In the last 24 hours, large -scale pepe operations increased from 8 trillion to 31.9 trillion. However, the main reason for this increase was sales pressure.

Pepe whales sold 190 billion token

Pepe whales sold 190 billion token within 24 hours after the price approached the lowest level of three months. However, Pepe, despite the negative market conditions, gained 7 %and signaled a recovery signal.

In general, the breast coin market continues to pressure with the last wave of decrease. The total market value of the breast coins decreased by about 1.2 %to $ 79 billion. However, Pepe increased by 7 %in the last 24 hours to 0.0000099 dollars. However, the loss of interest in whales can make a long -term rise difficult.

Whale sales can prevent Pepe from the rise

According to Intothheblock data, large transactions exceeding $ 100,000 in 24 hours increased fourfold to 8 trillion to 31.9 trillion. However, the main reason for this increase was sales.

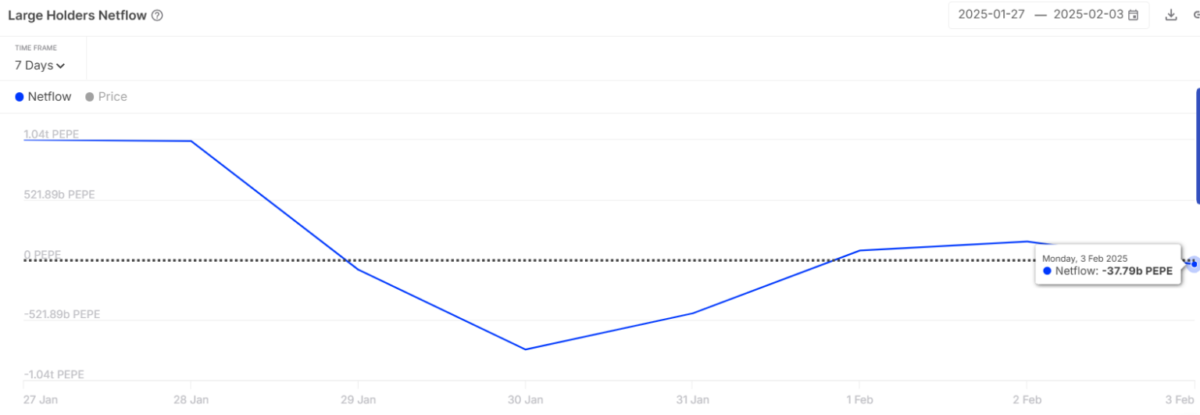

The net flow of whale accounts fell from 159 billion to -37 billion, which shows that 196 billion pepes were sold.

Sales of major investors usually indicate that investor confidence is reduced and pressure on the price may occur.

Currently, whales hold 48 %of Pepe supply. If these addresses continue to sell, a downward pressure may occur on the price.

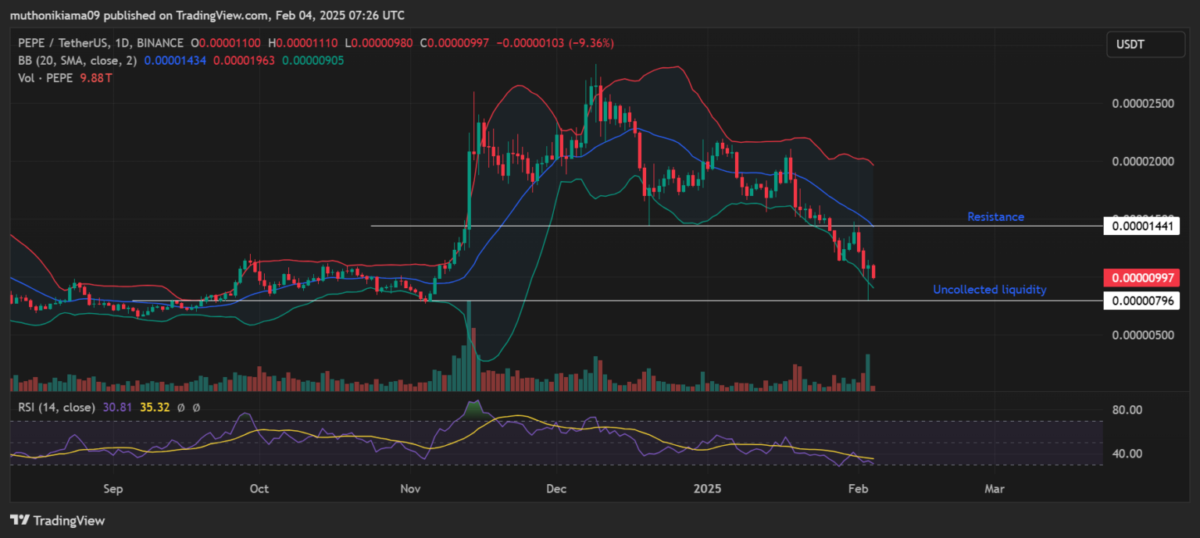

Pepe critical support and resistance levels

Pepe’s price movement is still under the control of the sellers and the relative power index (RSI) has declined to 30. The RSI line confirms that the market momentum is still tending to decrease by watching under the signal line.

If the Pepe loses $ 0.00000906 in the lower Bollinger band, it may drop to the next liquidity zone to $ 0.00000796.

In contrast, if the bulls allow Pepe to exceed $ 0.000014 dollars, a strong upward trend may begin. Investors should follow the RSI line changing direction and the rise above the signal line. This may indicate that the procurement pressure increases and the price can move upward.

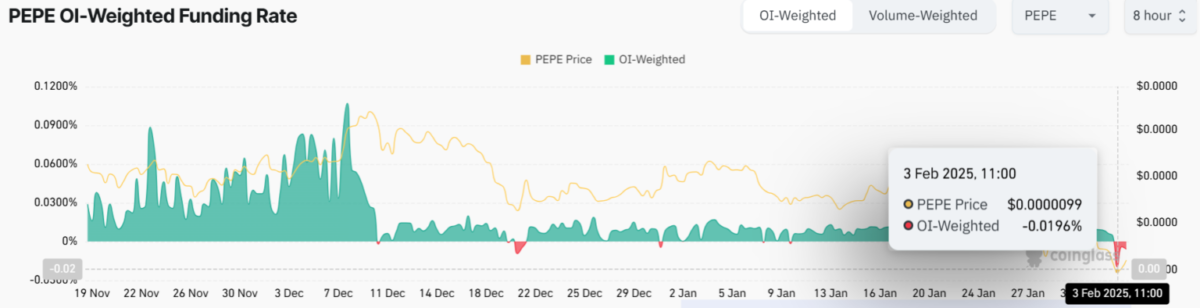

Short positions dominate the market

The expectation of decrease in Pepe is felt both in the spot market and in futures. According to Coings data, Open Interest increased by 6 %in the last 24 hours to $ 268 million. However, most of these positions consist of short (Short) operations.

For the last two days, Pepe’s funding rates have been negative, which shows that the demand for short positions is high.

In addition, the long/short ratio (Long/Short Ratio) decreases to 0.95, revealing that more investors have opened a decline in Pepe.

In general, the market thinks that Pepe will lose value. However, if a sudden rise is experienced, the open shorts positions may necessarily close, which may lead to the rapid movement of the price.