Bitcoin (BTC) has exhibited wavy price movements in the last 24 hours. The price exceeded $ 100,000 for a short time, but then fell below this level. This sudden decline shows that uncertainties in the market continue. However, in the long run, stability signals are supported by protecting the positions of mature investors.

New demand in Bitcoin and a different cycle

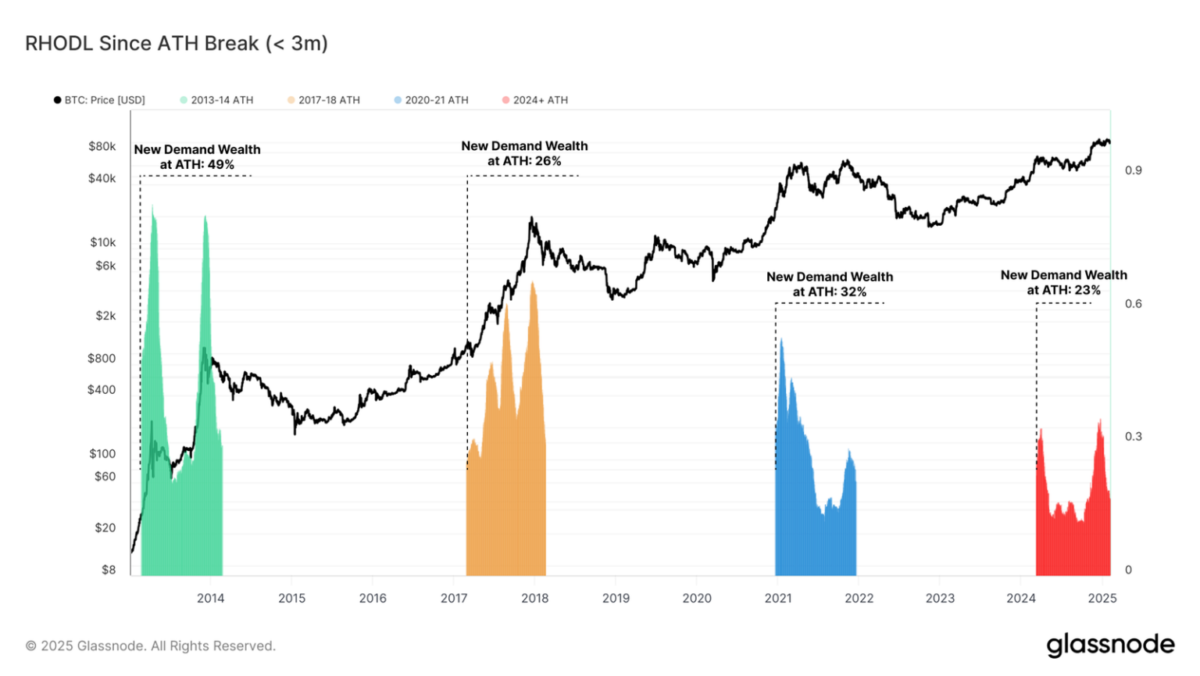

Bitcoin’s Rhodl (Realized Hodl) ratio has been 23 %since the last peak level. Although the new demand in this cycle is significantly stronger, the amount of coins held for more than three months is lower than the previous loops. This shows that the new demand comes in intermittent waves, not continuously.

While the previous market cycles usually end one year after the first summit, the current cycle follows a different path. Bitcoin, which reached a new summit in March 2024, could not catch the demand levels in the previous rally. This deviation creates questions about how the market will be shaped in the future.

Low volatility and controlled market

Bitcoin’s three -month volatility window is below 50 %in this cycle. In past bull runs, this rate ranged from 80 %to 100 %. This decrease in volatility shows that price movements are more structured and the impact of mature investors on the market increases.

The 2023-2025 cycle follows a model where price rally and consolidation periods are progressing in order. This indicates a more controlled bull market, contrary to excessive fluctuations in the previous cycles. This trend can reduce the risk of possible large collapse and create a more balanced market environment.

Critical support and estimates in Bitcoin price

Bitcoin’s short -term appearance remains unclear due to increasing volatility. The current price is quite close to a significant support level of $ 95,869. If this level is lost, the price is at the risk of falling to $ 93.625. Going below this level can increase sales pressure and cause more downward pressure on the price.

On the other hand, a recovery from $ 95,869 can allow Bitcoin to test $ 100,000 again. Breaking this psychological level may invalidate the appearance of fall and indicate the beginning of a new upward trend. Investors should closely monitor support and resistance levels and update their strategies according to market conditions.