Leading altcoin Ethereum is rallying under the influence of the network’s “Merge” upgrade. However, according to analysts, Solana (SOL) and Avalanche (AVAX) are likely to be forced to make short corrections. In line with the latest developments, we have prepared the forecasts of the analysts for the two altcoin projects for our readers.

“A possible fix for Solana (SOL) is imminent”

Solana and Avalanche posted significant gains on a weekly basis. However, they have reached critical resistance areas. SOL has gained about 14% over the past 7 days. At press time, SOL was trading at $43.70, gaining 4.12% over the past 24 hours. Wednesday’s US inflation fell to 8.5% in July. This led to a rally in global markets. Solana’s spike seems to be linked to this particular data. However, in the crypto space today, market participants are now more focused on Ethereum as the ‘Merge’ upgrade approaches.

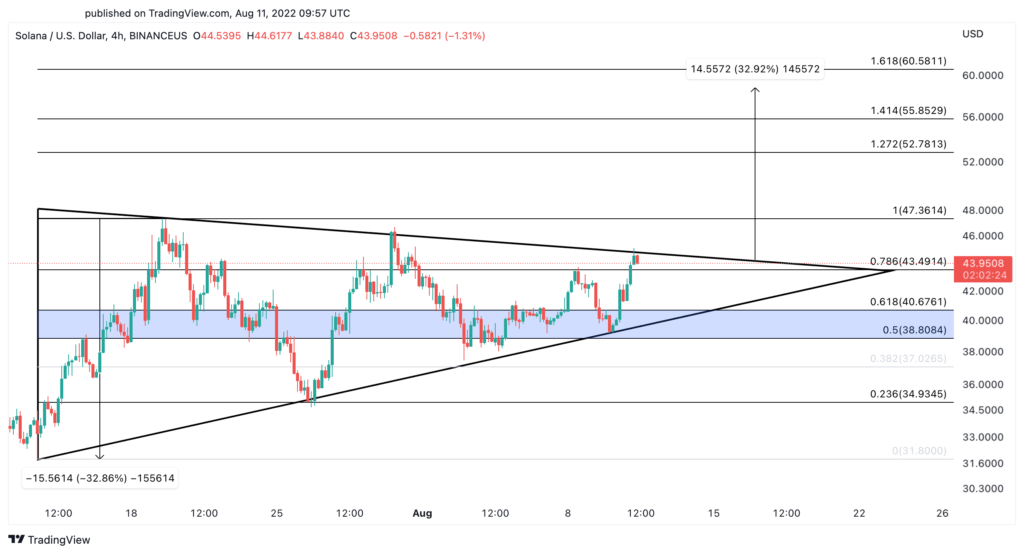

It is possible that the sentiment change will negatively impact Solana’s price action. If the SOL fails to close a four-hour candlestick above the $46 resistance, a possible correction towards $40 is close. The SOL must overcome this hurdle in order to advance further. The formation of a symmetrical triangle on the four-hour chart of Solana suggests it could enter a 33% uptrend towards $60. However, it has to pass $46 first.

LEFT four-hour chart / Source: TradingView

LEFT four-hour chart / Source: TradingView“Rise in profit taking may confirm pessimistic outlook for altcoin”

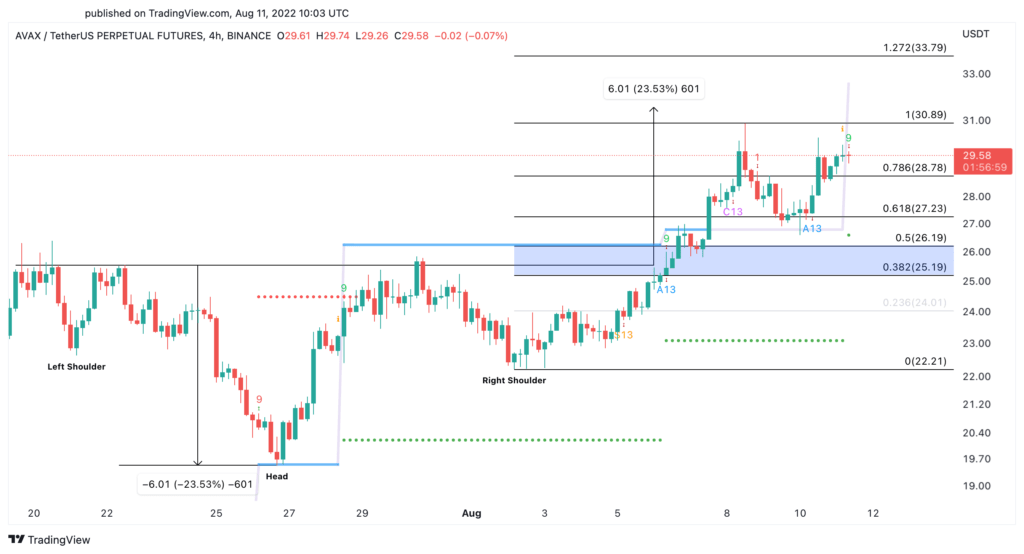

Avalanche experienced significant bullish momentum in the last week, gaining more than 24%. From a technical standpoint, the uptrend seems to have emerged after AVAX exited the head-and-shoulder pattern. Now that the token has almost reached the model’s target of $31.50, a sell signal is forming on the four-hour chart.

With more than 25 signals, the Tom DeMark (TD) Sequential indicator presented a green nine candlestick, which is indicative of a one to four candlestick retracement. Check out this article for the indicator’s accurate signals. The increase in profit taking, which pushed Avalanche below $28.80, is likely to confirm the gloomy outlook. If it loses this vital support level, AVAX is likely to face a correction to $27.20 or even $26.20

AVAX four-hour chart / Source: TradingView

AVAX four-hour chart / Source: TradingViewcryptocoin.com As you follow, the market reacted positively to the latest US Consumer Price Index report. Given this situation, further gains cannot be ruled out. It is possible for Avalanche to gain strength to invalidate the bearish thesis if it can close a four-hour candlestick above $31. Thus, it is likely to open a door for it to rise to $34. At press time, AVAX was trading at $28.90, down 0.98% in the past 24 hours.