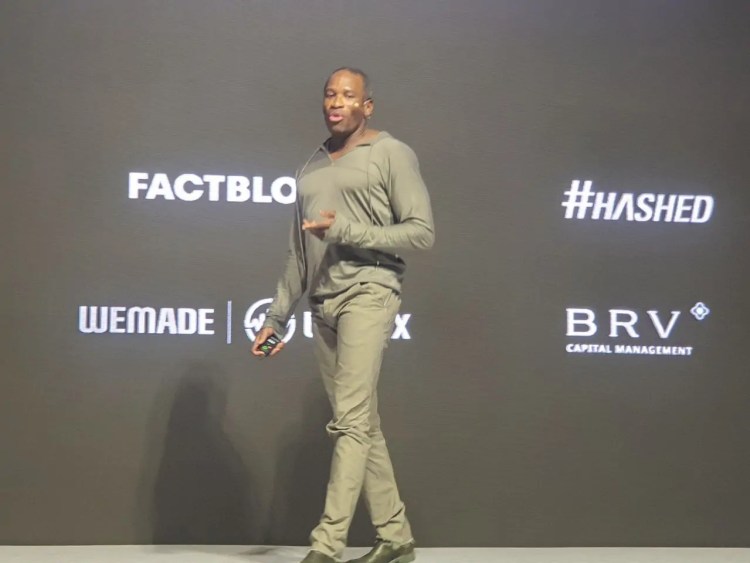

Bitcoin (BTC) has had an impressive rise over the past six months and its price is currently at $25,712. While many speculate about the reasons behind this steady rise, BitMEX co-founder and former CEO Arthur Hayes has a unique perspective. In his keynote speech at Korea Blockchain Week, Hayes argued that the catalyst for Bitcoin’s upward journey can be attributed to a series of events unfolding in March, particularly the Fed’s response to turmoil in the banking system. Here are the details…

Bitcoin forecaster attends conference

In his keynote speech at Korea Blockchain Week on September 5, Hayes argued that Bitcoin’s bull run began on March 10, the day Silicon Valley Bank (SVB) was taken over by the Federal Deposit Insurance Corporation. Silvergate Bank went into liquidation in March, followed by the forced shutdown of Signature Bank on March 12 due to regulatory pressures. These events shook the financial industry, leading the Fed to establish the Bank Term Funding Program (BTFP). Within the scope of this program, banks were offered loans with a maturity of up to one year in return for showing “qualified assets” as collateral.

Essentially, the Fed acted as a boost to stabilize the banking system by accepting distressed bonds in exchange for fresh dollars. Since then, the price of Bitcoin has increased by about 26%, and Hayes believes this is the true beginning of the current bull market. “We basically abandoned this whole front where we care about the value of the dollar and the value of any fiat currency,” Hayes said. This shift in perception has led investors to explore fixed-supply assets like Bitcoin.

The crypto industry is in a good position

Hayes claimed that this is pushing investors to consider fixed-supply assets like Bitcoin. However, the rest of the market has yet to respond. But he gave a six to 12 month timeline for the bull market to be noticed. Hayes said that even if the Fed and other central banks continue to raise interest rates or “print more money” to provide economic tightening, Bitcoin will still perform well.

Interestingly, while Bitcoin is making significant gains, Hayes predicts it will take some time for the broader market to fully respond to these economic changes. It offered a six to twelve month timeline for the rest of the market to keep up with this process. Hayes expressed confidence in Bitcoin’s resilience even as the Fed and other central banks continue to raise interest rates or “print more money”. .

AI, IPOs and token unlocks are critical

In a parallel analysis of the current economic landscape, Hayes also pointed out that traditional economic models are facing deterioration. The FED’s aggressive rate hikes to fight inflation had unexpected results. Rising financial asset prices can increase capital gains taxes and government revenue. Still, when the Fed raises interest rates, these prices could stagnate, reducing tax revenues and causing deficits to rise. This, combined with political austerity measures, results in the US Treasury issuing more bonds. Hayes argues that this cycle paradoxically fuels economic growth, as interest payments to the rich stimulate spending and nominal GDP growth.

While Hayes continues to advocate for cryptocurrencies, he believes the cryptocurrency industry, including AI-focused companies, is well-positioned to thrive amid these changing economic landscapes. With substantial cash reserves and solid revenue streams, AI companies are less dependent on traditional banks for loans or credit, making them attractive investments. However, Hayes also warned of potential risks in the AI industry, such as overvaluation, long timelines for IPOs, and token lock-in times. He said that the combination of the three crazes (artificial intelligence, crypto and money printing) could lead to a significant asset bubble.