Federal Reserve Chairman Jerome Powell stated that he will continue with his aggressive monetary policy to reduce inflation. This reduced the appeal of the zero-yield yellow metal. Also, gold prices hit a one-month low on Monday as the dollar boosted. Analysts interpret the market and share their forecasts.

“The momentum of gold has dropped”

Spot gold fell to $1,720.2 on the day, hitting a one-month low. Later, the rebounding precious metal rose 0.10% to $1,740 at the time of writing. U.S. gold futures were trading at $1,752.6, up 0.15%.

cryptocoin.com As you follow, the dollar index (DXY) has reached its highest level in 20 years. It made dollar-priced bullion more expensive for buyers of other currencies. City Index senior market analyst Matt Simpson says gold’s momentum is falling. The analyst notes that although there will be a safe-haven flow at some point, investors are currently focusing on high interest rates.

“Gold probably heading towards $1,700”

Fed Chairman Jerome Powell said at the Jackson Hole central banking conference on Friday that the Fed will raise rates as needed. He also noted that he would keep them there “for a while” to keep inflation down. In addition, he warned households and businesses that “it will be a bit of a pain”.

Isabel Schnabel, a member of the board of directors of the European Central Bank, reiterated the stance of the Fed chair. In this context, she said that central banks should act strongly to fight inflation even if it drags their economies into recession. Matt Simpson comments:

Gold is likely heading towards $1,700. It also has room to go for up to $1,680. It is possible for some buyers to step around the $1,680 level to support the market and return to $1,750.

“Gold will be subject to downward price pressures”

Gold price extends previous sales. Fed Chairman Powell’s hawkish speech is expected to weigh on the yellow metal, according to TD Securities strategists. Strategists say there are growing expectations that the Fed will continue to follow a hawkish trajectory through 2023. They note that this prompted money managers to aggressively reduce their gold positions. In this context, strategists make the following statement:

The Fed pointed to significantly higher interest rates for longer. Therefore, the lack of upside potential also convinced investors to reduce long-term risks. Considering Jerome Powell’s hawkish style in Jackson Hole, we anticipate that the decline in gold positions and downward price pressures will continue.

“Precious metal may fall to $1,700”

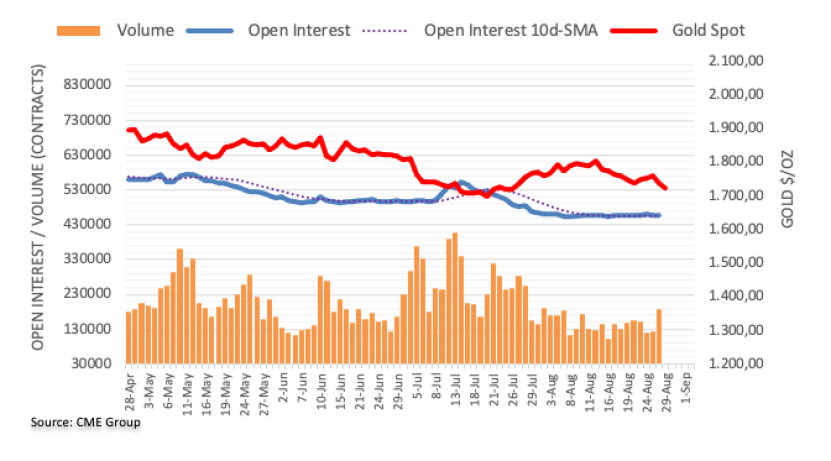

Open interest on gold futures markets continued its upward trend. According to preliminary data from CME Group, nearly 1.2 thousand contracts were up at the end of last week. Volume followed suit. Accordingly, this time it rose for the second consecutive session with approximately 63 thousand contracts.

Market analyst Pablo Piovano notes that gold prices declined sharply on Friday amid rising open interest and volume. Therefore, he says, it opens the door to more losses in the very near term. However, there is an initial support at $1,711 ahead of a possible visit to the $1,700 round level.