FVM, Filecoin is holding a one-day event called The Countdown to FVM, which will highlight FVM content and builders’ projects. Specifically, the FVM is expected to be interoperable with the Ethereum Virtual Machine (EVM), which will allow cross-chain bridges and enable easy transfer of crypto funds from one Blockchain network to another.

By offering compatibility with EVM and layer 2 Blockchains, Filecoin aims to lower user gas fees and increase transaction speed, which can attract more users, especially in the decentralized finance (DeFi) community. Indeed, Filecoin has landed on the radar of investors thinking that its price action is not matched by on-chain activity. For example, the network’s transaction fees have dropped in recent days. Filecoin is worth watching, especially if investors are going to make a profit considering other on-chain metrics are low. Currently, FIL is trading at $8.79 with daily gains of about 17%. The token is also leading the crypto market with over 70% weekly gains.

FIL seven-day price chart

FIL seven-day price chartThird cryptocurrency: Hedera (HBAR)

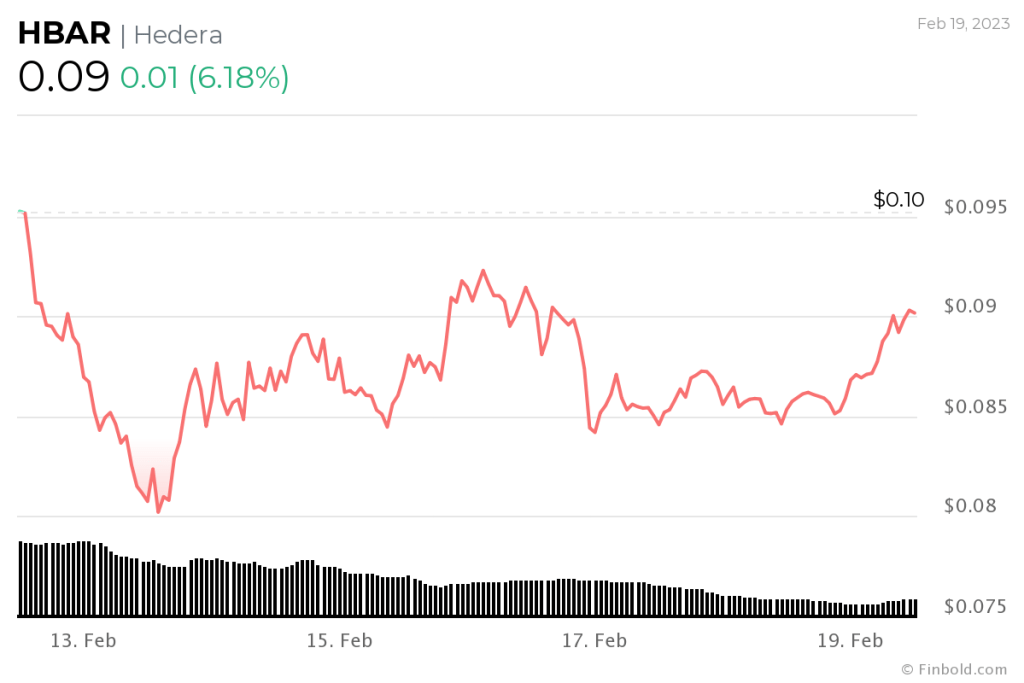

Hedera (HBAR) continues to be among the prominent crypto projects of 2023 as Blockchain attracts organic growth and adoption on several fronts. In particular, HBAR has recently recorded gains after the network signed a partnership with Dell Technologies. Accordingly, the tech giant will join the Hedera Governing Council with plans to run nodes, develop customized applications, and support distributed ledger technology automation.

Elsewhere, a notable development is the launch of the Ashfall NFT series, a collection of Non-Fungible Tokens (NFTs) that has sparked great interest. Additionally, the ecosystem announced the arrival of a $1 million metaverse fund targeting Africa’s creative industry. Indeed, these activities are reflected in the price of HBAR. But the real question is whether the network can sustain the gains and whether it will be an asset to watch next week. At press time, HBAR was valued at $0.09, up over 6% daily. However, the token is down over 5% on the weekly chart.

