The bear market is not over yet. But according to Glassnode, various metrics indicate that Bitcoin capitulation has already occurred.

What does the Realized Price metric indicate for Bitcoin?

When will the crypto bear market end? Investors continue to endure the current crypto winter. They have also witnessed the death of multiple protocols and mutual funds in the past few months. Now that’s the question on these investors’ minds. cryptocoin.com This week, Bitcoin (BTC) is once again testing resistance at its 200-week moving average. The real challenge is whether it can go higher in the face of multiple headwinds. Or whether the price will return to the range in which it has been trapped since the beginning of June.

On-chain market intelligence firm Glassnode has released its latest newsletter. Accordingly, “duration” is the key difference between the current bear market and previous cycles. In addition, many on-chain metrics can now be compared with these historical disadvantages. One metric that has proven to be a reliable indicator of bear market bottoms is the realized price. This metric ratios the value of all Bitcoin at the price they were purchased to the number of BTC in circulation.

The number of days the Bitcoin price traded below the actual price / Source: Glassnode

The number of days the Bitcoin price traded below the actual price / Source: GlassnodeAs the chart above shows, apart from the sudden crash in March 2020, Bitcoin has traded below its price for a long period of time in bear markets. Glassnode explains:

Average time spent below Actual Price is 197 days. In the current market for comparison, this period is only 35 days.

This is a sign that predictions for the end of the current crypto winter are premature. Because historical data shows that the market has several months of sideways price action before the next big uptrend.

Will the bottom be closer to $14,000 for Bitcoin?

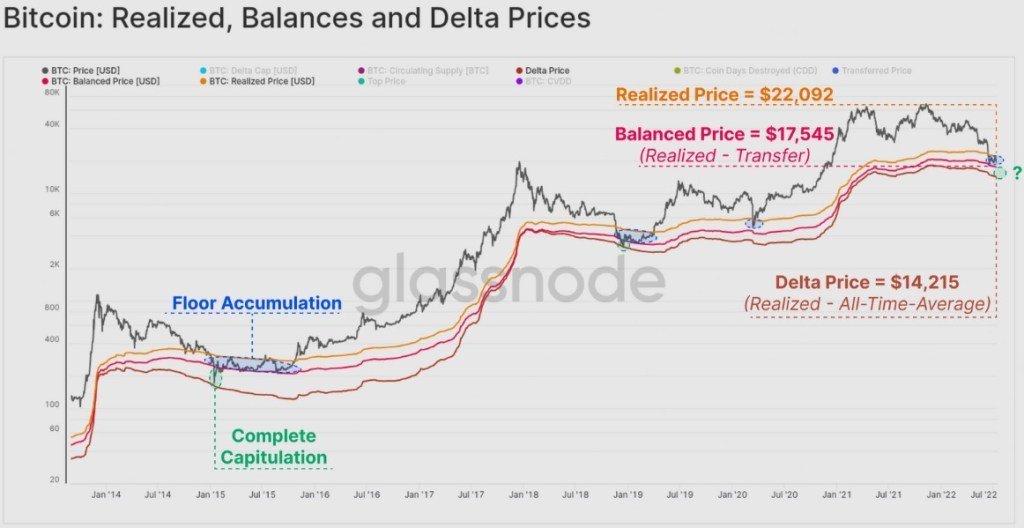

What traders need to pay attention to to understand the end of winter. In this regard, Glassnode highlights Delta price and Equilibrium price as “chain pricing patterns that tend to attract spot prices during late-stage bears.”

Bitcoin realized, balance and delta prices / Source: Glassnode

Bitcoin realized, balance and delta prices / Source: GlassnodeAs the chart above shows, the lows of the previous major bear market were set after a “short term wick to Delta price” highlighted in green. A similar move in the recent market shows BTC holding a low around $14,215. These bearish periods also saw BTC price in an accumulation range “between Balanced Price (low range) and Actual Price (high range)”. And this is where the price finds itself right now.

One of the classic signs that the bear market was ending was a massive capitulation event that exhausted the last remaining sellers. Some are still debating whether this actually happened. On-chain activity dropped to $17,600 in June. Glassnode emphasizes that this is a possible sign that surrender has indeed taken place.

Bitcoin total supply in loss / Source: Glassnode

Bitcoin total supply in loss / Source: GlassnodeThere was a total volume of 9,216 million BTC holding an unrealized loss as BTC fell to $17,600. After the June 18 capitulation event and the one-month consolidation price surge to $21,200, this volume has now dropped to 7.68 million BTC. Glassnode comments:

This shows that 1,539 million BTC was last traded between $17.6k and $21.2k (on a cost basis). It also states that around 8% of the circulating supply in this price range has changed hands.

