Amid the recent volatility, a mysterious altcoin analyst says that the altcoins he wants to buy are Solana (SOL) and Binance Coin (BNB).

Altcoin Sherpa shared why it chose SOL and BNB

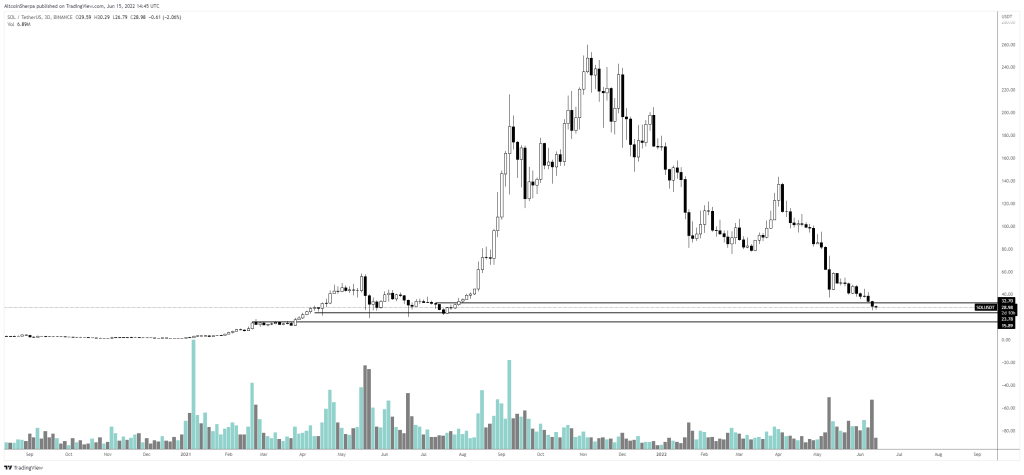

The mysterious Twitter analyst, nicknamed Altcoin Sherpa, said in his recent analysis that he believes Solana will recover. Ideal buy levels for SOL are between $15 and $25, according to Sherpa. The 9th largest cryptocurrency by market capitalization has dropped 18% since last week. It is now trading around $31.20. The analyst says current levels are not bottoms, although he expects recovery in the short term:

I think the current zone for Solana is a solid buy zone for a short-term recovery. But I am not overconfident. I don’t think it’s the ‘bottom’ either. However, if the market continues to decline, the bottom will likely be clear below $20.

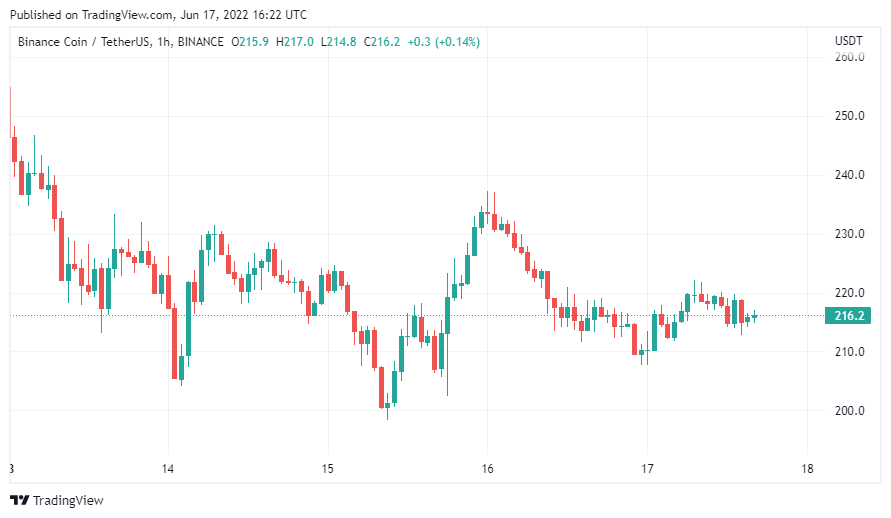

Analyst says it continues to buy BNB

In another tweet, Sherpa shared why he will continue to buy BNB. The analyst says he has increased his BNB purchases because he believes Binance will continue to support his own coin. Currently, Binance Coin (BNB) is trading around $215.72. For BNB, Sherp had some interesting statements:

BNB led the last bearish cycle. I don’t believe Binance CEO CZ will let it continue. The most popular exchange is still Binance. BNB is still useful on Binance Smart Chain. I will buy more than this even if I have it now. If things go bad, I’m aiming for plus 140 here.

Avalanche (AVAX) and Near Protocol (NEAR) are the other two altcoins on Altcoin Sherpa’s radar. If the drop continues, Sherpa says it will likely buy these altcoins. Regarding Avalanche, Altcoin Sherpa predicts that AVAX could drop to around $10.

