Gold prices benefited from weakness in the broad-based US dollar. Thus, the yellow metal gained about 2% last week, although it failed to close above $1,800. There will be no high-impact data releases from the US next week. Therefore, investors will closely follow the coronavirus-related headlines from China. It will also evaluate the technical developments of gold for new direction clues.

Powell spoke, gold prices rose

The negative change witnessed in risk sentiment helped the US dollar gain strength on Monday. This caused gold to decline towards $1,740. China continued to report record daily high coronavirus cases over the weekend. In addition, PMI data showed that business activity in the manufacturing and services sectors contracted in November. This has rekindled concerns about a global economic downturn.

There has been renewed optimism that China will continue to move away from its zero Covid policy. This made investors hopeful about the recovery in gold demand. Gold prices stopped the two-day bearish streak and closed modestly higher around $1,750.

cryptocoin.com As you can follow, the US Dollar came under heavy selling pressure on Wednesday. Thus, gold prices rose more than 1% on a daily basis. FOMC Chairman Jerome Powell made his final statements on December 3 before the start of the Fed’s blackout period. Powell agreed that it would make sense to slow the pace of rate hikes. Following Powell’s dovish comments, the probability of a 50bps rate hike by CME Group FedWatch Tool in December rose to 80% from 66% before the event. As a result, the 10-year U.S. Treasury bond yield fell nearly 4%. This provided extra support for the negatively correlated gold.

NFP report hits as US supports PCE and PMI gold

Dollar sales picked up on Thursday. As a result, gold prices rose above $1,800 for the first time in nearly five months. The US Bureau of Economic Analysis reported that the Personal Consumption Expenditure (PCE) Price Index fell to 6% in October from 6.3% in September on an annual basis. This data came below the market expectation of 6.2%. Hence, it allowed investors to continue pricing a Fed pivot. Also, other data from the US revealed that the ISM Manufacturing PMI fell from 50.2 in October to 49 in November. More importantly, the Price Paid Index declined from 46.6 to 43, indicating the slowdown in industry input price inflation.

However, the US dollar managed to show a recovery ahead of the weekend. Thus, it forced gold to erase some of its weekly gains. The U.S. Bureau of Labor Statistics reported that Non-Farm Employment rose 263,000 in November, compared to the market forecast of 200,000. In addition, annual wage inflation rose from 4.9% to 5.1%. The 10-year U.S. T-bond yield rose sharply on the upbeat jobs report. This caused the gold price to fall below $1,790 in the second half of Friday.

“It is possible that this situation will put pressure on gold prices”