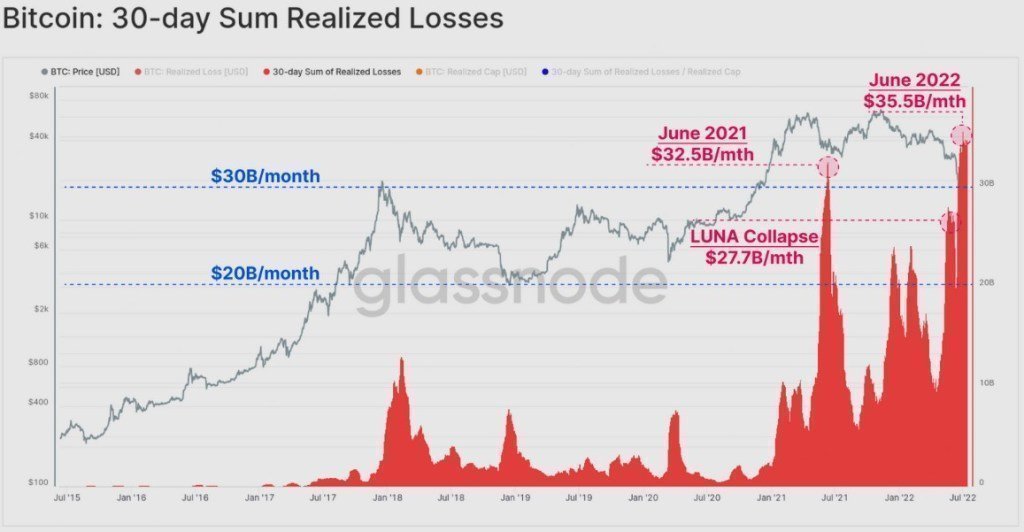

There is further evidence that capitulation has already taken place. That was the “amazing BTC volume” that was locked in a loss between May and July.

Bitcoin 30-day total realized loss / Source: Glassnode

Bitcoin 30-day total realized loss / Source: GlassnodeTerra’s collapse triggered a total of $27.77 billion in losses. On June 18, the 2017 cycle dip below the ATH level resulted in a total loss of $35.5 billion.

Is this the end of the bear market?

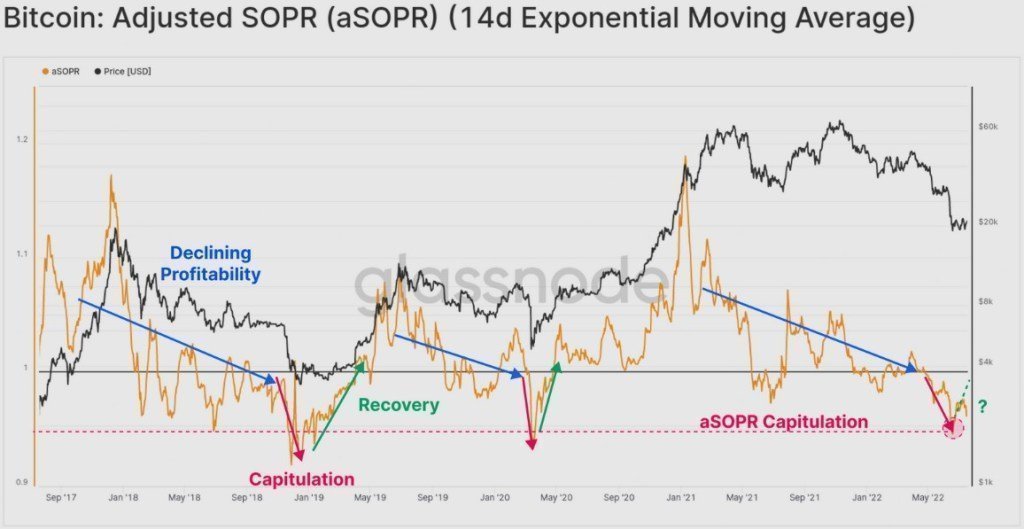

There is one final metric that indicates that capitulation has already occurred. Adjusted Output Profit Ratio (aSPORT), which compares the value of outputs at the time they are spent with their value at the time they are created.

Bitcoin tuned SPORT / Source: Glassnode

Bitcoin tuned SPORT / Source: GlassnodeAccording to Glassnode, when profitability drops (as represented by the blue arrows), investors will see massive losses leading to “a final moment of capitulation waterfall” highlighted in red. Glassnode has this to say about it:

At the end of the market, the seller reaches exhaustion. Then, prices start to recover. Finally, the pain of investors begins to subside.

He also touches on one more point to confirm that capitulation has indeed taken place and accumulation continues. Glassnode states that for this, the aSOPR value should ideally go above 1.0.