Markets managed to escape a “shock” from the main macro event of the week. In this environment, Bitcoin is holding firm around $29,000.

PCE offers “nothing to shock”

Data from TradingView shows BTC fluctuating around $29,000 on Bitstamp. cryptocoin.com As you can follow, the US Personal Consumption Expenditure (PCE) Index data, which is the macro event of the week, was generally in line with the figures that the markets have already priced. So it failed to provide a performance catalyst for Bitcoin. Finance commentator Tedtalksmacro comments:

The trend is our friend, but for now, the core is sticky. It has been hovering at 4.6% since December. The latest figures showed that there is nothing to shock the market in general.

US stocks saw little movement at the open. Binance order book data for Bitcoin showed modest bid liquidity moving towards the spot price. Naturally, this compressed potential volatility.

Here's how the #BTC order book is setup ahead of the report. #FireCharts pic.twitter.com/7sCpVP5mKU

— Material Indicators (@MI_Algos) April 28, 2023

Attention is increasingly focused on the macro events of the week ahead. Chief among these is the Federal Reserve’s interest rate decision. Financial commentary resource The Kobeissi Letter provides an assessment of the issue. In this context, according to the analyst, the already strong possibility of a rate hike gained momentum with the PCE data. In part of his Twitter analysis, he highlights the following:

Interestingly, the probability of a 25bps rate hike in June rises to 28%. However, at least 2 rate cuts are expected this year. The Fed still hasn’t said it supports any rate cuts this year. Next week is going to be huge.

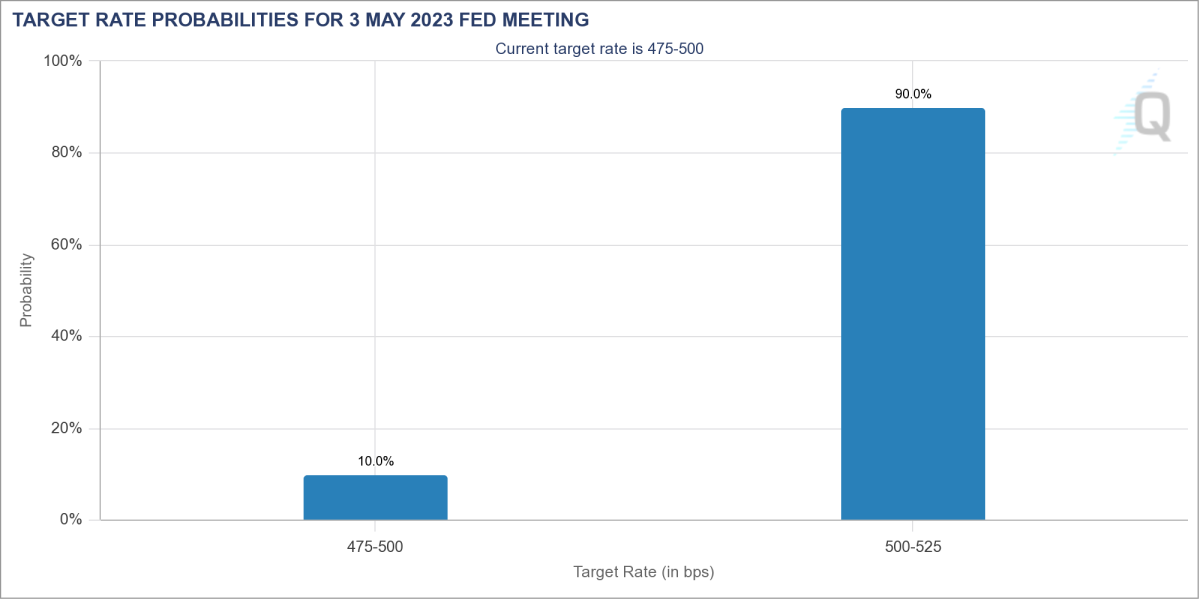

According to CME Group’s FedWatch Tool, a 0.25% rate hike is 90% likely at the time of writing, a 5% increase from the previous day.

Fed target rate probabilities graph / Source: CME Group

Fed target rate probabilities graph / Source: CME GroupBitcoin price strengthens short-term range

Meanwhile, there is little certainty in Bitcoin price action. Therefore, traders focused on the long-term trend. Analyst Jelle is already confident that big drops will be avoided. Therefore, the analyst pointed to the new trading range with a possible “slow bleeding” for BTC just below the $29,000 mark.

