Morgan Stanley warns that as the altcoin crash of 2022 unfolds, investors in the metaverse and NFT may be at the center of the next drop.

Morgan Stanley pointed to this altcoin market after the Terra debacle

According to a study published last week, serious declines in Bitcoin, Ethereum and other cryptocurrencies were accompanied by the collapse in stock markets. was not linked. Coinbase said that as crypto expert Sheena Shah observed, the rising costs were due to investor “speculation with minimal real user demand.” Shah’s analysis says that speculation is not limited to cryptocurrencies. NFTs and digital real estate in the Metaverse have been the target of speculation. It is stated that it will create problems for both parties, as it is invested only to make money through buying and selling.

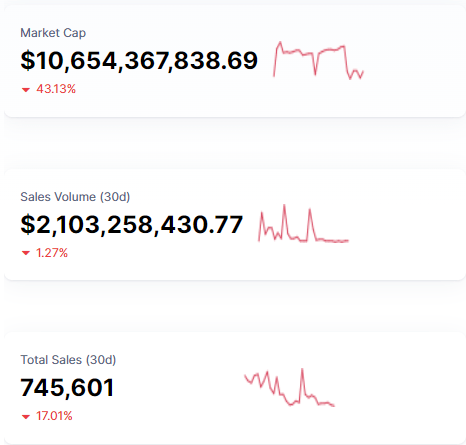

According to Shah, many consumers buy NFTs with the expectation of selling them to another bidder at a better price. The NFT market had a rough start to the year. Total NFT transaction activity rose from $3.9 billion to $964 million between mid-February and mid-March, according to Chainalysis’ analysis for May. The metaverse property auction for recent high-profile NFT collections such as the Moonbirds and Otherdeeds affiliated with the Bored Ape Yacht Club has worked well.

According to the statements made by Modesta Masoit, finance director of NFT ratings portal DappRadar earlier this month, NFT trading is largely focused on “blue-chip” NFT collections such as CryptoPunks. According to Masoit:

NFTs seem to be starting one of several maturation stages. We guessed it, and we think it’s a natural progression in technology like this.

Shah said that the fall of the TerraUSD stablecoin caught Morgan Stanley off-guard, resulting in a “broader reassessment of where various crypto assets should be traded.”

Morgan Stanley said NFTs will follow after the UST collapse

Morgan Stanley noted in a note that crypto-backed stablecoins have become an important part of the leverage being built within the DeFi ecosystem and This event is said to have led to increased uncertainty and instability, which has “leaded to a broader reassessment of where many crypto prices should be.”

bank note that crypto pricing of the massive increase in stablecoin market cap, which has increased thirty-fold since the start of 2020, as stablecoins are responsible for providing so much liquidity and leverage He says it has an effect on him. Morgan Stanley said its clients are asking whether the massive drop in crypto prices and the issuance of stablecoins poses “a more systematic risk to the broader financial markets.”