The cryptocurrency market has been facing the news of major bankruptcies and scams for a long time, so the importance of crypto Asset Markets (MiCA) regulations is becoming more and more apparent. So what changes will happen with MiCA Cryptocurrency rules? Which altcoins will it affect? Here are the details…

MiCA Cryptocurrency rules may hinder the innovation of altcoins!

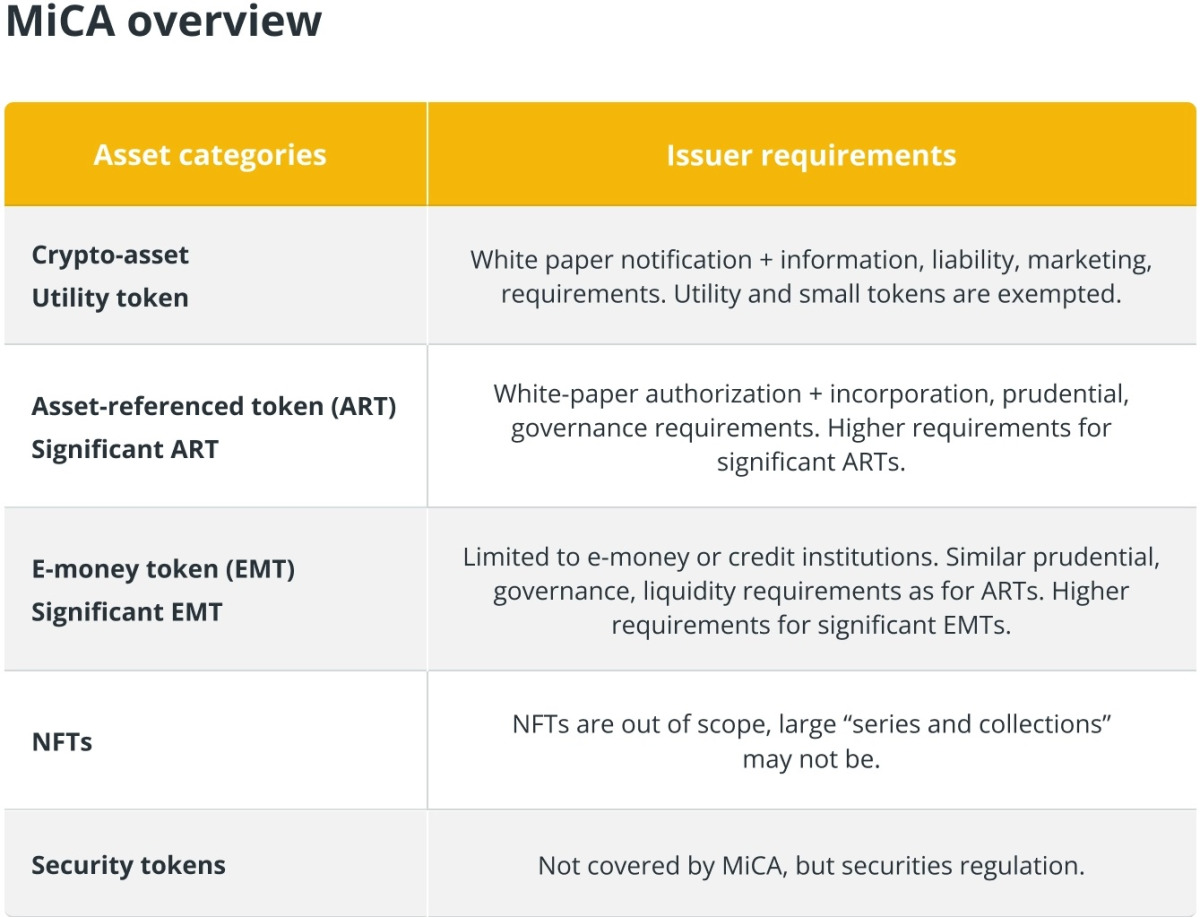

cryptocoin.com As we reported, the European Union has become the first major jurisdiction to adopt the Crypto Asset Markets (MiCA) regulation, a comprehensive crypto law that aims to provide legal certainty for the crypto industry and investors by establishing standard regulations and harmonized rules at the EU level. MiCA could ultimately stifle innovation, introduce a one-size-fits-all approach to regulation for DeFi, increase compliance costs for decentralized exchanges (DEXs) and DeFi platforms, raise privacy concerns, and require collaboration between the crypto industry and regulators to strike a balance between regulation and innovation. .