HBAR seven-day price chart

HBAR seven-day price chartSEC’s target Ripple (XRP) is worth watching

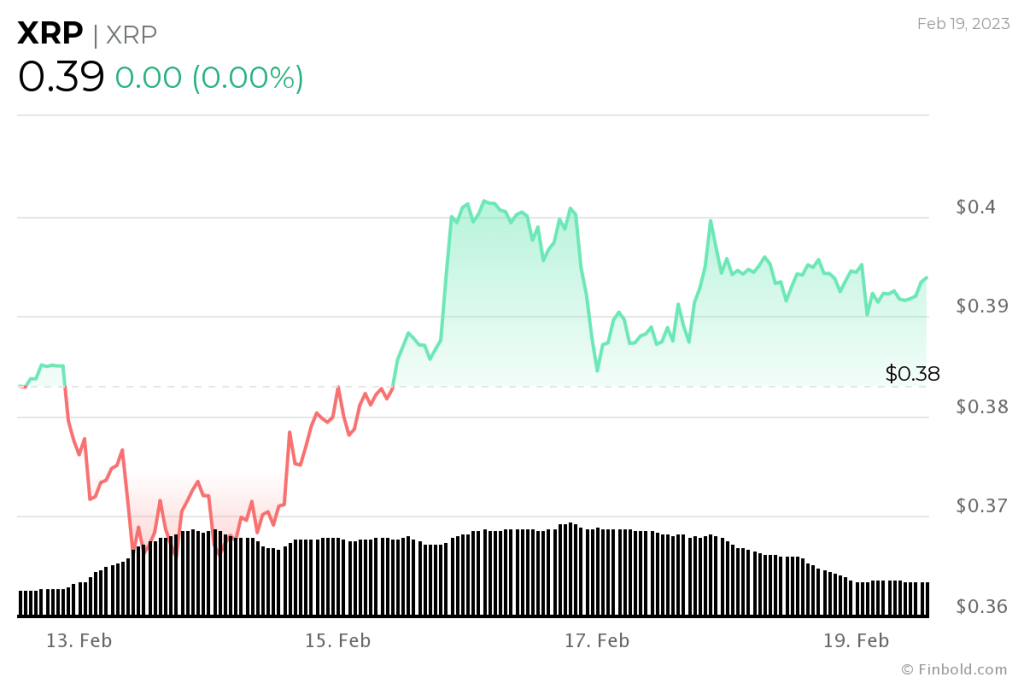

XRP is in the limelight of the crypto industry mainly due to the ongoing high-profile legal litigation involving the US Securities and Exchange Commission (SEC). cryptocoin.com In December 2020, the SEC filed a lawsuit against Ripple, the company behind XRP, alleging that the sale of XRP was an unregistered security offering. In particular, the case is witnessing increased activity as both parties await summary judgment. Currently, the focus is on the renewed edition to unseal several documents that are likely to affect the outcome.

In particular, media personality and Forbes senior contributor Roslyn Layton filed a petition to gain access to the Hinman speaking documents. The petition submitted by Layton argues that the press and public have a fundamental and strong assumption about access to judicial documents recognized by both the First Amendment and Federal common law. The Hinman speech by William Hinman, Director of the SEC’s Corporate Finance Division in June 2018, highlights Ripple’s possible position on the classification of securities. In his speech, Hinman considered Bitcoin (BTC) and Ethereum as non-securities, and this can be applied to XRP as well.

In that case, XRP remains an asset to watch, considering how the SEC will respond to the latest Layton motion, as the summary ruling may provide a clue as to what to expect. At press time, XRP was trading at $0.39 with weekly gains of around 2%. Currently, the token is trying to recover and stay above the $0.40 resistance position.

XRP seven-day price chart

XRP seven-day price chartLeading cryptocurrency Bitcoin (BTC) is also on the list

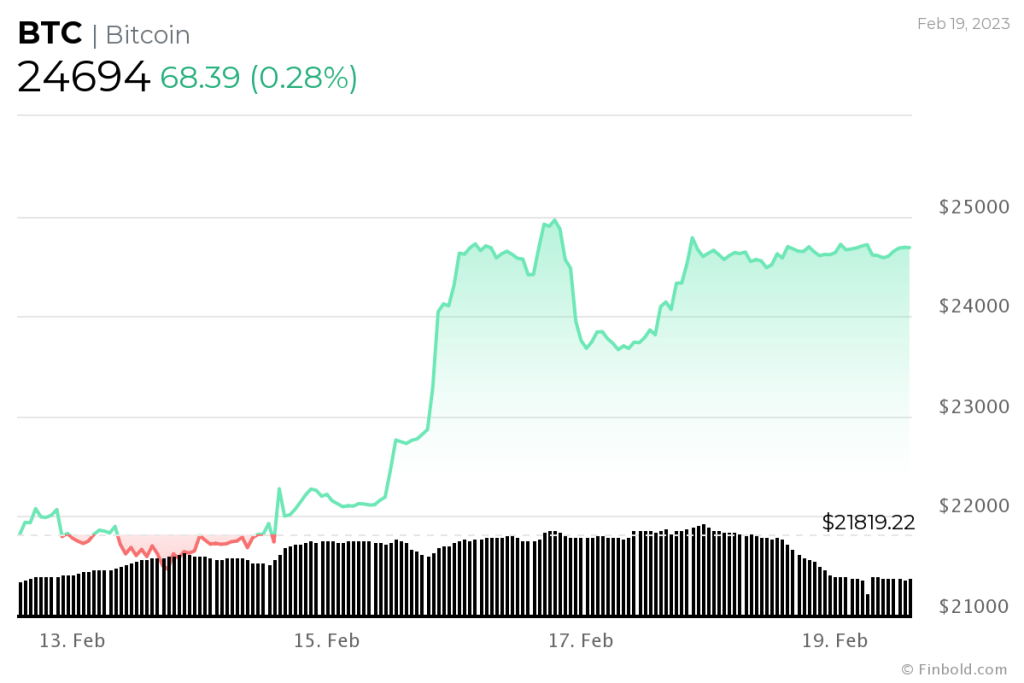

The first cryptocurrency renewed its bullish momentum after emerging as one of the biggest losses in new regulatory uncertainty. The rally saw Bitcoin regain $25,000. Analysts suggest that if the leading cryptocurrency stays above the position, it could open up room to target $30,000. Bitcoin’s revival over the past week has been fueled by several factors, including increased on-chain activity with the adoption of the Taproot feature. Taproot adoption hit an all-time high of 13%. At the same time, the general acceptance of the asset is increasing and around 44 million addresses hold some BTC.

As the new week begins, the focus is on whether Bitcoin can sustain its bullish momentum supported by various technical indicators. For example, Bitcoin recently hit another bull market cross. Historically, the level has been associated with constant rallies. Bitcoin is currently changing hands at $24,649, gaining less than 0.5% daily. On the weekly chart, BTC is up over 12%.

BTC seven-day price chart

BTC seven-day price chart