$AVAX: Some targets. Long term I think that 10bucks gets tagged eventually. #AVAX pic.twitter.com/c48eU4b5r8

— Altcoin Sherpa (@AltcoinSherpa) June 15, 2022

Bitcoin is full of bull traps

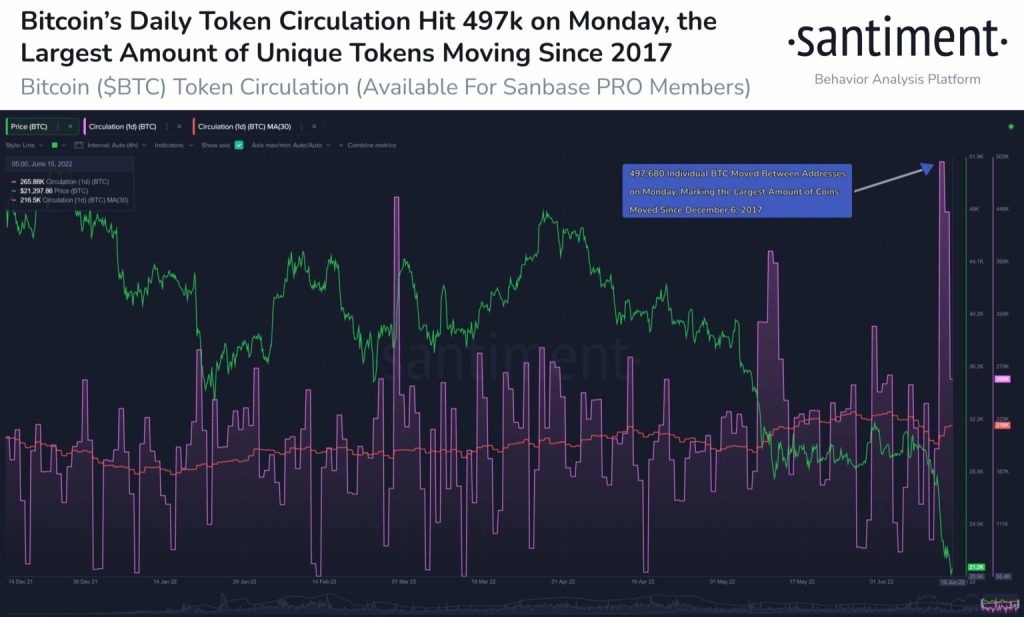

In recent days, Bitcoin investors have become active again after the current slump. 3AC and Celsius liquidations tied to massive price drops. In fact, Bitcoin’s on-chain metrics have been showing some interesting developments lately.

According to Santiment, Bitcoin’s daily token circulation hit a 4.5-year high on June 13. Moved 497,680 BTC to start the week. Thus, he pointed to the divisive nature of the transactions currently in focus.

Santiment also quoted that “high capitulation increases can and will foretell bottoms.”

📉 It's no surprise to see #Bitcoin transactions being made in waves of realized losses. And this past week has actually seen the most realized losses since this data was available in 2009. High capitulation spikes can & will eventually foreshadow bottoms. https://t.co/7w7XlopIKD pic.twitter.com/nqXfjSPvJE

— Santiment (@santimentfeed) June 15, 2022

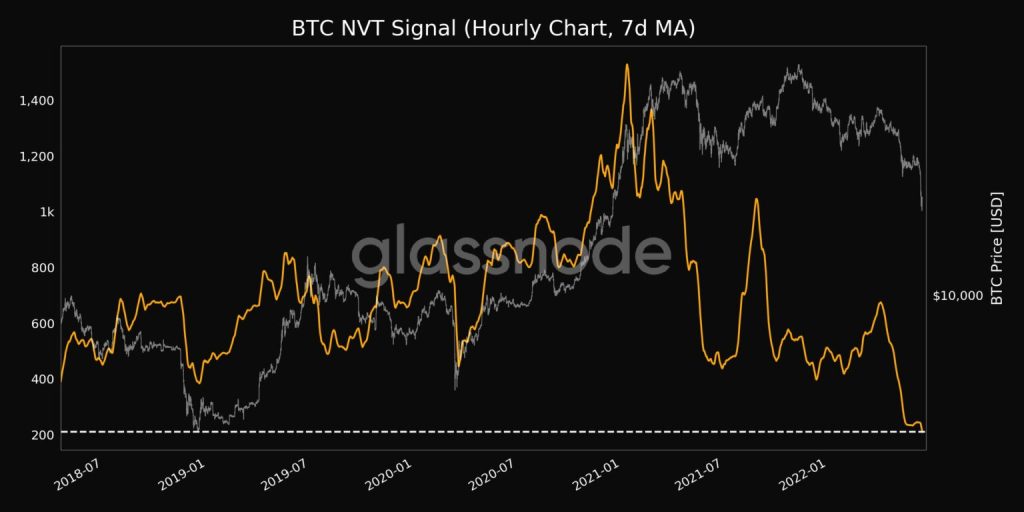

Adding to the woes, Bitcoin’s NVT signal hit a 4-year low of 209,845.

In addition, as we quoted as Kriptokoin.com , the Federal Reserve approved the largest interest rate hike in over 25 years on June 15. The decision was widely anticipated in the crypto community, especially after the recent crash. Similar to the previous FOMC meeting, the decision sparked a bullish breakout in the crypto market.

Finally, another popular cryptocurrency analyst, CryotoCapo, warns investors of “bullish traps.”

Funny how the first bull traps were being above 40k, then above 30k, and now above 20k.

— il Capo Of Crypto (@CryptoCapo_) June 15, 2022

Capo also posted another tweet, describing this spike as a ‘bull trap’.

Seeing some bottoms calls here. Honestly, this is one of the clearest fake pumps that we have seen until now.

In my opinion, the 20k level won't hold for long. We haven't seen proper capitulation yet, and there are no bullish signs.

I remain out of the market.

— il Capo Of Crypto (@CryptoCapo_) June 15, 2022