#Bitcoin is establishing a new range here – seems like volatility will come down in the coming days.

Slow bleed towards 28.7 makes sense.

No need to get euphoric or scared, consolidation is a necessary part of market movement.

The long-term direction remains up, be patient. pic.twitter.com/rwil38uRkP

— Jelle (@CryptoJelleNL) April 28, 2023

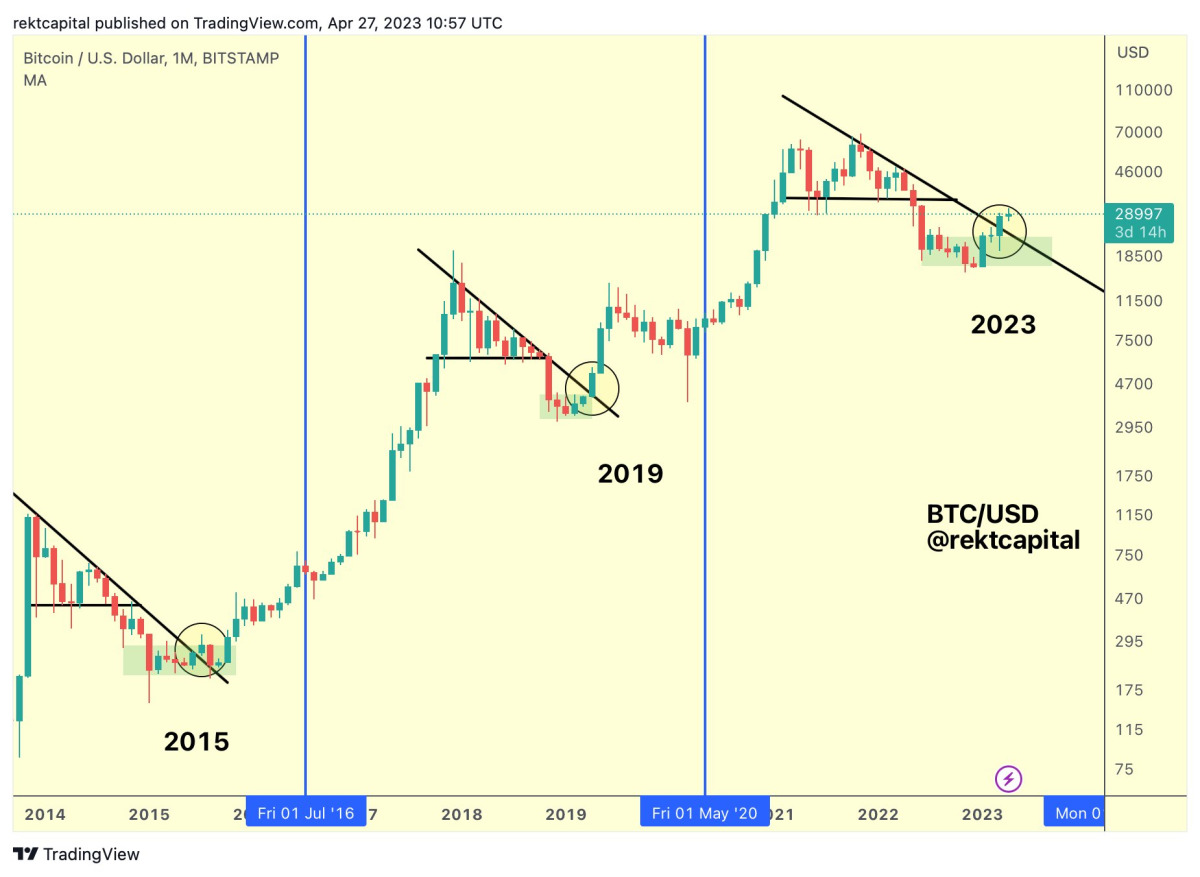

Meanwhile, popular trader and analyst Rekt Capital is zooming in further, considering a potential repeat of historical bullish trends to confirm last year’s downtrend is over. Based on this, the analyst says:

Bitcoin (BTC) has already broken the downtrend. Now it’s all about maintaining the new uptrend. The real question is whether a retest is needed. However, history shows that the medium and long-term outlook is bullish.

Bitcoin (BTC) price explanatory chart / Source Rekt Capital/Twitter

Bitcoin (BTC) price explanatory chart / Source Rekt Capital/Twitter