Gold prices gained more than 2% during the week. However, it later reversed its direction. Gold lost weekly despite an impressive rally following the Federal Reserve’s policy announcements.

“Gold prices are at the mercy of US interest rates”

US Treasury bond yields fell sharply in the second half of the week. This, in turn, allowed gold to gain traction. As you follow on Kriptokoin.com , the FOMC increased the policy rate by 75 basis points. With the initial reaction to this decision, the benchmark 10-year US Treasury bond yield rose above 3.4%.

At the press conference, however, Powell chose to stay away from a 75 basis point increase in July. This statement caused yields to drop sharply. The Swiss National Bank, meanwhile, made an unexpected rate hike Thursday. The Bank of England followed suit with a 25 basis point rate hike. These developments caused the market to shift towards European bonds. Against this backdrop, the 10-year US rate extended its decline before settling at 3.2% on Friday.

The US Dollar Index hit its highest level in more than two decades at 105.78 on Wednesday. But it wiped out most of its weekly earnings. The Swiss franc and Japanese yen became safe-haven assets. Despite the risk-averse market environment, the dollar failed to gather strength. Market analyst Eren Sengezer makes the following assessment:

Renewed dollar weakness helped gold maintain its bullish momentum on Thursday.

“In this scenario, gold is likely to come under renewed bearish pressure”

Fed Chairman Powell will present his semi-annual monetary policy report to the Senate Banking Committee on Wednesday. In addition, Powell will answer questions after giving his keynote speech. According to the CME Group FedWatch Tool, markets are currently pricing in a 75 basis point rate hike in July with an 88.5% probability. The analyst interprets the issue as follows:

Powell is likely to revive expectations for a 50 basis point increase at the next meeting. The market position then shows that there is room for US interest rates to fall. On the other hand, even if Powell approves of a 75 basis point increase, another decisive rally in US interest rates may be difficult.

According to the analyst, it is possible that gold prices will also be affected by next week’s PMI reports. Major central banks continue to tighten their policies. And investors are increasingly worried about a global recession.

PMI data from the Eurozone and Germany are likely to point to a loss of growth momentum in the private sector. It is possible, then, that market participants may see it as a reminder of the widening policy gap between the European Central Bank (ECB) and the Fed. In this scenario, the analyst sees gold likely to come under renewed bearish pressure.

Gold prices technical view

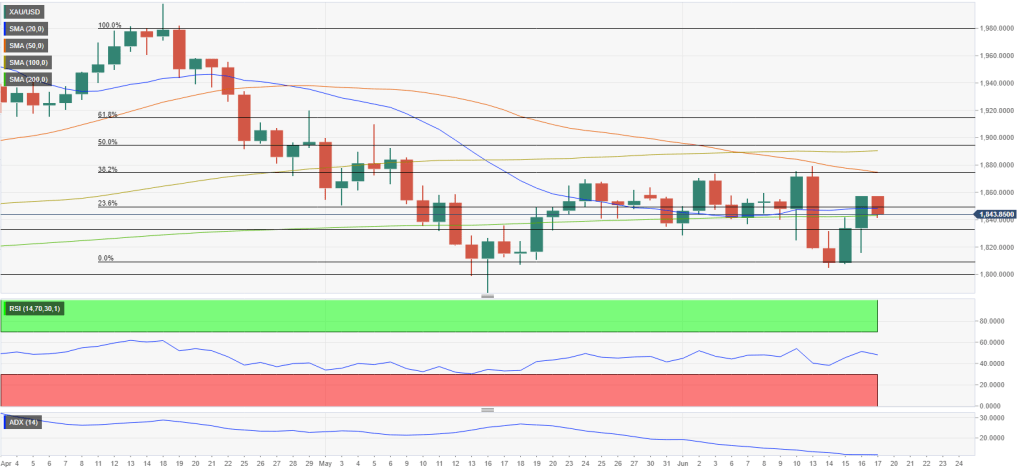

Then market analyst Eren Sengezer looks at the technical picture of gold and analyzes it. The short-term technical outlook does not provide a clear direction clue. However, sellers are likely to stay on the sidelines as long as gold manages to stay above the 200-day SMA currently at $1,840. FOMC Chairman Jerome Powell has two days of testimony in the US Senate next week. His comments during these conversations will be the next major catalyst.

Gold prices lost their upward momentum on Friday. The 23.6% retracement level of the latest downtrend Fibonacci and the 20-day SMA form the initial resistance at $1,850. If gold starts using this level as support, it is likely to target $1,875 (50-day SMA, Fibonacci 38.2% retracement) and $1,890 (100-day SMA).

On the downside, a daily close below $1,840 (200-day SMA) could be seen as a bearish break and bring sellers. In this scenario, temporary support is aligned with $1,830 (static level) ahead of $1,810 (static level) and $1,800 (psychological level).

Meanwhile, the Relative Strength Index (RSI) on the daily chart is just below 50. This reflects the indecision of gold in the short term. Similarly, the Average Directional Index (ADX) indicator is currently at its weakest level since the beginning of February 12.