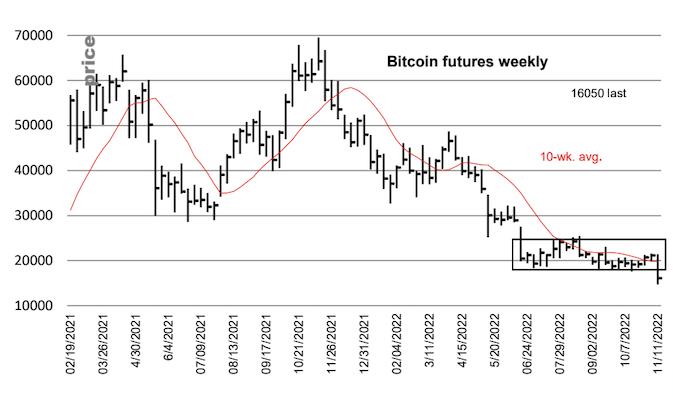

According to Morgan Stanley, the Bitcoin (BTC) market has recently awakened from a long sleep and put the bears in the driver’s seat. According to analysts of the financial institution, current chart patterns suggest that Bitcoin is likely to slide to $14,000 or below. Here are the details…

Morgan Stanley points to $12,500 and $13,500 for Bitcoin

cryptocoin.com As we reported, the top cryptocurrency has lost 22 percent in the last week. It hit a two-year low of $15,600 as the collapse of FTX hurt investor confidence. The dip marked a bearish break in months of sideways or sideways trading above $18,000. Thus, it opened the doors for a significant sale. “From a technical standpoint, Bitcoin has now dropped below $18,000, which has been a support area in recent weeks,” strategists at Morgan Stanley said. The next levels to watch are $12,500, the high of 2019, and $13,500, the high of the third quarter of 2020, according to analysts.

Range breakouts often bring a significant drop or rally. According to technical analysis theory, an asset generates potential energy during consolidation. This energy is released in the direction where it breaks at the end of the gap. The longer the consolidation, the greater the energy store and the post-break/break movement. For this reason, experienced traders avoid trading against a range breakout or breakout.

FTX catalyst, worst in years

Analysts at Delphi Digital wrote in a note to their subscribers, “First, think of the consolidation window as an arc that twists over time and is filled with potential energy. “Each successful bounce of support and rejection of resistance adds more potential energy,” he said. “When prices finally break out of range, the impulse action can be extremely strong, just like the initial relaxation of a spiral spring,” he added.

According to experts, technical models can and often fail. However, Bitcoin’s recent range breakdown will likely bring more pain, as unfavorable macroeconomic conditions and the collapse of FTX are likely to put investor risk appetite under pressure. Delphi’s team used the following statements, stating that there is support between $14,000 and $16,000:

This crash was accompanied by one of the worst crypto catalysts to date, weighing on investor sentiment and asset prices. We combined the local crypto catalyst in the FTX-Alameda boom with a perpetually bleak macroeconomic backdrop that did not change materially.

Will we see lower levels?

Michael Oliver, founder of Momentum Structural Analysis, stated that Bitcoin flowing from lows may have started the bottom process. But he said the market may not find a bottom anytime soon. “The presumed fundamental action [above $18,000] could be a harbinger for a bottom, but any dip will likely be a gush from the next range lows,” Oliver wrote in his weekly note.

“Based on various metrics, we suspect lower lows will be seen and it is likely that this market may not find an effective bottom until December. But for now, let it float,” he added.