On the other hand, the Dodd-Frank Act in the United States and other similar regulations in traditional finance have come under criticism for their negative impact on innovation. For example, increased regulatory requirements and compliance costs have made it harder for smaller banks and financial institutions to compete with larger ones. As a result, the number of community banks decreased and the banking sector became more concentrated. Similarly, MiCA’s restrictions could hinder industry consolidation by making it harder for smaller DeFi startups to enter the market. However, the fundamental principles of DeFi may also be compromised by the implementation of MiCA’s laws regarding decentralized networks.

Compliance costs may increase for DEXs and DeFi platforms!

Experts MiCA Cryptocurrency rules are expected to increase compliance costs for DEX and DeFi platforms. According to experts, MiCA cryptocurrency regulation could impose a set of rules and regulations on DEXs and DeFi platforms to ensure consumer protection, prevent money laundering and maintain market integrity, just like in the traditional financial sector where compliance requirements can be costly and time-consuming. In the years following the 2008 financial crisis, financial institutions endured great costs. Similar costs are also expected for the cryptocurrency market.

Similarly, MiCA regulation is expected to increase operating costs and potentially limit the entry of new projects into the market. The impact of costs on innovation and competition in the cryptocurrency market is yet to be seen, but demand for compliance can create an entry barrier for new companies and limit the ability of smaller businesses to compete with larger, more established players who can better meet these costs.

MiCA Cryptocurrency Rules raise privacy concerns

Privacy issues will also come up as MiCA regulation requires crypto service providers to collect and store significant amounts of personal data, including users’ credentials, transaction history, and other sensitive data. This data collection could lead to privacy breaches and increase the vulnerability of cryptographic assets to hackers, according to experts.

Traditional financial laws such as the US Bank Privacy Act (BSA) and the EU’s General Data Protection Regulation (GDPR) have previously been subject to similar privacy concerns. GDPR’s strict data protection standards have come under criticism for overburdening businesses, increasing compliance costs and hindering innovation. BSA has also come under criticism for requiring financial institutions to comply with onerous reporting requirements, which can be costly and time-consuming, and putting customers at risk of privacy breaches by collecting and storing their personal data.

Which altcoins will MiCA Cryptocurrency rules affect?

The head of the European Banking Authority (EBA) said central banks should veto major stablecoins if they fear it could upset monetary policy, fearing that unauthorized use of blockchain could prove to be financially unsound. In the coming months, EBA President José Manuel Campa will lay out detailed rules for implementing the European Union’s Crypto Asset Markets regulation (MiCA), a landmark framework that will require stablecoin issuers to obtain a license and have appropriate reserves.

“Central banks have the power to veto the widespread issuance of so-called stablecoins if they affect public policy objectives, including financial stability or monetary policy,” Campa said at an event hosted by the Official Monetary and Financial Institutions Forum OMFIF on Thursday. should be,” he said. Campa’s agency will also be responsible for directly overseeing major issuers under the MiCA. MiCA allows central banks to intervene in new stablecoin issuance proposals, called asset-referenced tokens in MiCA. It also requires that issuance be halted if the tokens become widely used with more than 1 million transactions per day.

On the other hand, Campa said he could see a future where stablecoins “will become even more important” as a means of payment, just as private payment systems now complement central bank money. But he stressed that they must abide by “reasonable scares”, including complying with anti-money laundering laws.

Some Stablecoin Issuers announced their decision after MiCA

In response to another question from Timothy Massad, former U.S. Commodity Futures Trading Commission Chairman, Campa expressed concerns that stablecoins on decentralized, permissionless blockchains might not be safe or sound, as expressed by the U.S. Federal Reserve, Federal Deposit Insurance Agency, and the Office of the Currency Comptroller. seemed to share. EU stablecoin issuers “need to ask for permission… you need to put your project forward, and that project needs to be evaluated, especially in terms of the concerns raised by US regulators,” Campa said, adding that the scrutiny will be more on more ambitious projects.

“All issuers will be subject to a robust authorization as well as forward-looking supervision framework,” Campa said, noting that the reserves of the largest issuers, including prudent governance, business conduct and redemption arrangements, will face “enhanced stress testing.” However, MiCA will receive final signature from finance ministers next week, and its provisions will likely take effect around July 2024. Major companies such as Circle and Unstoppable Finance have already announced their intention to issue stablecoins under MiCA.