Proof-of-reserve tracking services are on the rise to increase transparency for crypto participants.

In the wake of FTX’s liquidity crisis in the past weeks, crypto exchanges have begun to share proofs of reserve to reassure their investors. Considering the need for transparency, exchanges created a trend by sharing their assets. CoinMarketCapand CoinGecko names such as these made the reserves of the stock exchanges participating in this trend traceable. In addition, exchanges offered services to track their own reserves.

Proof of Reserve Tracking Services Expands

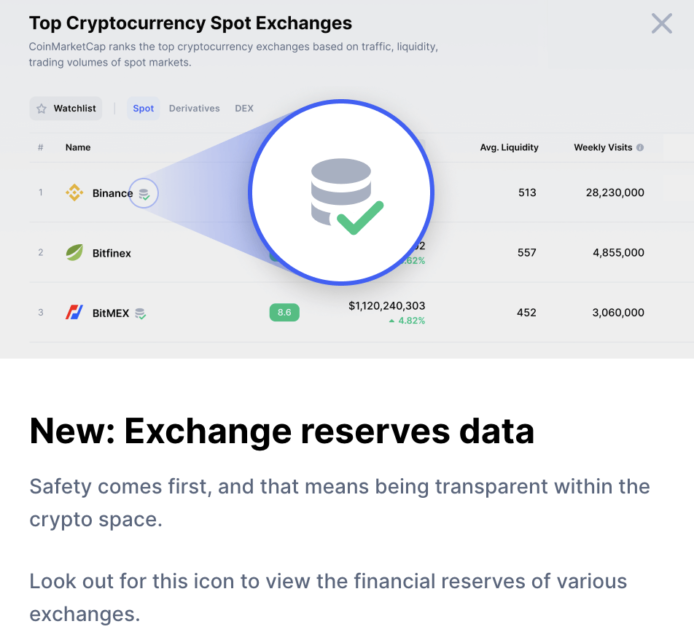

Crypto price monitoring site CoinMarketCap (CMC) and CoinGecko have introduced a feature where the reserves of centralized crypto exchanges can be tracked to increase transparency for crypto investors.

The proof of reserve tracker provides information on the addresses, balance and value of assets in wallets related to the type of tokens in which the reserves are held. The full value of the reserves is calculated along with the percentage breakdown of the various assets held in reserve by the exchange.

CMC , receives data from Nansen, DefiLlama and the exchanges’ own websites. It also aims to update information every five minutes. The data is currently Binance, KuCoinand BitfinexAvailable for seven centralized crypto exchanges, including

On the crypto exchange side, the first step came from Phemex. The crypto exchange has revealed its new service, where its users can check their assets and the stock’s proof of reserve.

With the Proof of Reserve system of the exchange, which is a live screen, users can instantly check both their own assets and Phemex’s assets whenever they want.