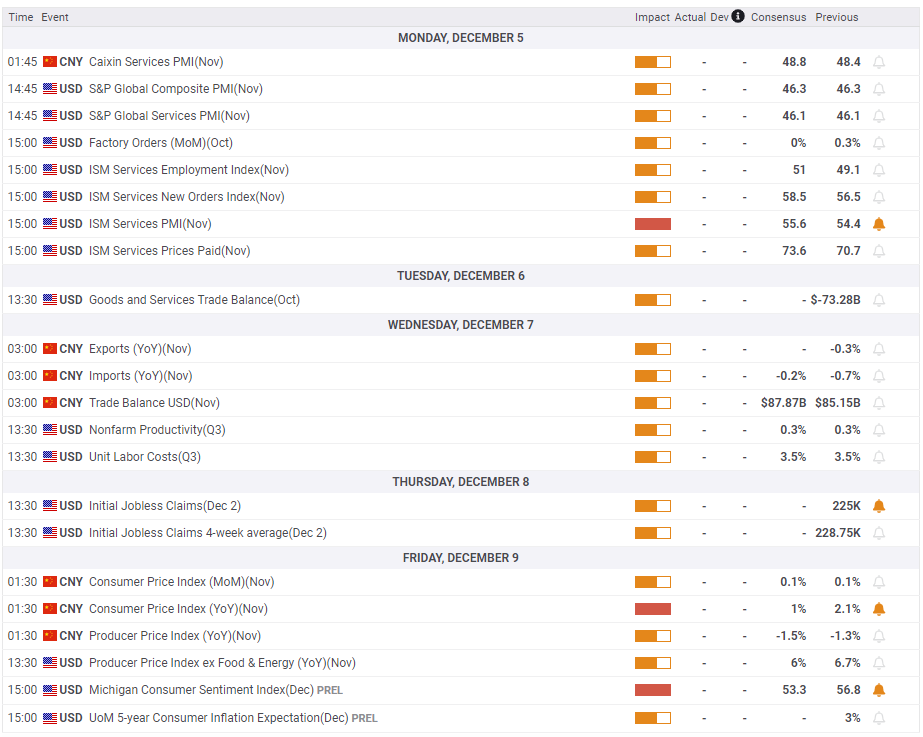

The ISM Services PMI report will appear on the US economic chart on Monday. Expectations are that the Price Paid Index will rise from 70.7 in October to 73.6 in November. According to ISM Market analyst Eren Şengezer, the market response to the Manufacturing PMI indicates that if the inflation component falls in November, the US dollar is likely to weaken against its rivals. The analyst further explains:

On the other hand, the rise in the Price Paid Index, coupled with a headline PMI of around 55 as expected, could help the dollar find demand and put pressure on gold.

US Consumer Sentiment and China’s Covid updates to follow

The University of Michigan will release its December Consumer Sentiment Survey on Friday. Forecasts are that consumer confidence in the US will continue to weaken. However, investors are likely to react to the long-term inflation expectation data, which was 3% in November. According to the analyst, an increase in this component could support the US dollar and hurt the gold price. Naturally, the opposite is also true.

In the absence of other noteworthy macroeconomic data releases, market participants will closely monitor developments surrounding China’s zero Covid policy. According to the analyst, if Chinese leaders decide to ease coronavirus restrictions and take measures to boost economic activity, the gold price is likely to rise sharply in 2023 with rising expectations for a strong demand recovery.

Gold prices technical view

Market analyst Eren Şengezer draws attention to the following levels in the technical outlook of gold. Despite Friday’s decline, gold prices remain on the uptrend. Also, on the daily chart, the Relative Strength index (RSI) indicator is holding comfortably above 50.

On the upside, $1,800 is aligned as an important pivot level. Once gold stabilizes above this level using it as support, it is possible to target $1,830 and $1,860 afterward. If the gold price drops below $1,780 and fails to regain that level, sellers are likely to show interest. Also, it is likely to pull gold towards $1,740 and $1,720.

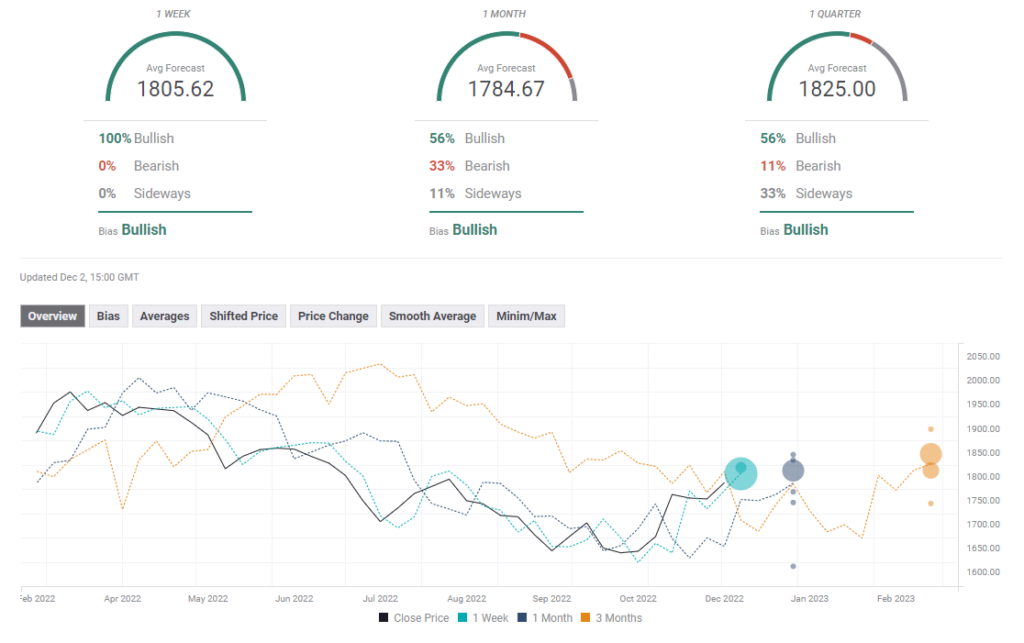

Gold price prediction survey

Experts participating in the FXStreet survey predict that the gold price will continue to rise in the short term. They also expect the average one-week target to remain at $1,805. Meanwhile, there is a slight uptrend in the one-month outlook. However, the average target is $1,784.