Leading altcoin Ethereum (ETH) miners no longer receive any ETH as rewards after Merge. Despite this, they continue to be net buyers in the altcoin project after Merge.

Miners continue to buy the leading altcoin after Merge.

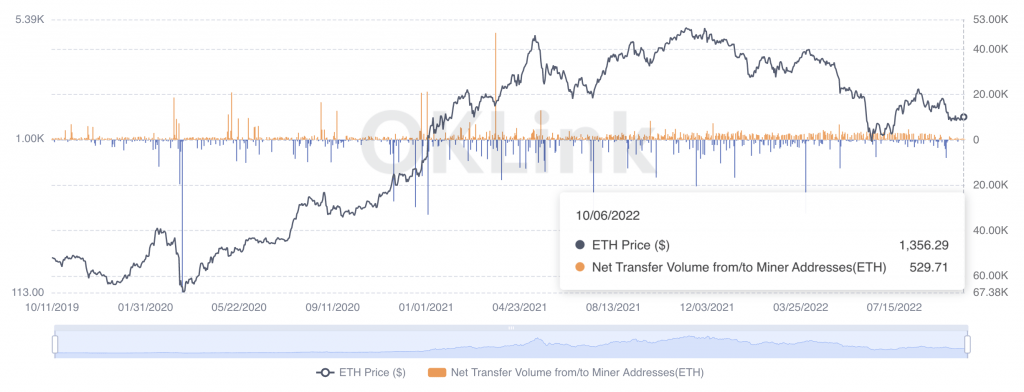

According to data from OKCoin’s OKLink, miners added 1,880 ETH worth $2.5 million to their addresses last week, resulting in a net inflow of between 100 and 500 ETH per day. OKLink states that this data includes ‘tokenized miner addresses, including Foundry USA, F2Pool, AntPool, Poolin, Binance, SlushPool, BTC.com, Huobi.pool, 1THash&58COIN, OKxPool, Luxor, ViaBTC and others’.

cryptocoin.com As you follow, the first drop in assets of around 15,000 ETH occurred in the days around Merge. After that, the positions now seem balanced. All four major pools saw a sharp drop around September 15. Ethermine dropped its holdings from 17,000 to 5,000 and continued at around 300 ETH.

Nanopool exhausted its holdings of around 1,500 ETH on September 15. Hive dropped by about 1,000 ETH per week, from around 16,000 ETH to 7,000 ETH. Flexpool is going slower after an initial drop from 6,000 to 1,500. These four large pools now hold 13,500 ETH combinations, or what is just a one-day reward for their mining.

Ethereum miners net inflows / October 2022

Ethereum miners net inflows / October 2022Miners appear to be holders or stakers

Only real miners get this ETH. Some then post them on exchanges. However, some prefer to hold off. The increase in entries shows that formerly miners are now only ETH investors and are increasing their positions. Or possibly an indication that many miners are converting to stakers.

What the latter case is will become clear once the rewards are unlocked, perhaps this summer, when we see exactly which addresses have received these rewards. But the initial drop indicates at least some miners are leaving. However, anecdotally at least some miners have adapted by providing staking-related services.

But the slack continues as we approach the first month since Merge this Saturday. It is possible that many miners have set monthly rewards for distribution. So it’s possible that some are still waiting for September payments.

However, instead of picking up and going, miners seem to have become holders or stakers after the initial drop. It is possible that they are even buying now. This is likely to have contributed to the altcoin’s price stabilizing at around $1,300 and its rate slipping just below 0.07 BTC.