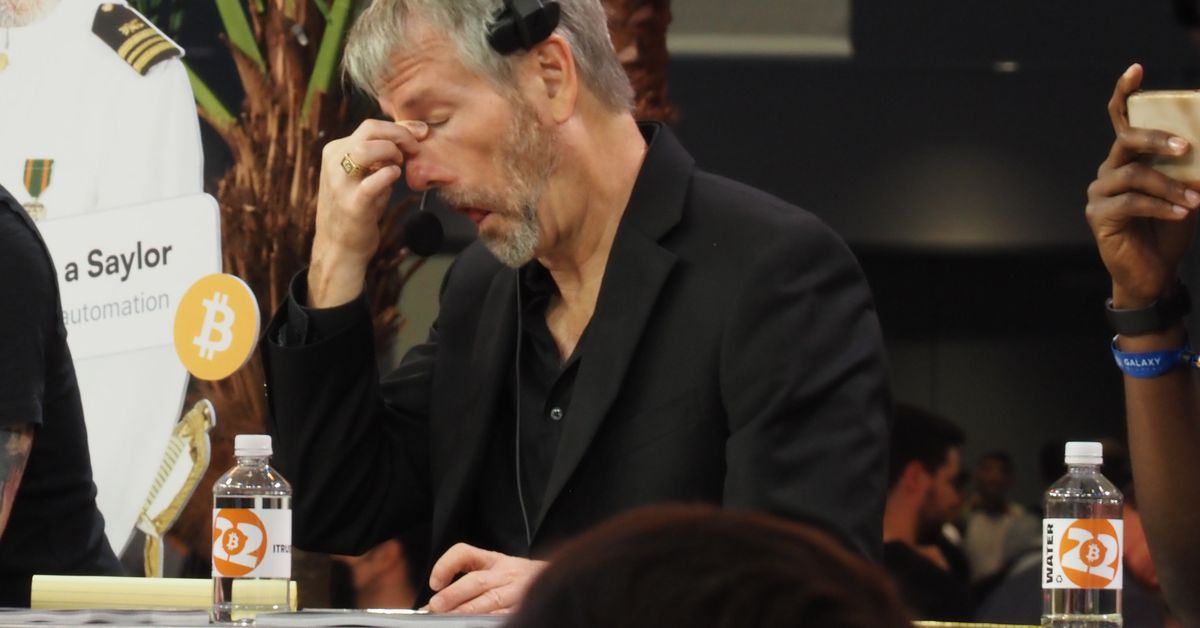

Michael Saylor’s MicroStrategy (MSTR) is sitting on an unrealized loss of more than $1 billion on its bitcoin (BTC) holdings as the price of the largest crypto touches $22,900 in Monday trading.

-

The CEO of the technology company began purchasing bitcoin in August 2020 at a price just under $12,000. Subsequent purchases over the following months brought the company’s holdings to 129,918 bitcoin, now valued at under $3 billion versus what’s a near-$4 billion investment.

-

Much of the funding of MSTR’s buys came via junk bond and convertible note sales.

-

Last month, MicroStrategy CEO Michael Saylor dismissed talks of a margin call, stating that a problem would only occur if bitcoin reached $3,562.

-

MicroStrategy shares are down 24.32% on Monday as it leads the sell off in crypto-related stocks.

Read more about

MicroStrategyBitcoin

The Festival for the Decentralized World

Thursday – Sunday, June 9-12, 2022

Austin, Texas

Save a Seat Now

BTC$22,751.84

BTC$22,751.84

18.13%

ETH$1,189.29

ETH$1,189.29

21.21%

BNB$216.98

BNB$216.98

17.83%

XRP$0.305194

XRP$0.305194

14.80%

BUSD$1.00

BUSD$1.00

0.07%

View All Prices

Sign up for Market Wrap, our daily newsletter explaining what happened today in crypto markets – and why.