Known for its accurate signals, the TD Sequential indicator has set new levels for Bitcoin. According to technical analyst Ali Martinez, a significant rise could be imminent.

If this prediction comes true, Bitcoin price could soon reach $31,300

In a recent analysis, Martinez said that Bitcoin has the potential to hit not only one but two key price targets in the short term. Martinez’s focus revolves around the TD Sequential, which helps identify potential price trends in the crypto market. The analyst drew attention to the 12-hour BTC chart just a day ago. Here he warned of a critical buy signal that coincides with the formation of a candlestick pattern.

This bullish signal is strengthened as Bitcoin maintains a price level above $29,800.

#Bitcoin is working on that buy signal presented by the TD Sequential we spotted the other day. I believe $BTC first target is $30,600 and the potential second target is $31,300. But I will keep an eye and let you know if this changes. https://t.co/dqq8RGStUO pic.twitter.com/Lw864gxUdE

— Ali (@ali_charts) July 20, 2023

Bitcoin drops as S&P 500 strengthens

BTC is currently hovering around $29,830 with a slight decrease of 1.5%. Despite this minor setback, the analyst’s forecast indicates that a major rally may be on the verge. According to Martinez’s latest tweet, the initial price target for Bitcoin is at $30,600. This shows that there is a potential for an increase of about 2.6% from its current price. However, the estimates are not limited here. Martinez continues to talk about a possible second target of $31,300, which would represent a more substantial gain of around 5%.

Bitcoin suggests more volatility in coming days

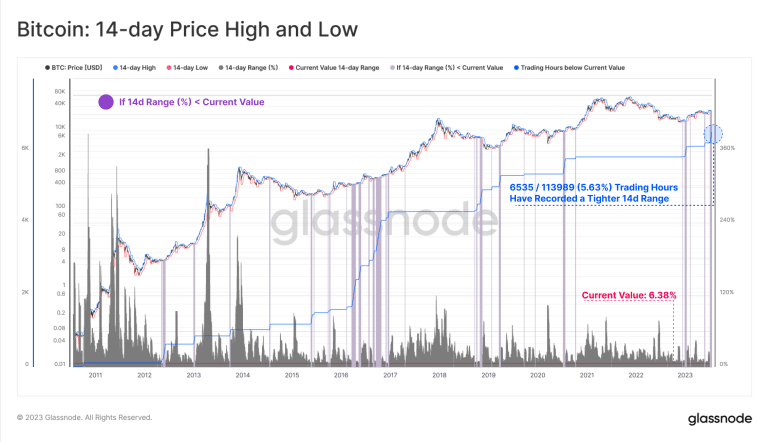

Meanwhile, since hitting year-highs last month, Bitcoin price is 30,000-31. It was traded in a narrow range of $ 000. The recession dampened investor enthusiasm. It has also triggered questions about the sustainability of the market boom last month based on the growing institutional interest in cryptocurrencies.

Glassnode reports that around 5.6% of total transaction hours record a narrower range than this value. This underscores that there is a large possibility of movement in both directions for BTC in the coming days.

Trading activity drops

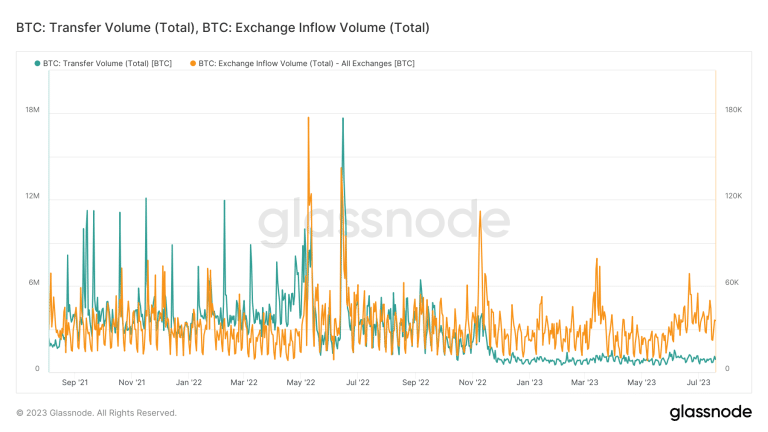

On-chain transfer volume is the total number of tokens transferred in successful transactions. This number has decreased significantly since the enthusiasm seen at the start of the market rally last month. Combined with the falling foreign currency inflows, it was seen that the transaction volumes softened. This shows that he continues to think long-term. Such investors tend to wait, especially for many years. This strategy sets the stage for a potential BTC supply shock.

Meanwhile, high-profile investors like Elon Musk’s Tesla haven’t given up on their BTC holdings either. The tech giant announced in its second quarter earnings report that it continues to hold approximately $184 million worth of BTC on its balance sheet. Tesla’s crypto reserves remained unchanged for the fourth quarter in a row. cryptocoin.comWe have included the details of the report in this article.