An anonymous Shiba Inu whale managed to turn the crisis into an opportunity during the recent market crash, where Bitcoin lost $20,000. The giant investor, who closely follows the agenda, pocketed a profit of $ 4.14 million in just 48 hours.

Shiba Inu whale turns USDC crisis into ‘million dollar’ opportunity

A recent report by Lookonchain shows that a mysterious whale made $4.14 million from its ETH position in the past few days when USDC lost price stability. The same whale managed to sell all its ETH before UST/LUNA collapsed in May of last year.

On-chain data shows that the whale was one of the first Shiba Inu (SHIB) investors, selling all of its SHIBs at the peak of May and October 2021. Whale currently has a portfolio of over $71.72 million and started with just $400,000. “Such smart addresses have never been seen!” Lookonchain said from the whale in the report. he said.

Never seen such smart addresses!

– Made $4.14M by trading $ETH during $USDC depegging!

– Dumped $ETH before UST/LUNA crashed!

– Buy $SHIB early and sell all $SHIB at the May and October 2021 price peaks.

Currently holds over $71.72M (the cost may be only $400K).

1.

🧵Thread— Lookonchain (@lookonchain) March 13, 2023

These transactions brought in a profit of 4.14 million dollars in 48 hours.

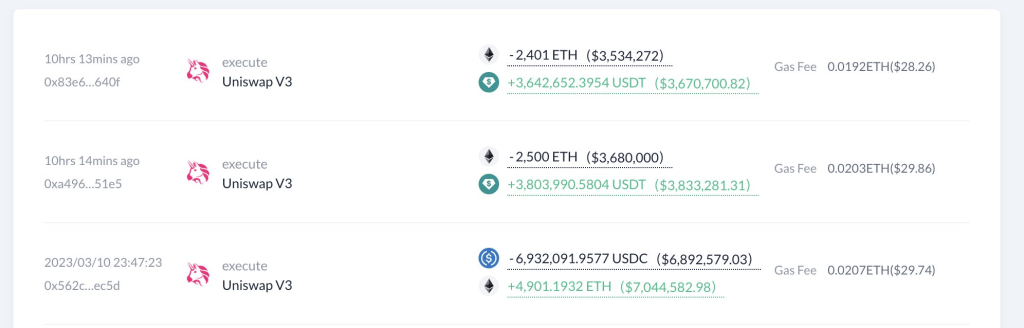

According to the data, 15 wallets (which may belong to the same person) purchased $47,670 ETH at $67.58 million USDC on March 10 at $1,418. He then sold 47,668 ETH at $1,505 for 71.72 million USDT. Whale earned $4.14 million in 2 days on this transaction, with a 6% return on investment.

Meanwhile, it was alleged that these 15 addresses may belong to the same person as they received a large amount of SHIB from the same “0x7617” address on April 21, 2021. This address started buying SHIB very early and bought 5.5 trillion SHIB at a cost of just 180 ETH ($400k) before the SHIB price rose sharply in May 2021. Then, in May and October 2021, he traded all SHIB for 35,000 more ETH through 34 addresses.

Later, on May 6, 2022, these addresses exchanged ETH for USDC. Now, most funds have been converted to USDT and concentrated at 15 addresses. Total funding equates to approximately 71.72 million USDT. Let us remind you that this whale started investing with only $400,000.

What happened at USDC?

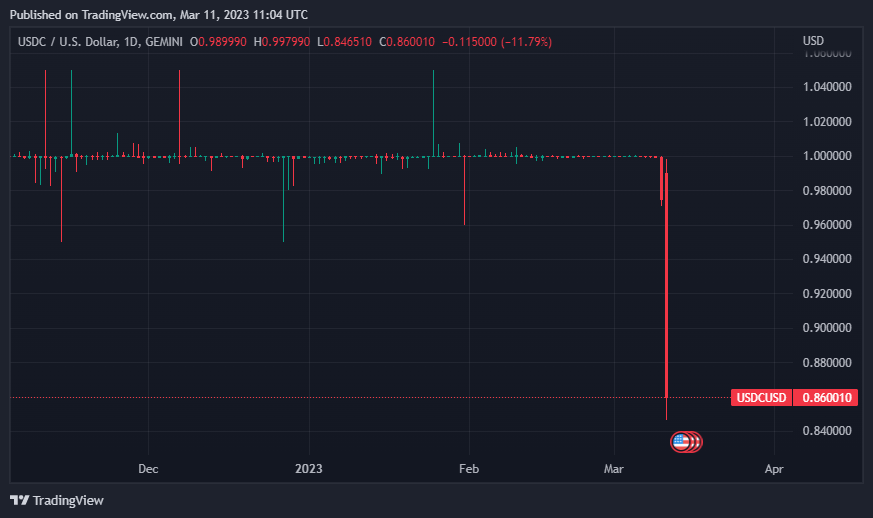

USD Coin (USDC), backed by US-based cryptocurrency firm Circle, tumbled to a record low on the morning of March 11 after the company announced that about 8% of its $40 billion reserve was tied to collapsing lender Silicon Valley Bank. cryptocoin.comIn this article, we have covered all the details of what happened.

Regulators closed the SVB on Friday and confiscated its deposits in what became the largest US banking bankruptcy since the 2008 financial crisis. The company’s spectacular collapse began late Wednesday when it surprised investors with the news that it had to raise $2.25 billion to support its balance sheet. USDC, which lost its stability in a short time, witnessed the transfers of names such as Vitalik Buterin.