A mysterious crypto whale made $5 million from short positions on 4 altcoins amid the day’s Silvergate-driven sales. The US payment network has been in trouble since the collapse of FTX and has been selling its own assets to meet customer demands.

Mysterious altcoin whale makes millions in Silvergate sales

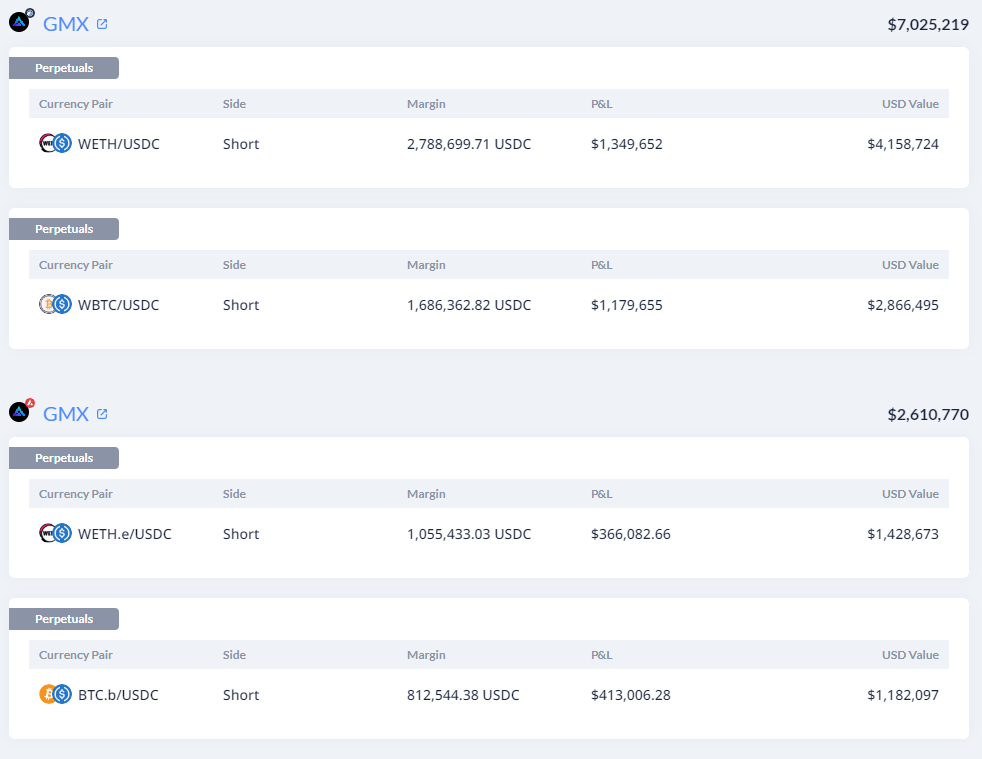

The giant investor, whose identity is unknown, earned $5 million overnight through professional transactions and left 99% of the market behind. Whale has shorted Ethereum, Bitcoin, and MATIC on the Polygon and Arbitrum networks on the decentralized cryptocurrency exchange GMX, which offers leveraged trading.

The whale’s largest position is the WETH/USDC short, which is currently at $1.3 million. However, it seems that the whale still owns a large amount of BTC and Ethereum, despite the large short positions.

GMX enjoys post-FTX whale attention

GMX, the native cryptocurrency of the leveraged trading platform GMX, is on the receiving end of big whale interest after the FTX crash, according to new data provided by Santiment. This whale interest has been bolstered by whales laden with short positions on the platform, resulting in a significant increase in the price of GMX over the past few months.

Data from Santiment suggested that wallets holding 100,000 – 1 million GMX had purchased around 10 million tokens. While the purchase of large amounts of GMX may positively impact the token in the short run, it may make holders more vulnerable to whale actions in the long run.

'@CryptoHayes isn't the only one buying $GMX! 🧐

On-chain data from @santimentfeed shows that wallets with 100K to 1M #GMX have bought 10 million tokens since #FTX collapse, worth around ~$20 million. And their purchasing power doesn't appear to be slowing down. https://t.co/KxwjBqNfvf pic.twitter.com/cbD7Jtw7WR

— Ali (@ali_charts) February 27, 2023

Whales were also related to the GMX protocol apart from the token

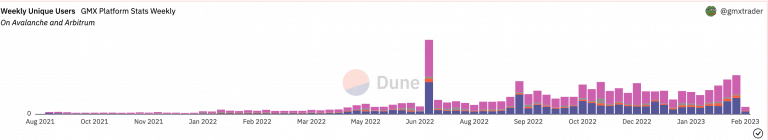

According to data provided by Dune Analytics, the number of weekly unique users signing up for the GMX protocol is increasing. The total number of unique users added to the platform was the result of users’ margin trading, swaps or liquidations.

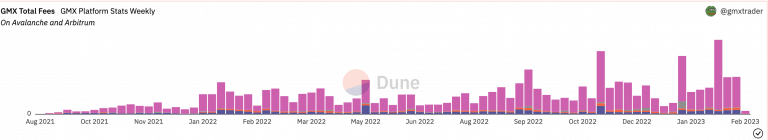

However, despite the increasing number of users on the GMX protocol, the overall fees collected by GMX continued to fall. While the fees from liquidation and clearing transactions remain the same, the fee charged from overdraft transactions on the platform has decreased. Fee from margin transactions fell from $7.65 million to $3.34 million.

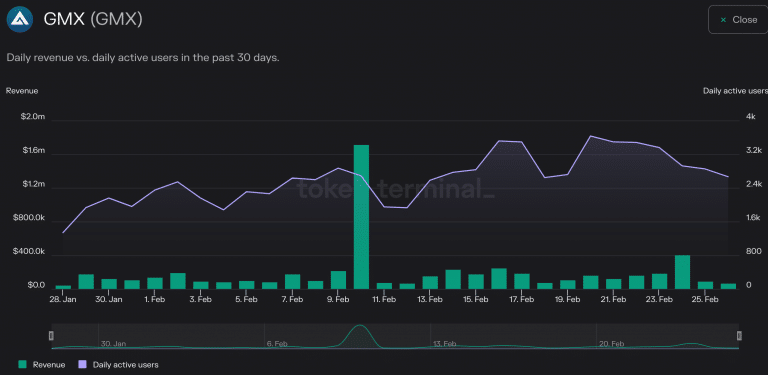

The drop in fees generated also affected the revenue collected by the protocol, which has decreased by 24.5% in the last 24 hours. Additionally, the number of active users on the network decreased by 6.5%, according to Token Terminal. A drop in activity in the protocol can severely impact the token.

Altcoin market spills over Silvergate news

US payments network Silvergate has been in trouble for months, but what happened in March was a confirmation of just how bad the company was. After FTX went bankrupt in November 2022, Silvergate faced massive withdrawal requests. The company is currently selling its assets to meet customer demands. cryptocoin.comIn this article, we have covered the effect of the news on Bitcoin and altcoin market in detail.