Crypto broker Voyager Digital has suspended trading and withdrawals. The incident has raised concerns over whether it is a new LUNA case. After the news was heard in the market, the altcoin price started to decline while other cryptocurrencies were mostly in the green.

A new LUNA case? Altcoin price has fallen!

cryptocoin.com As you can follow from , the crypto market is going through very difficult days. In this environment, some altcoin projects such as LUNA are disappearing into the pages of history. The harsh winter and harsh conditions in the crypto market are pushing projects to make difficult decisions. The LUNA event had a serious impact on the market. Now, investors have started to look at the new developments as well.

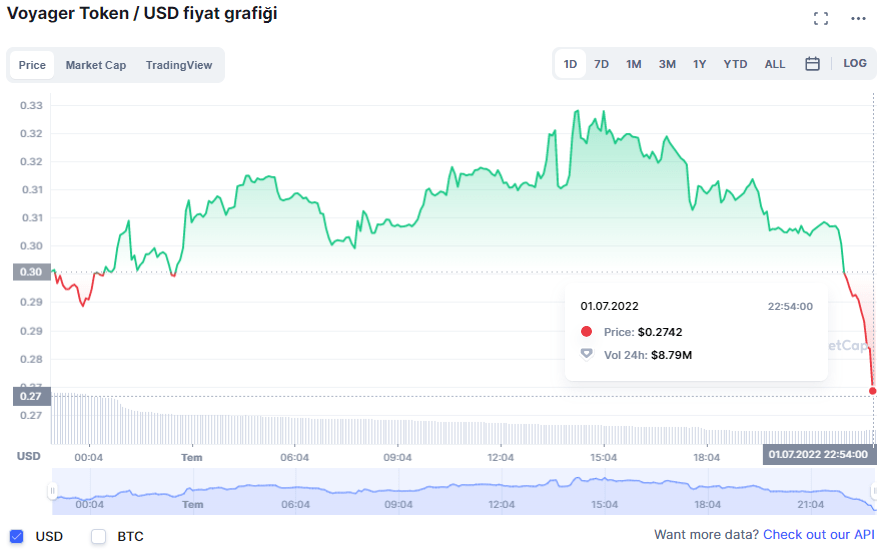

Finally, crypto broker Voyager announced that it is temporarily suspending user transactions. Amid a deepening meltdown in the crypto markets, Voyager Digital Ltd. has temporarily suspended trading, deposits and withdrawals due to challenging market conditions. The impact of the news manifested itself in the altcoin price as the market tried to recover. Voyager Token (VGX) price dropped 7% on a daily basis to $0.2742, according to CoinMarketCap data at press time.

The suspension began at 14:00. It also applies to its loyalty rewards program in New York, Voyager said on Friday. Voyager CEO Stephen Ehrlich made the following statement on the subject:

This was an extremely difficult decision. However, we believe it was the right decision, given the current market conditions. This decision will preserve the value of the Voyager platform. It will also give us additional time to continue exploring strategic alternatives with various interested parties.

Voyager shares also hit hard after the suspension

New York-based Voyager offers crypto trading, staking and yield products. Voyager is among the companies that have been hit amid the drop in Three Arrows Capital Ltd.’s liquidity. He previously received a line of credit from Sam Bankman-Fried’s trading firm Alameda Research.

Voyager dropped as much as 43% in the US sea following the news. This has made it one of the worst performing crypto stocks. Shares of the firm’s main stock exchange in Canada were not trading on Friday due to the Canada Day holiday.

Last month, Voyager issued a notice of default on a loan worth approximately $675 million to Three Arrows Capital. He is actively seeking bailout from his troubled crypto hedge fund, including a court-ordered liquidation process in the British Virgin Islands. Moelis & Co. and Consello Group as financial advisors and Kirkland & Ellis LLP as legal advisors.