The price of Ethereum has lost critical $ 2,800 support, and analysts warn that the decline trend may deepen. While the volatility in the market increases, the accumulation of ETH of major investors (whales) is remarkable.

What will happen if Ethereum does not exceed $ 2,800?

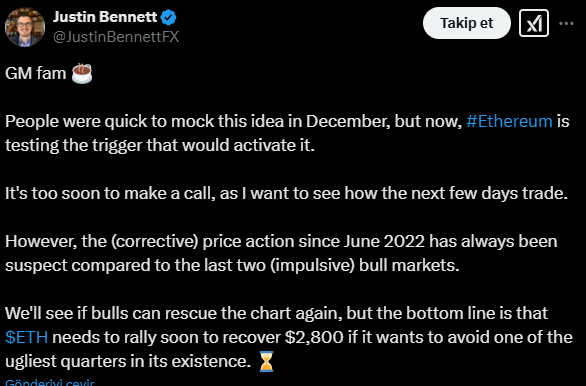

Crypto analyst Justin Bennett says Ethereum should quickly recover the $ 2,800 level to maintain its current market structure. According to the analysis, Ethereum price movements have focused on the correction stages since June 2022, and the strong rise acceleration seen in the previous bull markets was missing.

Bennett emphasizes that if the price falls below the existing trend line, Ethereum can survive one of the worst quarters. If the bulls cannot reclaim this level, the sales pressure may increase and the downward movement may accelerate.

Ethereum whales see fall as an opportunity

The last decline in the price of Ethereum, while creating serious fluctuations in the market, it is seen that large investors have accumulated ETH. The investor group, known as “7 Siblings ,, acquired a large amount of Ethereum at low prices. This shows that investors who want to turn the fall into an opportunity believe Ethereum can recover in the future.

What happens if the $ 2,800 level cannot be passed?

Analysts say that Ethereum should exceed $ 2,800 key resistance to continue the rise trend. If it is above this level, a new wave of strengthening in the crypto market may start and give reassuring investors.

However, if Ethereum does not exceed this level, a long -term period of weakness may be experienced. If the price goes below the current support, the sales pressure may increase and may deals with bears control.

Bennett compares Ethereum’s latest price movements with past market cycles and emphasizes that a strong upward movement has been missing since 2022. The fact that the rapid and strong rise in the previous bull markets is not experienced this time makes long -term investors anxious.

Uncertainty in the market

Technical analysis indicators show that Ethereum is at a critical point and that price movements in the coming days will be decisive. The “Bull Bear Power” indicator reveals that the power of bears has started to decrease and gives signals of a potential recovery.

Ethereum, after falling to $ 2,200 during the day, recovered and rose to $ 2,728. Although a decrease of 8 %on a daily basis, the transaction volume increased by 162 %and reached $ 93.77 billion. This shows that the market still has high investor interest.

The fact that Ethereum approached $ 2,800 in the coming days can be a new direction decisive in the market. If this level of resistance is exceeded, a stronger rise period may begin for investors. However, a unsuccessful test may increase new decreases in Ethereum price by increasing sales pressure.