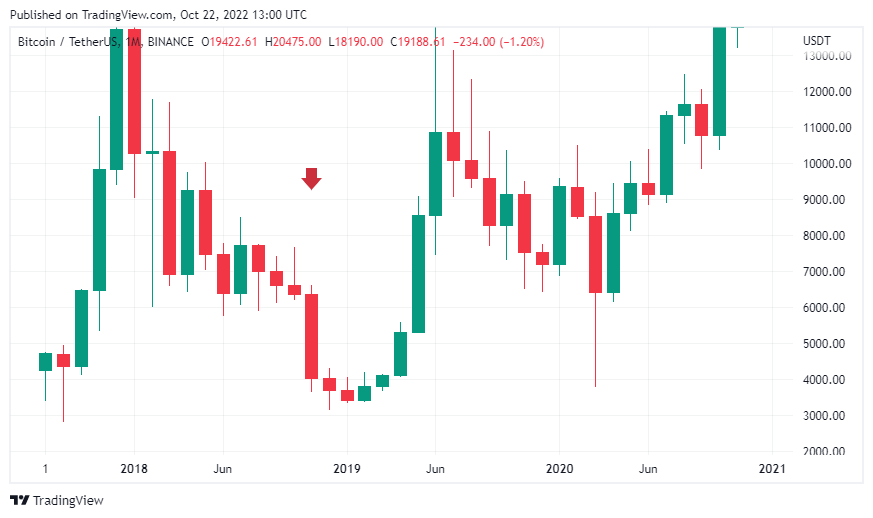

Experts are nervous about a possible “November 2018” scenario. If history repeats itself, Bitcoin (BTC) faces another 50% drop.

Could Bitcoin drop another 50%?

The macroeconomic environment is causing the Bitcoin price to struggle under difficult conditions. Now, many experts predict that the market will crash again in November 2018. Bitcoin broke the $19,000 resistance again after falling to $18,845.59 amid these fears. Michael van de Poppe, CEO of Eight Global and well-known analyst, states that Bitcoin is in the November 2018 phase.

Bitcoin had experienced a drop of about 37% on this date. It wiped $70 billion from its market value in a very short time. In the last days of November 2018, its loss reached 50%. Analysts are worried that the negative scenario for Bitcoin price may now reoccur.

Many analysts, including Florian Grummes, predict that Bitcoin will drop to $10,000. In the worst case, he worries that BTC could potentially drop to $6,000.

Why is Bitcoin stagnant?

Falcon macroeconomic conditions are one of the main reasons for the Bitcoin price drop. Central banks continue to raise interest rates due to rising inflation. The war between Russia and Ukraine exacerbates the situation. In addition, the Organization of the Petroleum Exporting Countries decided to cut the supply in order to raise oil prices. The Biden administration claims that OPEC+ made its decision because of its support for Russia. According to reports, OPEC’s decision may cause global oil prices to rise even more.

Also, the US Consumer Price Index showed economic inflation of 8%. The Fed thinks that a highly restrictive monetary policy will be necessary to keep inflation under control until 2024. However, the Fed is currently unsuccessful in its fight against inflation. The rate hike four times in a row did not yield any results. As a result, recession fears also negatively affect the cryptocurrency market.

How likely is a fall?

Analysts have different perspectives on what BTC will do next. Some say we’ve been in a bear market for 124 days since BTC traded at $30,000, despite on-chain data saying otherwise. As a result, according to the 50% rule, BTC could bottom at $15,000 before experiencing a strong bull market.

Meanwhile, the team of analysts at Messari reported some interesting market observations. For example, Bitcoin may be dropping its correlation with the S&P500. Second, while Bitcoin’s price action has been sideways since the last week of September, it has continued to gain strength.

1/ Despite the greater macro volatility #Bitcoin's volatility is at its lowest levels in over two years.

Could Bitcoin finally be decoupling from the greater market? 🧵 pic.twitter.com/GgsrXkaQia

— Messari (@MessariCrypto) October 19, 2022

Messari analysis also looked at Bitcoin’s unusually low volatility. Bitcoin has extremely volatile price movements. That’s why his latest performance is unusual. Low volatility could be a sign that the bears are losing their strength. These observations highlight a ‘quiet before the storm’ type of situation. However, cryptocoin.comAnalysts like Mike McGlone, who you follow on , say $100,000 is close.