Solana (Left) is struggling to protect the $ 200 level on Tuesday, February 4. The market value increased over 100 billion dollars again, but the transaction volume decreased by 40 %to $ 8.9 billion.

Despite this recovery, the price movement remains uncertain. Solana’s exceeding $ 222.8 resistance in the coming days or going below $ 191.69 support is among the critical factors that will determine the direction of the price.

Solana whales accumulate again

In the Solana network, the number of whale addresses, which hold at least 10,000 go to 5,120, rose to 5,120. This number was 5,096 4 days ago and remains slightly below the 5,167 address, which is the highest level of all time recorded on January 25th.

This increase shows that large investors are still interested in Solana and potentially contribute to the stability of the price. In particular, the rapid increase, which started at the level of 5.054 on January 17, indicates that large players have returned to the market.

Following whale movements is important in terms of understanding left price trends. Because the accumulation of major investors may be a sign of an upward acceleration in the market.

The risk of decrease is decreasing

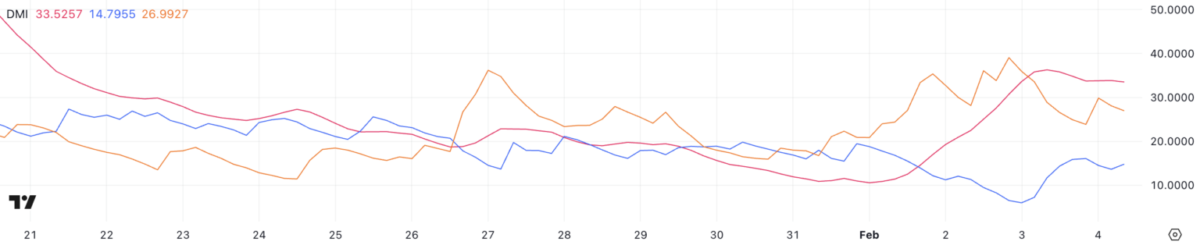

Solana’s DMI (directional movement index) graph shows that the ADX indicator rises from 10.5 to 33.5. ADX, rising up to 36.2 yesterday, shows that a strong trend is currently developing, but its direction is still not clear.

- Since ADX is over 25, the market has a train on a train, but it is unclear whether this trend is up or down.

- The value of the positive DI (Directional Indicator) rose to 14.7, while the negative DI fell from 39 to 26.99. This shows that sales pressure is reduced, but the purchasing power is still weak.

If +DI, if it rises on the -Di, it may be a signal that the upward trend has begun. However, the market continues to be indecisive for the time being.

Can solana stay above $ 200?

Currently, the left price is stuck between $ 222.8 resistance and $ 191 support. Short -term moving averages continue to remain under long -term averages.

- If the left can exceed $ 222.8, it can rise to $ 244.99 and test the $ 271 level with a strong rally.

- However, if the price falls below $ 191.69, it can be withdrawn to $ 181.91 and then to $ 168.77.

For the time being, indecision in the market prevails, but whale accumulation and decreasing sales pressure are among the factors that increase the potential of rise.